Asian Boom - US Explodes

ASEAN boom, digital, logistics, manufacture, export, intra-state, China! US is arming, militarising, defending, offending, nuclearising, & might drag allies down a rabbit hole in year of the rabbit

UPDATE: Today, the Long Mekong Daily puts the spotlight on the Year of the Rabbit to reveal a startling difference between Southeast Asia and China economic development and the counter balancing militarisation of the region by the US. Russia’s position straddling the northern arc from Europe to Northeast Asia explains why the United States needs to weaken Russia before it can significantly increase pressure on China along the first island chain. But the United States has led its allies down a rabbit hole where the moon is eclipsed by a looming nuclear shadow.

Meanwhile, in Asia, the moon’s a balloon where the rabbit enjoys the glow of booming prosperity. The choice is clear - US President Biden needs to become a “peacemaker” and strike a grand bargain for global prosperity by negotiating peace in Ukraine, lift US sanctions regimes globally, de-weaponise the dollar and reform the US economy through trade and investment liberalisation. ASEAN and China, as everyone knows, are market economies, the US is not!

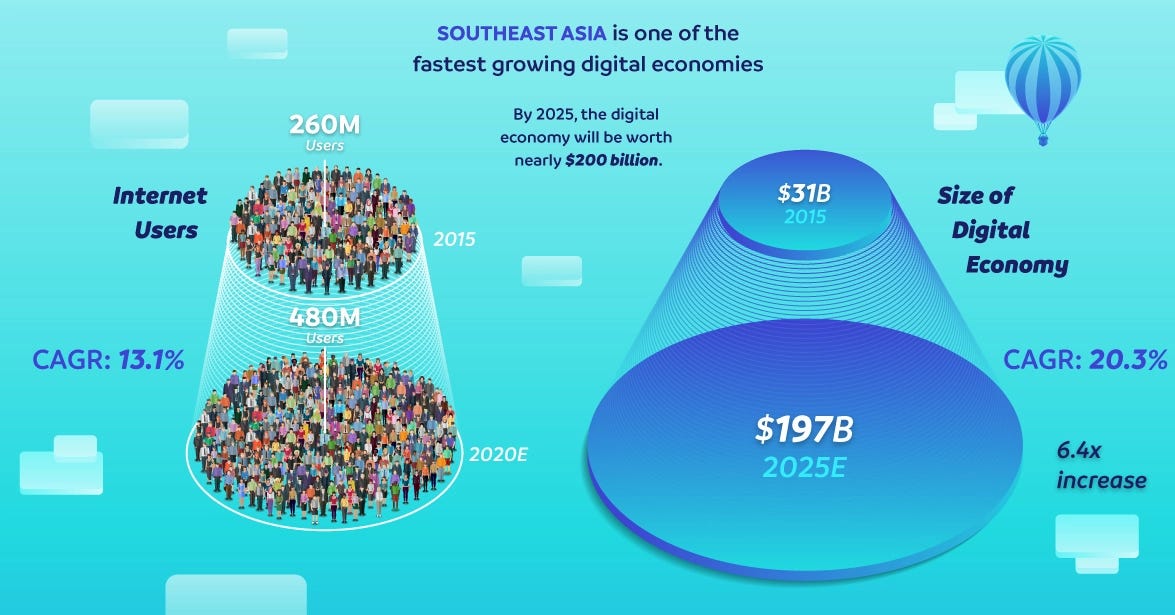

Digital infrastructure propels new SE Asian Tigers

China’s exports to Southeast Asia jumped by 20% in 2022, despite a year-on-year decline in China’s total exports driven by a 19% drop in exports to the US and a 17% drop in exports to the European Union. Southeast Asia’s 700 million people stand at the cusp of an economic transformation comparable to the rise of the “Asian Tigers” – Taiwan, South Korea and Singapore – during the 1980s and 1990s.

China’s leading position in digital as well as physical infrastructure has created a natural economic partnership with Southeast Asia, which represents a vast pool of young workers to replace China’s aging and shrinking industrial labor force.

Southeast Asia leads the world’s economic growth league, along with South Asia.

In 2020, China exported almost twice as much to members of the Association of Southeast Asian Nations (ASEAN) as it did to developed Asia (Japan, Taiwan and South Korea).

