Contagion

Xi kicks 2 peace goals, Biden calls for help, US financial Contagion - bank shares plunge & 3 mega failures, US loses war games, AUKUS hurts regional peace and stability.

UPDATE: 2023 is turning out to be a complete disaster for the US economy and foreign policy. There is literally no wins on the board and yet, escalation and contagion continues. If the readers of the Long Mekong did not know the meaning of Paper Tiger, look no further than the United States. The Biden administration has an entire zoological park full of paper tigers. The NATO special military operation in Ukraine is fast falling flat. AUKUS is a lot of words and Australian money, but it turns out to be just US nuclear subs and missiles based in Australia. Sanctions on China, Russia and Iran and almost everybody do not work and cost the US economy dearly. Speaking of which, the US financial sector is another paper tiger that has seen three big failures, two in two days, and surely more to come.

Finally, the paper tiger wants to call Xi Jinping, but only for optics. China holds all the cards - 5% GDP growth, peace dividends and the backing of the entire Global South. The only crisis that should concern President Biden is that he has failed to see that the US paper tiger is chasing its own tail.

President Xi Jinping to meet with Presidents Putin and Zelensky

The meetings with Presidents Putin and Zelensky, reflect Beijing’s effort to play a more active role in mediating an end to the war in Ukraine. President Xi is considering visiting other European countries as part of his trip to Russia, though his full itinerary has yet to be confirmed.

A direct conversation with Mr. Zelensky would mark a significant step in Beijing’s efforts to play peacemaker in Ukraine and is further evidence of Beijing’s credentials as a global power broker after it facilitated a surprise diplomatic breakthrough between Saudi Arabia and Iran last week.

The new surge of diplomacy reflects a conviction on the part of President Xi that China’s peaceful development and non-interference foreign policy is preferred by the Global South and some quarters in the EU and US to the US Cold War campaign of “all-round containment, encirclement and suppression”. President Xi’s Moscow visit, which could happen as early as next week, marks China’s new role as global peace mediator and champion of free trade, globalisation and the UN charter.

The Editor

Biden Calls Xi Jinping for Help!

US President Joseph Biden is desperately seeking a tension-easing call with China’s Xi Jinping. The enormous diplomatic blunders of Antony Blinken in Munich and the G20 meeting in India need to be redressed. Russia is making steady advances and Ukraine defences are collapsing as the Whitehouse realises that neither the EU, NATO or the US can sustain a drawn out conflict financially or materially. While US media continues to talk about Ukraine victory, balloons and nuclear submarines, the US economy edges ever closer to the cliff (see below).

The hysteria over the ballon incident confirmed Beijing’s view that the Whitehouse is in serious turmoil and without a coherent strategy for either its domestic economic policies or foreign policies. The cancellation of a trip by Secretary of State Antony Blinken to Beijing was clearly due to the fact that Beijing holds all the cards.

The story floated by (US sources ) about Kamala Harris visiting Beijing while House speaker McCarthy met with Tsai Ing-wen is another example of US desperation. President Biden is between a rock and a hard place and will need to accede to Beijing’s terms on many fronts if the US is to emerge from this polycrisis of its own making. Otherwise, Beijing will let the US economy take the fall on its own.

“The administration has been clear that their strategy is to put a floor under the deterioration of the relationship and to put guardrails around that […] The question is whether or not whether the Chinese are going to meet them halfway and what kind of price will the Chinese try to extract for doing so? Because there’s always a price.”

While Jake Sullivan points to the National People’s Congress as the reason for not moving forward, it is clear that President Xi’s statements about “containment, encirclement and suppression,” followed by two diplomatic coups has shaken Washington to the core just as the structural weaknesses of the US financial sector have begun to crumble.

The Editor

US Financial Contagion

US bank shares plunge

California’s Silicon Valley Bank (SVB) collapses

New York’s Signature Bank collapses

FTX, world’s second largest crypto exchange collapses

US and EU Bank shares plunge

Global bank shares and short-dated U.S. Treasury yields plunged on Monday as concerns over fallout from the collapse of Silicon Valley Bank (SVB) lingered despite action from regulators. U.S. authorities have also taken over New York-based Signature Bank (NASDAQ:SBNY), the second bank failure in a matter of days. (see below). HSBC's shares dropped after it said it would acquire the UK subsidiary of stricken SVB for the token amount of 1 pound ($1.21). Shares of U.S. regional banks slumped, led by losses in First Republic Bank (NYSE:FRC) as news of fresh financing failed to assuage bank contagion fears.

