Capital Flows

Davos recession and a Polycrisis? China drives global economy, investors flood HK. China-ASEAN RMB rises. Indonesia Central Bank worries. Gold glitters. Rich countries drain $152tn from Global South

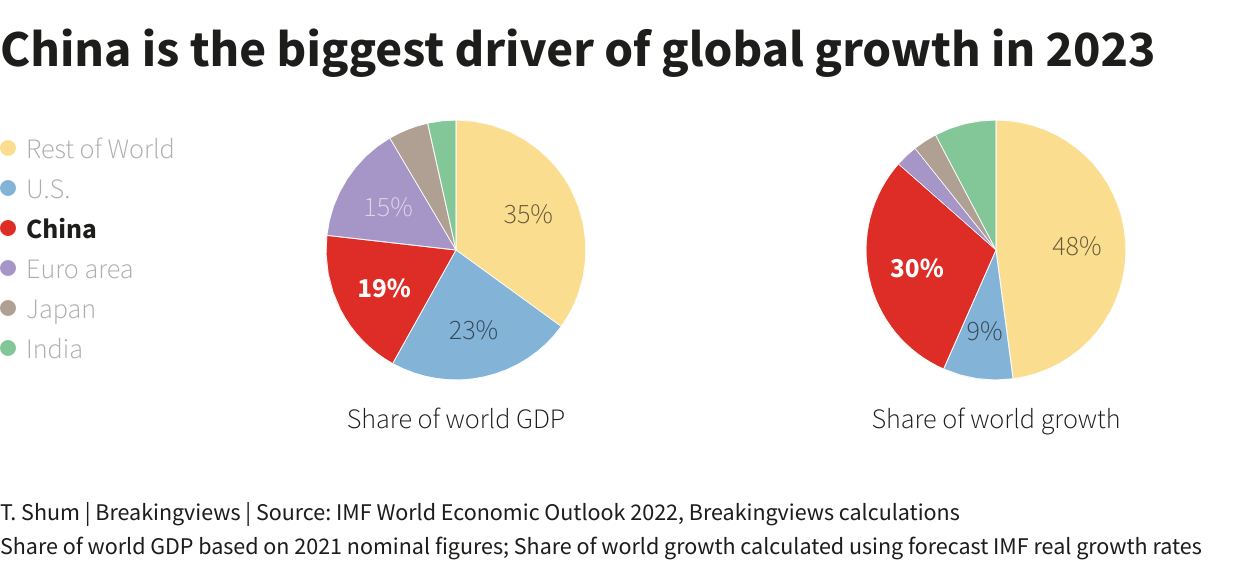

UPDATE: Two-thirds of global investors in Davos expect a recession. Adam Tooze predicts a “Polycrisis”, where the whole is even more dangerous than the sum of the parts. China’s reboot drives global economic growth again and again and again. Investors feel the winds of change and flock to the People’s Republic of China. RMB settlement volume between China and the Association of Southeast Asian Nations (ASEAN) reached 4.8 trillion yuan ($687 billion) in 2021, a year-on-year increase of 16 percent. World Gold Council says net gold purchases made by central banks worldwide spiked 47 percent year-on-year to 50 metric tons in November led by China, Türkiye, Uzbekistan and India.

The industrial rise of rich countries depended on extraction from the global South during the colonial era. Europe’s industrial revolution relied in large part on cotton and sugar, which were grown on land stolen from Indigenous Americans, with forced labour from enslaved Africans. Extraction from Asia and Africa was used to pay for infrastructure, public buildings, and welfare states in Europe – all the markers of modern development. The costs to the South, meanwhile, were catastrophic: genocide, dispossession, famine and mass impoverishment.

Imperialism never ended, they argued – it just changed form.

Imperial powers finally withdrew most of their flags and armies from the South in the mid-20th century, however, the underlying patterns of colonial appropriation remained in place and continued to define the global economy.

Global recession in 2023 seen as likely in WEF survey

DAVOS — Two-thirds of private and public sector chief economists surveyed by the World Economic Forum (WEF) expect a global recession in 2023, the Davos-organiser said on Monday as business and government leaders gathered for its annual meeting. Some 18 percent considered a world recession "extremely likely" - more than twice as many as in the previous survey conducted in September 2022. Only one-third of respondents to the survey viewed it as unlikely this year.

"The current high inflation, low growth, high debt and high fragmentation environment reduces incentives for the investments needed to get back to growth and raise living standards for the world's most vulnerable," WEF Managing Director Saadia Zahidi said in a statement accompanying the survey results.

