ASEAN Mobilises Electric Mobility

ASEAN is well suited for the establishment of key EV supply chains including commodities, components and cars.

UPDATE: Electric mobility is the global trend and nowhere is that more so than in Southeast Asia. While Tesla grabs the headlines, its Shanghai Gigafactory is exporting more cars from China than ever before. China has the edge in global manufacturing and uptake of EV’s with over half of all new car sales being fully electric. However, the US is keen to compete, and seeks a place in ASEANs emerging EV market and supply chains. Opportunities abound for ASEAN countries and today’s Long Mekong Daily takes a broad view of the potential for electric mobility production supply chains to be established across the ten Southeast Asian economies and Asia more widely. Plug in and read the all digital Long Mekong Daily.

Electric Mobility For Asia - McKinsey

Asia’s electric-vehicle market is poised for growth. Those who approach the challenges and opportunities with an ecosystem view can create significant value for their business—and the global climate.

The case for immediate electrification of consumer transport is undeniable. The transport sector accounts for about 17 percent of global greenhouse gas emissions, and stimulating supply and demand for electric-vehicle (EV) adoption in the mass market will be pivotal for Asian countries to meet national emissions goals and a global 1.5-degree climate change target.

For industry incumbents and attackers, accelerating EV ecosystem development across Asia is a major opportunity to seize significant growth through new green business-building opportunities. Asian countries are in many ways on the front line of climate challenges. Asia is home to 93 of the 100 most polluted cities and six of the top ten countries most affected by climate risks. The region also faces relatively high energy demand, as many countries are still rapidly growing and urbanizing. China alone consumes more than three times the total energy used in Europe, a situation that complicates its effort to reach net zero.

The transport sector is one of the largest sources of greenhouse gas (GHG) emissions, so its progress will be pivotal for meeting the climate change challenge in Asia. We estimate that between 2018 and 2050, the sector could contribute around 14 percent of emission abatement potential.

To capture this decarbonization potential, regulators around the world have introduced ambitious goals for electric vehicles. These include the EU’s Fit for 55 plan to achieve carbon neutrality by 2050 and the Biden administration’s target for half of new autos sold in the United States in 2030 to be EVs.

In line with these goals, by 2030, we could expect EV adoption to reach 45 percent under currently expected regulatory targets. This estimate includes battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and fuel cell electric vehicles (FCEVs).

In Asian countries, consumers are adopting EVs at different paces. Compared with mature markets, such as China and Japan, emerging Asia—particularly India and ASEAN—is lagging. In 2021, EVs made up less than 1 percent of new-vehicle sales in the region

Read full article here.

South Korea woos Tesla gigafactory

South Korea will offer "tailored" incentives to encourage Tesla to set up an electric vehicle gigafactory in the country and will minimise any risks posed by militant unions, President Yoon Suk-yeol told Reuters.

Yoon held a video call with Tesla Chief Executive Elon Musk last week and Yoon's office cited Musk as saying South Korea is among the top candidate locations for a new Tesla factory. "If Tesla, Space X or other companies are considering more investment in Korea including constructing a gigafactory, the government will do our best to support the investment.”

President Yoon also provided a brief overview of the advantages Tesla would have if it chose to build in South Korea. “We are preparing a tailored approach to grant some advantages to these specified companies,” he said.

Last week, South Korea’s presidential office reported that Elon Musk and President Yoon talked through a video call. During their discussion, the Tesla CEO reportedly told President Yoon that he considered South Korea one of the top candidates for a Tesla factory in Asia.

Read more here.

Southeast Asia Hopes to Become the World’s Next EV Hub

A number of nations hope to carve out lucrative market niches as global sales of electric vehicles begin to take off. As countries around the world strive to reach their climate targets, many are turning to electric vehicles (EVs) as a way of reducing carbon emissions.