Despite China’s leading position in Southeast Asian trade, US and European investors dominate foreign direct investment in the region. China funded just $13 billion of direct investments in the region in 2021, compared with $40 billion for the US and $27 billion for the European Union.

Read full article here.

ASEAN+3 Regional Economic Outlook in Five Charts

ASEAN+3 growth in 2022 is projected at 3.3 percent, mainly driven by robust economic activity in ASEAN. Growth is expected to strengthen to 4.3 percent in 2023, buoyed by the economic reopening in China and the resumption of international tourism. Here are the region’s prospects summarized in five key charts, as seen in AMRO’s latest ASEAN+3 Regional Economic Outlook.

1. Exports are losing momentum. ASEAN+3 exports have been falling since July 2022, mostly due to weakening global demand (Figure 1). In China, strict pandemic containment measures weighed on factory activity, especially in the fourth quarter. The global tech down-cycle, reflected in weaker demand for electronic products, also held back ASEAN trade performance, a trend that may persist in the coming months given slower growth in the global economy.

Read the full report here.

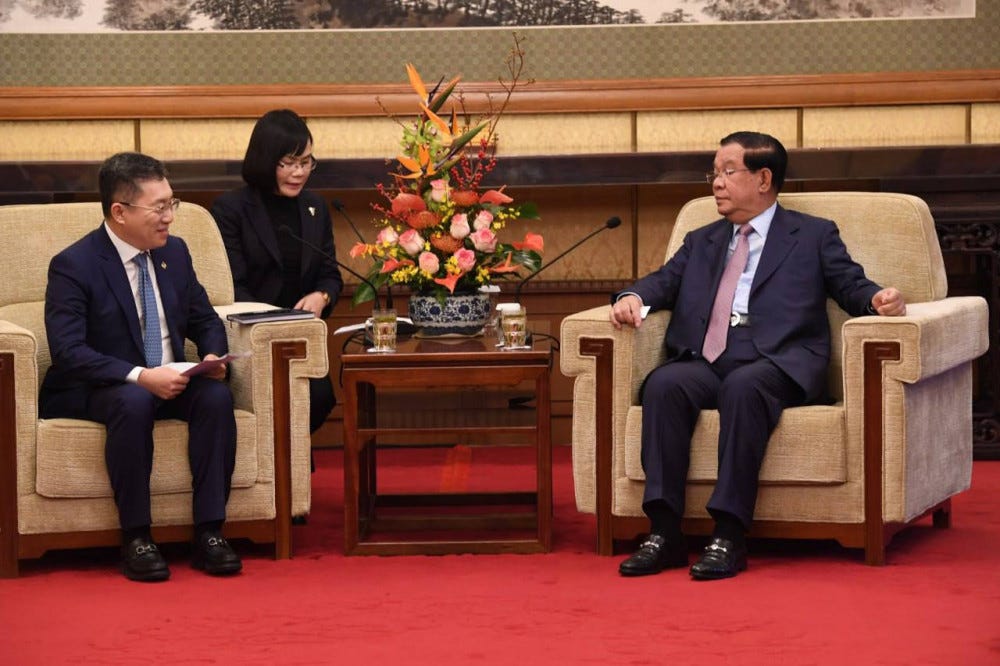

PM Hun Sen in China

Twelve (12) cooperation deals between the Government of the Kingdom of Cambodia and the Government of the People’s Republic of China will be signed during the three-day official visit of Cambodian Prime Minister Samdech Akka Moha Sena Padei Techo Hun Sen to Beijing, China. The deals will be inked on Feb. 10 under the witness of the Cambodian Premier and his Chinese counterpart H.E. Li Keqiang following their bilateral talks, he pointed out. The 12 documents cover the bilateral cooperation in the fields of politics, economy, trade, culture, and many other development projects.

Besides, Samdech Techo Prime Minister will pay separate courtesy calls on H.E. Xi Jinping, President of the People’s Republic of China, and H.E. Li Zhanshu, Chairman of the Standing Committee of the National People’s Congress, the minister delegate added.

Samdech Techo Hun Sen received different delegations of major Chinese companies investing in Cambodia, particularly in physical infrastructure construction, wastewater treatment, and so on.