The survey comes after the World Bank last week slashed its 2023 growth forecasts to levels close to recession for many countries as the impact of central bank rate hikes intensifies, Ukraine conflict continues, and the world's major economic engines sputter.

Read more here.

“Polycrisis” in Davos

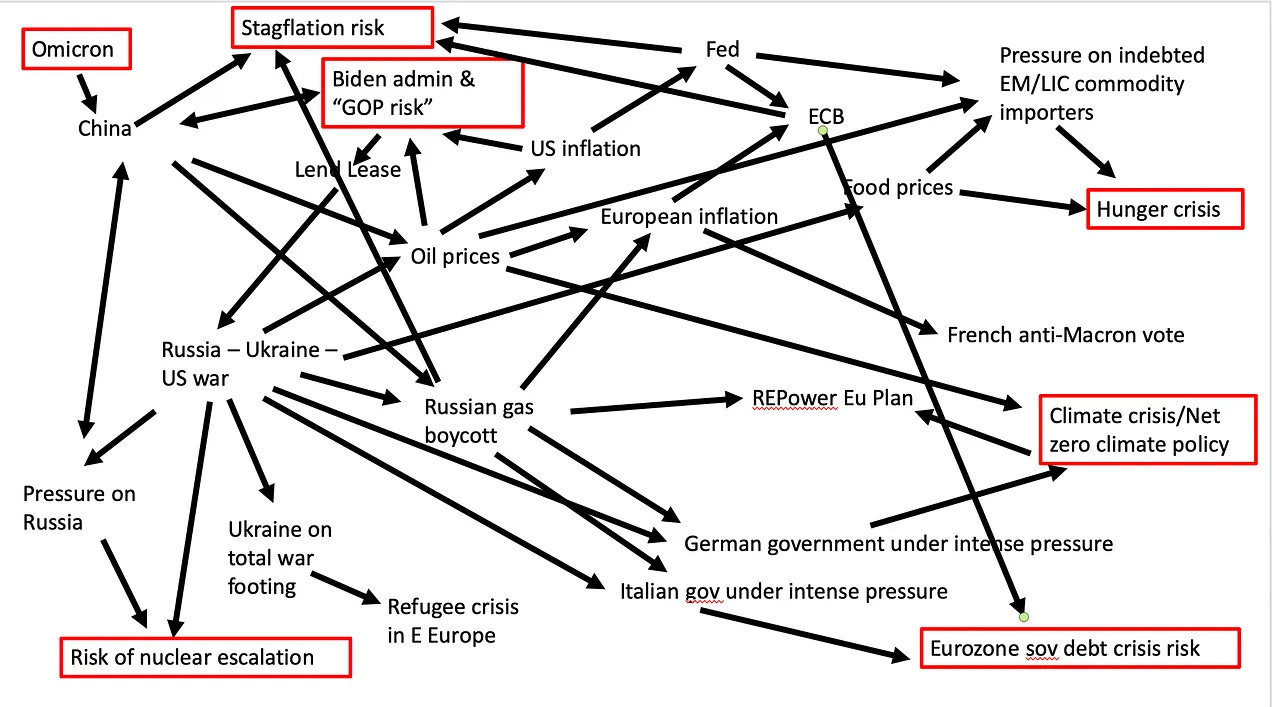

A polycrisis is not just a situation where you face multiple crises. It is a situation like that mapped in the risk matrix, where the whole is even more dangerous than the sum of the parts.

As business leaders and policymakers gather for the first day of the World Economic Forum in the Swiss ski resort of Davos there is a warning that the world’s biggest companies are facing multibillion-dollar writedowns on recent acquisitions.

US media and healthcare companies are among those to have slashed the value of business units in the past few months, and accountants at valuation service Stout are warning that more cuts could be imminent as the annual reporting season gets under way.

An era of high interest rates, rising inflation, geopolitical uncertainty and climate chaos is undermining business confidence around the globe. In a recent column, the academic Adam Tooze said the world was facing a “polycrisis”.

Gideon Rachman, the FT’s foreign affairs commentator, wrote yesterday that “the fear haunting the WEF is that a long period of peace, prosperity and global economic integration could be coming to a close — just as it did in 1914”.

Read more about Polycrisis here.