Global efforts to diversify supply chains combined with the drive to adopt green technology have created an opportunity for EV production that is ripe for the taking, especially in Southeast Asia. According to the International Renewable Energy Agency, 20 percent of all vehicles in the region will be electric by 2025, and there is even more potential for growth considering the region’s total population of more than 680 million people and a burgeoning middle class. Southeast Asian countries are taking notable steps to establish their domestic industries as an essential part of the EV ecosystem by developing materials that support supply chain resilience and implementing economic policies to facilitate domestic adoption.

Battery Manufacturing

The market for EV batteries in the Indo-Pacific is expected to surpass $90 billion by 2028. As countries like the United States look to strengthen their supply chains for emerging technologies and avoid dependence on China, Southeast Asia offers an attractive alternative. Although nearly 75 percent of all lithium-ion batteries and 50 percent of battery refining materials currently come from China, Indonesia is well-positioned to become an epicenter for battery production; the world’s largest deposits of nickel, tin, and copper are located in the country.

To achieve this goal, Indonesian President Joko “Jokowi” Widodo recently called for the country to build an “industrial ecosystem for lithium batteries.” In 2020, the government banned nickel ore exports in preparation for the increased demand in the battery supply chain. In June 2022, Indonesia opened its first EV battery production facility with upstream and downstream elements of battery production in Central Java. South Korea’s LG Energy Solution and Hyundai Motors also recently began construction on an EV battery plant in Indonesia with hopes to start mass producing battery cells in 2024.

Read full article here.

Increasing Uptake: Southeast Asia on the verge of an EV surge

The interest in electric vehicles (EVs) in the Association of Southeast Asian Nations (ASEAN) has increased over the years.

According to the ASEAN Automotive Federation, the total number of vehicle sales in ASEAN member states stood at 2.45 million in 2020. This number is expected to increase with population growth and economic development. EV uptake is also expected to be fuelled by growing pollution concerns and the need to switch to cleaner and environment-friendly modes of transport. Emerging EV technology could bring about improvements in energy efficiency as well as in the environment and health of human beings.

Southeast Asia Infrastructure provides a snapshot of the key factors favouring EV growth, current EV adoption, key factors to be taken into consideration, and the EV outlook in the ASEAN region.

Factors favouring EV growth

Electrification of transportation, or e-mobility, has gained interest in the ASEAN countries, due to a number of factors. Traffic in the ASEAN countries has become synonymous with congestion and smog. This has provided an impetus to major cities in the region to adopt green and sustainable strategies, including the adoption of EVs. Further, with consumers becoming more environment conscious, the demand for EVs has increased.

In view of the growing focus on mitigating climate risks and achieving the Paris Agreement goals for 2050, countries have started realising the importance of decarbonising the transportation sector, with EVs being one of the ways to achieve this. The ASEAN region has been able to develop a favourable policy environment to provide the right push for the adoption of EVs.

Read full article here.

China’s Electric Car Exports More Than Double, Mostly to Europe

Tesla and other firms boost output after lockdowns end China is growing its share of global export car market. China’s shipments of cars rebounded in May, with electric vehicle exports more than doubling, as Covid lockdowns gradually ended.

Car manufacturers in China shipped $1.2 billion worth of electric passenger vehicles, up 122% from a year earlier and almost triple the level in April, when car factories in Changchun and Shanghai such as those run by Tesla Inc were shuttered or barely open. Passenger cars worth $2.8 billion were exported, the fourth-highest monthly total in the past few years. By 2030, electric vehicles will make up 90 percent of new car sales in China, William Li, CEO of the Chinese EV startup Nio, predicts. Right now, China is bursting with new EV startup companies that are making strides in the domestic market and reaching out to other Asian countries such as Nepal and Thailand.

Ships loaded with 10,000 MG4 electric vehicles left Shanghai's Haitong port for Europe in China's largest single shipment of EVs bound for overseas markets. In the fourth quarter, the hatchback is expected to be sold in around 20 major nations on the continent. By 2023, it will be available in some 80 countries around the world.

The MG4 EV is the first model that SAIC built using its dedicated electric platform. It was the result of SAIC's Chinese and British teams and was developed based on new car quality standards in different countries.Fu Bingfeng, executive vice-president of the China Association of Automobile Manufacturers, called the model the first global model by Chinese automakers. "It opens a new chapter for SAIC and also for China's automotive industry," Fu said.