“This visit of Samdech Techo Prime Minister to China coincides with the 65th anniversary of the establishment of Cambodia-China diplomatic ties, and marks the 3rd year of his visit to China (in 2020) when others turned away from the country due to COVID-19 fear,” he underlined.

Read full article here.

State of Southeast Asia Survey

If ASEAN can’t tango with China or the U.S., who else? Pragmatic as always, ASEAN’s favourite choices for hedging partners remain the EU and Japan but attention appears to have also fallen on India as its third choice this year.

A tango for two is an intricate, demanding affair, often daunting even for the most skilled dancers. In the case of ASEAN, the grouping must tread carefully in order to navigate two separate tangos, one with China and the other with the United States, to ensure a peaceful, stable and secure Southeast Asia. But China and the United States are increasingly loath to venture onto the same dance floor, making it difficult for ASEAN to find a way to balance the interests of both powers while still ensuring regional security and economic cooperation.

After decades of peaceful economic cooperation, a tectonic geopolitical shift starting with a low-boil U.S.-China trade war four years ago has now developed into moves to decouple the world’s two largest economies amidst calls for ‘China containment’. This is against a background of greater militarisation after the invasion of Ukraine, rising protectionism and stronger nationalistic sentiments around the world.

Download the full report here and or read the article here.

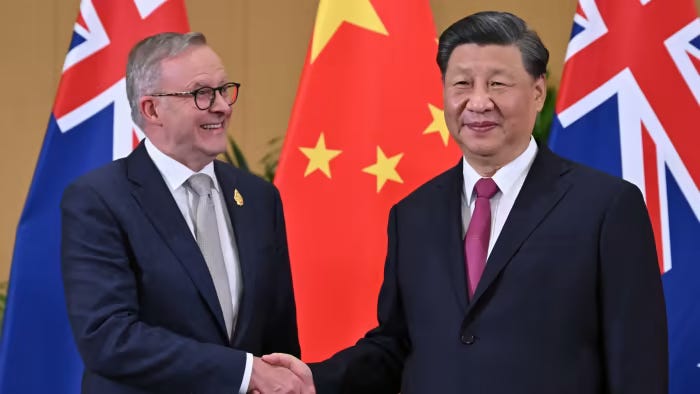

Australia-China monthly wrap-up

January saw a continuation of guarded goodwill between Australia and the People’s Republic of China (PRC). Prime Minister Anthony Albanese noted that ‘There is increased engagement at different levels between our respective agencies, and that's a positive thing’, and President Xi Jinping in a message sent to Governor-General David Hurley marking Australia Day said that relations were moving in the ‘right direction’.

The importance of Australia-PRC trade was particularly emphasised by Trade Minister Don Farrell. While acknowledging that ‘they’re an autocracy, we’re a democracy’, he pointed to the importance of identifying ‘where we can work together’ given ‘China continues to be our largest trading partner’ and Australia had ‘made pretty well near record sales to China worth $300 billion in the last 12 months.’ He went on to say, ‘[T]hat's more than Japan, Korea, the United States, the United Kingdom and France put together.’ The Prime Minister made the same point, underlining the symbiotic nature of the economic relationship.

Read the full article here.

America Needs to Reassure Japan and South Korea

How to Shore Up Washington’s Eroding Credibility in Asia.

Last month, South Korean President Yoon Suk-yeol warned that in the face of mounting North Korean provocations, South Korea might consider building its own nuclear weapons or asking the United States to deploy tactical nuclear weapons to the South, as it did during the Cold War.

Yoon’s comments are not the only indication that U.S. allies in East Asia are growing concerned about the credibility of Washington’s so-called extended deterrence commitments. Would the United States honor its pledges to use the full range of U.S. capabilities, including nuclear weapons, to deter and, if need be, defeat external attacks on the territory and sovereignty of its allies?

In Japan, which has barred the possession, production, and introduction of nuclear weapons since 1971, discussions about acquiring a nuclear deterrent have not yet entered the mainstream. Nonetheless, unease is growing in the Japanese government about the ability of the United States to uphold its security commitments.

Read the full article here.