China’s Reboot and Stable Energy to Help Europe Grow in 2023

China’s reopening and an ebbing energy crisis are expected to give Europe's economy a boost this year, helping it avoid a recession, the latest MLIV Pulse survey shows. A series of rate hikes by the European Central Bank aimed at taming the region’s inflation, however, are expected to tarnish the appeal of the region’s debt. The ECB’s deposit rate will top 3.5% after another 1.5 percentage points of hikes, according to more than a third of 201 respondents in the poll. An additional 15% see it heading to 4% or above, which would be a record level.

That helps explain the survey participants’ strong conviction that euro area bonds will underperform US Treasuries this year. The Federal Reserve “seems closer to ending the cycle than the ECB” and there’s also “greater uncertainty” over where euro-area rates peak, said Rohan Khanna, rates strategist at UBS Group AG. With possible Fed cuts later this year and a wave of supply from European governments, the outperformance of Treasuries versus bunds is one of his top trades.

Goldman Sachs Group Inc. economists now expect the euro-zone’s gross domestic product to grow 0.6% in 2023, compared with their earlier forecast of a recession and overall decline of 0.1%.

Read full story here.

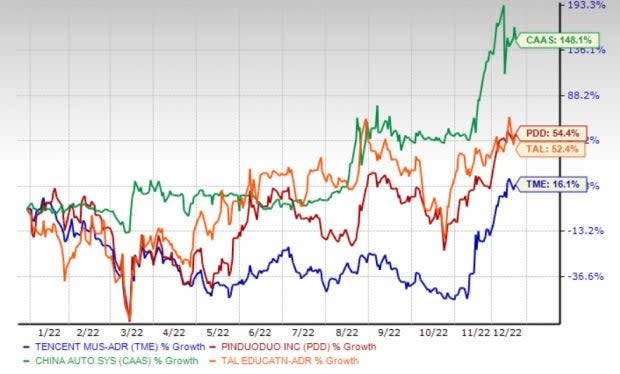

HONG KONG -- Foreign investors have stepped up their purchases of Chinese stocks in 2023 as a weeks-long share-market rally in the world's second-largest economy forces fund managers to retreat from bearish positions. In the first nine trading days of the new year, foreign investors bought a net 64 billion yuan ($9.5 billion) of Chinese stocks via the trading link between the mainland and Hong Kong. That compares with only 90 billion yuan in net purchases for all of 2022, which was the lowest figure since 2017.

Analysts say many of the foreign buyers remain worried about China's prospects but are reversing course because of the rally that began in early November. Some are closing out bets -- called "short sales" -- that shares would fall. Others are adding to "underweight" positions -- meaning they have less exposure to China than the benchmarks they use to gauge performance.

"I wouldn't say that investor sentiment or their positioning is even back to neutral," said Jian Shi Cortesi, who manages $400 million in two funds for Zurich-based GAM Investment that have exposure to China.

She said there is still a "quite significant underweight in China" but that "as China starts to perform, if you are underweight, you are suffering." A Jan. 9 Goldman Sachs report said the Chinese allocations of global mutual funds with $800bn in assets were 410 basis points below their benchmarks.

Read more here.

China-ASEAN cross-border RMB settlement volume has surged nearly 20-fold in the past decade, according to a report released on Saturday during the ongoing 19th China-ASEAN Expo.

RMB settlement volume between China and the Association of Southeast Asian Nations (ASEAN) reached 4.8 trillion yuan ($687 billion) in 2021, a year-on-year increase of 16 percent, data from the People's Bank of China (PBOC) backed Financial Society of Guangxi showed.

By the end of 2021, China had signed separate bilateral currency settlement agreements with Vietnam, Indonesia, and Cambodia in local currencies, as well as currency swap agreements with countries including Indonesia, Malaysia, Singapore and Thailand worth about 800 billion yuan, said Chen.

The RMB-based Cross-Border Interbank Payment System handled 3.3 trillion yuan of China-ASEAN trade in 2021, a yearly surge of more than 50 percent.

China has been ASEAN's largest trading partner for 13 consecutive years. In the first eight months, the country's imports and exports with the bloc hit 4.09 trillion yuan, an increase of 14 percent compares with the same period last year, accounting for 15 percent of the total foreign trade value, customs data showed.

Read more here.