China's vehicle exports had been low compared with its production as the world's largest vehicle maker. The situation started to change in 2021, when overseas sales doubled to 2.01 million units, ranking only behind Japan and Germany. The surge was mainly driven by China's sufficient car supplies and a wide choice of electric and plug-in hybrid models, according to the CAAM.

The growing momentum has continued well into this year. The association said vehicle exports between January and August hit a record 1.82 million units, up 52.8 percent year-on-year, with over 340,000 being new electric vehicles.

Wang expects China will overtake Germany this year in vehicle exports as Chinese companies are at the fore of the industry's new trends like electrification and connectivity.

The Rationale Behind the US-ASEAN Electric Vehicle Initiative

The Biden administration has announced its intention to compete more vigorously with China for Southeast Asia’s EV market.

As a follow-up to what he promised at the U.S.-ASEAN Special Summit earlier this year, President Joe Biden proposed the establishment of a U.S.-ASEAN Electric Vehicle Initiative at this month’s U.S.-ASEAN Summit in Cambodia.

In announcing the initiative, a flagship initiative of the U.S.-ASEAN Transportation Dialogue Partnership, Biden hopes to work with his ASEAN counterparts to create an integrated electric vehicle (EV) ecosystem in Southeast Asia. Specifically, the initiative will focus on the development of the region’s EV infrastructure, the adoption of EVs throughout the region, and the development of EV solutions and technologies for the region. In addition, the United States will also help the ASEAN to create an ASEAN roadmap for EV implementation.

First, the Initiative should be understood as an extension of the Biden administration’s domestic agenda. Biden’s passion and support for made-in-the-U.S. EVs was evident even during his presidential campaign. In addition to stating that EVs are the future of the American auto industry, he pledged to take a more active role in supporting the development of U.S. EVs. Recently, Biden even stated that EVs were an integral part of restoring American greatness.

Since taking office, Biden has taken concrete steps to promote the production and adoption of EVs in the United States. With the bipartisan Infrastructure Investment and Jobs Act, for instance, the Biden administration can invest $7.5 billion in EV chargers, more than $7 billion in the provision of critical minerals and other components which are necessary for EV battery production, and over $10 billion for clean transit and school buses. Although there are no articles in the recently passed Science and Chips Act that specifically address EVs, the Act will also stimulate their development, as sufficient and advanced chips are critical for the future of EVs. In doing so, the Biden administration is attempting to create the basis for an EV manufacturing boom and EV supply chain in the United States.

Read full article here.