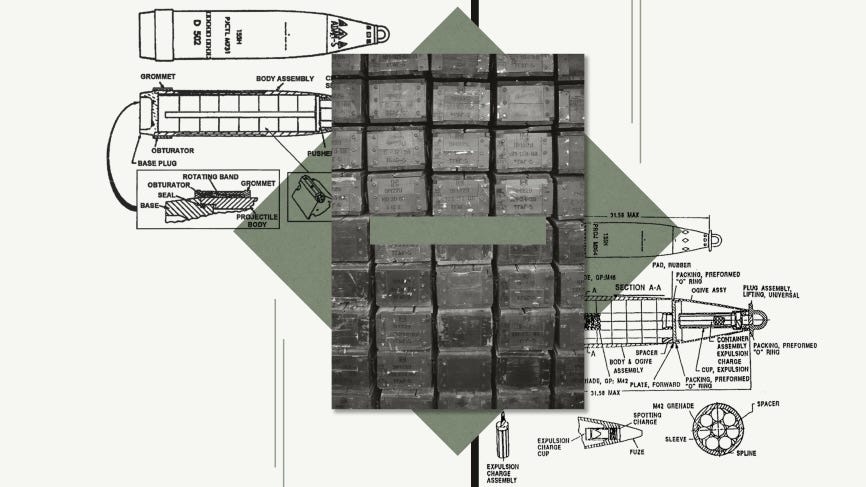

Empty Bins in a Wartime Environment: The Challenge to the U.S. Defense Industrial Base

The U.S. defense industrial base is not adequately prepared for the competitive security environ- ment that now exists. It is currently operating at a tempo better suited to a peacetime environment. In a major regional conflict—such as a war with China in the Taiwan Strait—the U.S. use of munitions would likely exceed the current stockpiles of the U.S. Department of Defense (DoD), leading to a problem of “empty bins.”

According to the results of a series of CSIS war games, for instance, the United States would likely run out of some munitions—such as long-range, precision-guided munitions—in less than one week in a Taiwan Strait conflict. These shortfalls would make it extremely difficult for the United States to sustain a protracted conflict—and, equally concerning, the deficiencies undermine deterrence. They also highlight that the U.S. defense industrial base lacks adequate surge capacity for a major war. These problems are particularly concerning since China is heavily investing in munitions and acquiring high-end weapons systems and equipment five to six times faster than the United States, according to some U.S. government estimates.

Download the full report here.

Geostrategic competition and overseas basing in East Asia and the First Island Chain