Perry Warjiyo: Synergy and policy innovation - key to resilience and saving the economy from crisis risk

As a small country in an open economic system, Indonesia is not immuned from the impact of global turmoil which often leads to higher risk of economic crisis. What happened in the last 5 (five) years serves as a concrete example. In 2017 and 2018, there was a trade war between the United States (US) and China which caused global financial market turmoil and decreased the volume of world trade. At the same time, to reduce inflation to the 2% target, the US central bank, The Fed, raised its monetary policy interest rate 4 (four) times during 2018 or 9 (nine) times since the normalisation of monetary policy began in December 2015, to 2.25%-2.50%, an interest rate hike that President Donald Trump opposed. The impact of the US-China trade war and US monetary policy tightening through trade channel led to the global economic slowdown.

The slowdown was felt not only in these two largest economies in the world, but also in other countries due to China’s central position in the global supply chain. Even larger and immediate impact occured in financial channel. The US-China trade war caused global financial market panic, foreign capital flight and pressure on exchange rate depreciation in developing countries, including Indonesia. The Rupiah exchange rate depreciated to Rp15,000 per US dollar in mid- 2018 before stabilizing at around Rp13,500 per US dollar at the end of 2018 after a large intervention

by Bank Indonesia. At the IMF and World Bank Annual Meeting in Bali in October 2018, President Joko Widodo voiced out loud “The Winter is Coming”, referring to the famous television drama series “Game of Thrones”, to stop the trade war between the two economic giants and seek solutions to save the world economy.

Download the full report here.

Gold glitters as central banks stock up

GOLD prices have edged higher and reached a near seven-month high, supported by a weaker dollar and hopes that the Federal Reserve might slow its pace of interest rate hike. Spot gold was up 0.2 per cent at US$1,868.89 per ounce, as of 0016 GMT. US gold futures also inched 0.2 per cent higher at US$1,873.80.

Central banks' gold reserves around the world have broadly risen over the past 12 months to combat various market headwinds such as inflation or volatility, with the trend set to continue this year, industry experts said.

The People's Bank of China, the country's central bank, added 970,000 ounces of gold holdings in December, according to the bank's latest data on Saturday. Its total gold reserves stand at 64.64 million ounces after the latest purchases.

It is the second consecutive month for the PBOC to increase its holdings of the yellow metal, following a 103,000-ounce purchase in November.

It should be noted that China's gold reserves had remained unchanged for three years since September 2019.

Thanks to the PBOC's higher demand for the precious metal, A-share firms with business related to gold mining or retailing performed strongly. They reported an average share price increase of 0.21 percent on Tuesday, while the benchmark Shanghai Composite Index shed 0.21 percent.

Similar practices have been seen elsewhere. According to the World Gold Council, net gold purchases made by central banks worldwide spiked 47 percent year-on-year to 50 metric tons in November. Turkiye, Uzbekistan and India made the largest increases in gold holdings in November, which was in line with the overall trend throughout 2022.

Central banks around the world shored up gold reserves in 2022 at a pace not seen since 1967, when the US dollar was still backed by the precious metal, according to the WGC. The pace has been further accelerated since November. To date, central banks' total gold reserves have reached 36,745 tons, the highest level since November 1974, added the WGC.

Read more here.

Rich countries drained US$152 trillion from the global South since 1960

Imperialism never ended, it just changed form.

We have long known that the industrial rise of rich countries depended on extraction from the global South during the colonial era. Europe’s industrial revolution relied in large part on cotton and sugar, which were grown on land stolen from Indigenous Americans, with forced labour from enslaved Africans. Extraction from Asia and Africa was used to pay for infrastructure, public buildings, and welfare states in Europe – all the markers of modern development. The costs to the South, meanwhile, were catastrophic: genocide, dispossession, famine and mass impoverishment.

Imperial powers finally withdrew most of their flags and armies from the South in the mid-20th century. But over the following decades, economists and historians associated with “dependency theory” argued that the underlying patterns of colonial appropriation remained in place and continued to define the global economy. Imperialism never ended, they argued – it just changed form.

They were right. Recent research demonstrates that rich countries continue to rely on a large net appropriation from the global South, including tens of billions of tonnes of raw materials and hundreds of billions of hours of human labour per year – embodied not only in primary commodities, but also in high-tech industrial goods like smartphones, laptops, computer chips and cars, which over the past few decades have come to be overwhelmingly manufactured in the South.

This flow of net appropriation occurs because prices are systematically lower in the South than in the North. For instance, wages paid to Southern workers are on average one-fifth the level of Northern wages. This means that for every unit of embodied labour and resources that the South imports from the North, they have to export many more units to pay for it.

Read more here.

Download the research articles here and here.