PTT-Foxconn EV project eyes Thai production for Chinese automakers

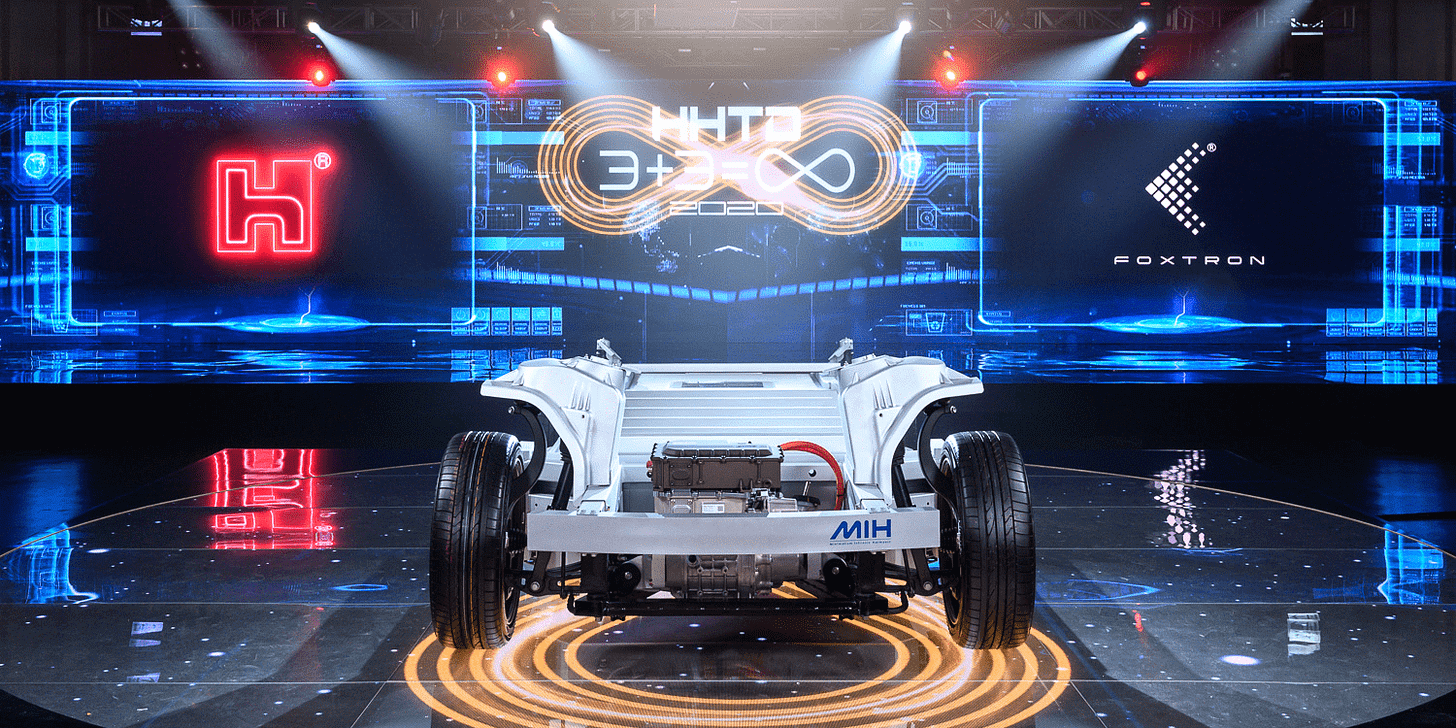

Talks underway for first deal with startup Hozon amid Bangkok's electric drive. Thai state energy group PTT is in talks to build electric vehicles for Chinese automakers as its joint venture with Taiwanese contract manufacturer Foxconn aims to start production in 2024.

Ekachai Yimsakul, managing director of Arun Plus, PTT's electric vehicle subsidiary, discussed these plans in a recent interview with Nikkei. The joint venture, called Horizon Plus, seeks its initial outsourcing deal with Chinese startup Hozon New Energy Automobile, Ekachai said. PTT signed a memorandum of understanding with Hozon in November.