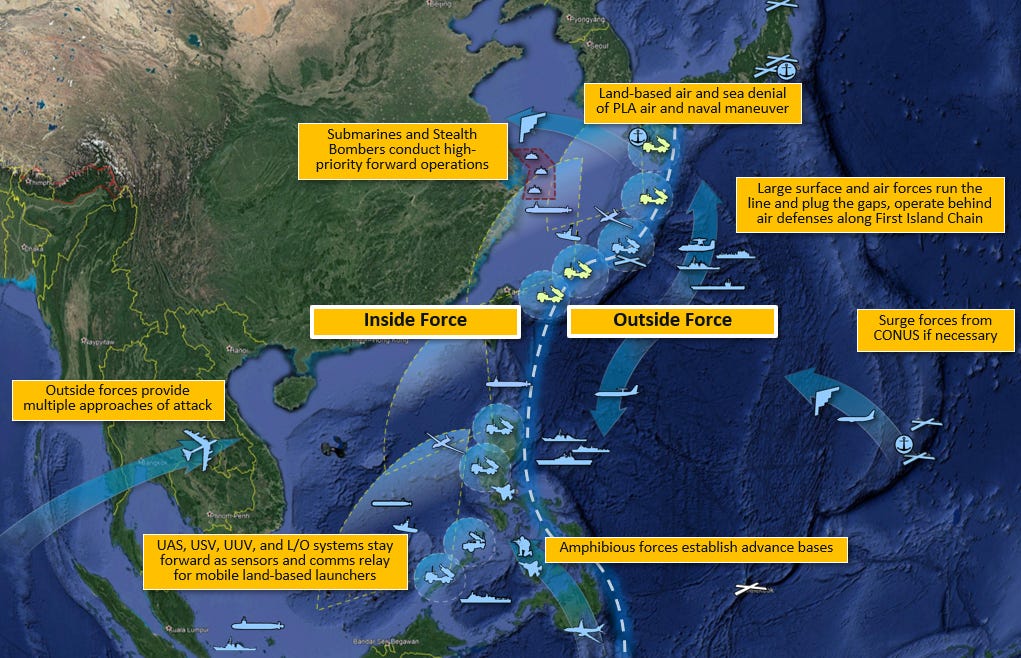

Under the U.S. Indo-Pacific strategy, the Department of Defense (DOD) now enfolds East Asia within the broader regional framework of the Indo-Pacific. However, significant U.S. forward presence and the U.S. obligation to defend allied territory in Northeast Asia with ground forces means that the needs and dynamics of great power basing in that region will differ from the maritime theaters of the South Pacific and Indian Oceans.

Although the DOD has been simultaneously criticized for being too ambitious or doing too little to address U.S. force posture, geostrategic competition with China dictates prudence in making any major changes to overseas basing in East Asia. Yet Chinese ambitions to strengthen its claims over Taiwan and the South China Sea may require some adjustments to U.S. force posture to surmount evolving challenges within China’s so-called first island chain. For long-term geostrategic competition with China, U.S. force posture in East Asia may be sized correctly but wrongly composed and dispersed. That is, the numbers and strategic concentrations of U.S. forces today in East Asia may be largely right, but their specific capabilities may not always be sufficient — they should continue to evolve, not according to a single grand plan but according to ongoing strategic developments.

Download the Brookings policy brief here.

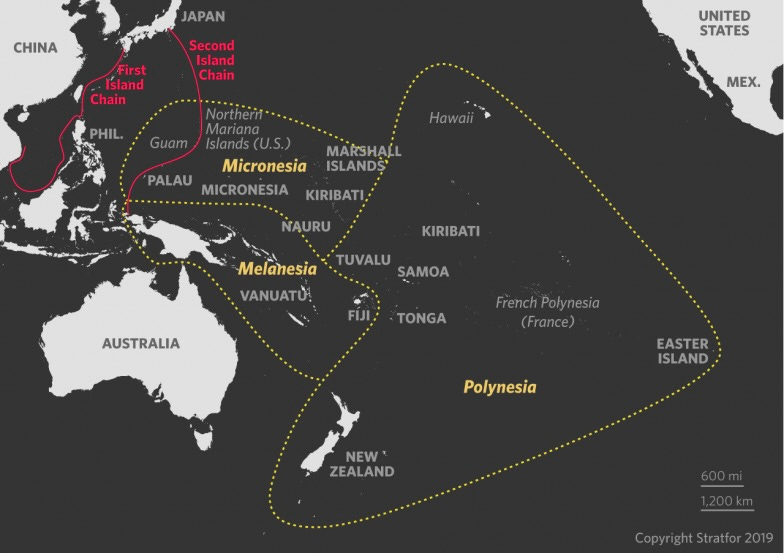

The struggle for bases and access in the Pacific Islands

The Pacific island clusters of Melanesia, Micronesia, and Polynesia share a geopolitical reality: they lie in the main space that separates the world’s two biggest powers. The United States has retained an arc of territories and bases across the northern reaches of Oceania, though it has at times neglected the underlying relationships that support this access. Recently, China has been trying to take advantage of that neglect by advancing its economic, resource, and diplomatic interests in the region.

The Pacific Islands are particularly important to China’s “counterinsurgency” strategy, which seeks to prevent reinforcement of the United States’ position inside the first island chain — a string of islands that encloses the seas immediately off China’s eastern coast. Beijing’s tactics involve using presence, investment, diaspora, elite ties, corruption, and pressure to acquire diplomatic relationships and logistics access. Not all Chinese advances have been successful, but China is making inroads across the southern reaches of the region. While the United States, Australia, and Japan are undertaking robust (albeit belated) soft power efforts to dull China’s expanding influence, questions around employing hard power loom. The United States is still debating whether to reinforce its military presence inside the first island chain, under the shadow of Chinese missile trajectories, or fall back to the second chain — or beyond — in Oceania.

Download the Brookings policy brief here.