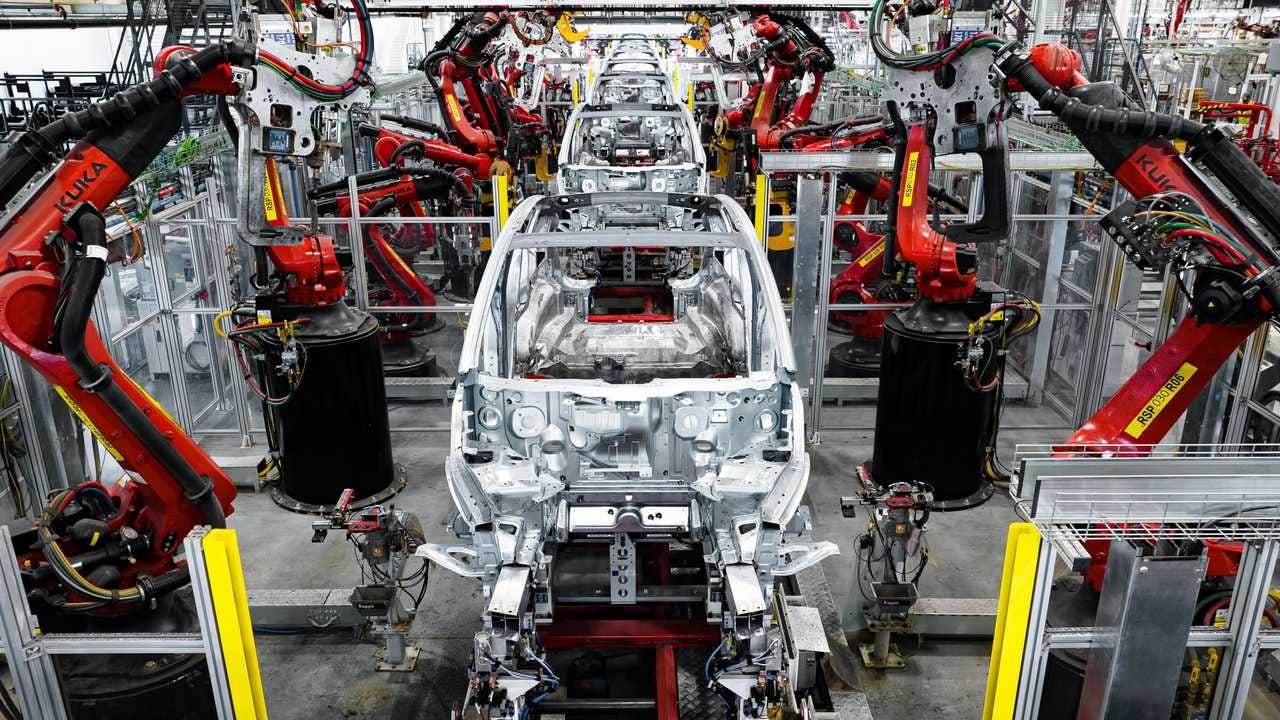

PTT debuted the venture in February with Foxconn, the major Apple supplier formally known as Hon Hai Precision Industry. They plan to invest $1 billion to $2 billion in an electric vehicle factory in eastern Thailand. Construction is slated to begin in mid-2022, Ekachai said. The venture brings Foxconn's smartphone business model to the auto industry. The partners intend to build finished cars for manufacturers, using a platform and software developed by the Taiwanese company. Working with automakers can help PTT and Foxconn break into the industry and give outsourcers an entry to the Thai market. Shared production facilities can save automobile companies time and money on manufacturing, Ekachai said.

Read more here.

Europe forecast to import 800,000 Chinese-built cars by 2025

Europe could become a net importer of cars by 2025, led by Chinese-built EVs. By 2025, up to 800,000 Chinese-built cars could be sold in Europe, most of them full-electric vehicles.

Such a development would turn Europe to a net importer of cars, PwC said, with a 2025 import surplus of more than 221,000 vehicles. In 2015, Europe exported about 1.7 million vehicles. The shift will come as Chinese brands increase market share and, at the same time, European brands build more EVs in China, PwC said.

Of the potential 800,000 Chinese-built cars, about 330,00 would be from Western automakers such as Tesla, BMW and Renault Group, all of which currently export EVs to Europe from China, including the Tesla Model 3, the BMW iX3 and the Dacia Spring. “While Chinese manufacturers are selling more and more BEVs in Europe, both European and American manufacturers are increasingly shifting their BEV production to China,” PwC said in a news release.

Felix Kuhnert, partner and automotive leader at PwC Germany, said European automakers continued to face supply chain issues and were focusing on building more-expensive (and lower-volume) EVs in Europe. “Chinese manufacturers, on the other hand, have optimized and developed their products in the domestic market, so that they are now bringing affordable BEV models, innovative technology and novel concepts to Europe,” Kuhnert said in the release.

Earlier efforts by Chinese brands to enter the European market have largely failed, PwC and other analysts said, but China’s expertise in full-electric vehicles could be a competitive advantage this time around. “Chinese [automakers] are now seeking to consolidate their foothold in Europe,” PwC said. “Compared to their previous market entries in the past decade, the playing field has now been significantly leveled.”

Read more here.

Download PWC EV study report here.