The U.S. dollar also fell. Gold and silver prices rallied on safe-haven buying. Gold climbed, with spot prices last up over 2.4% to their highest since early February. U.S. futures gained 2.6% to settle at $1,916.50.[GOL/]

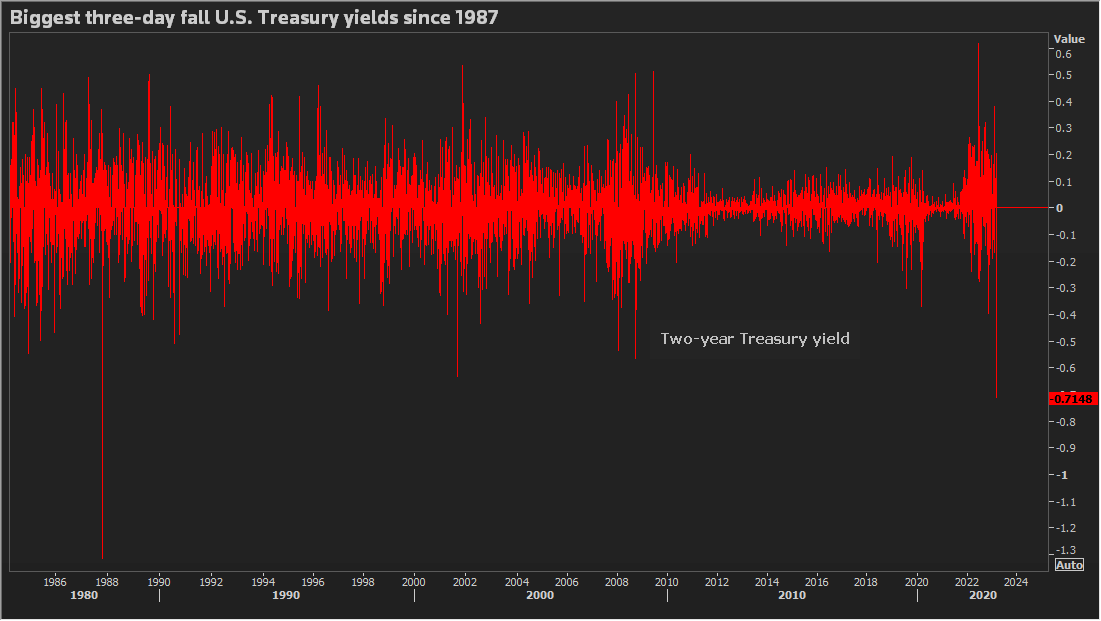

Short-dated U.S. Treasury yields plunged, pushing their prices higher.

The two-year note's yield fell below 4% for the first time since last October and was on track for its biggest one-day drop since October 1987 in the wake of Black Monday's stock market crash.

The European Central Bank, which meets on Thursday, is still widely expected to lift its rates by 50 basis points and to flag more tightening ahead, though it will now have to take financial stability into account.

European stocks logged their steepest one-day fall this year, with the pan-European STOXX 600 index closing down 2.3%. Europe's bank index slumped nearly 6% after shedding 3.8% on Friday.

Analysts said it was crucial the Fed would accept collateral at par rather than marking to market, allowing banks to borrow funds without having to sell assets at a loss.

"We are seeing a classic flight to safety […] Higher interest rates and a slowing economy was always going to bite."

Goldman Sachs (NYSE:GS) and many traders no longer expect a rate hike of 50 basis points by the Federal Reserve next week and the current projection is for a 25-basis-point move, with some even expecting no hike at all, making gold, which does not yield interest, more attractive.

Read more here.

Silicon Valley Runs Out of Money

SVB, as it’s known, was the biggest U.S. lender to fail since the 2008 global financial crisis – and the second-biggest ever. Silicon Valley Bank, which catered to the tech industry for three decades, collapsed on March 10, 2023, after the Santa Clara, California-based lender suffered from an old-fashioned bank run. State regulators seized the bank and made the Federal Deposit Insurance Corporation its receiver.

At the end of 2022, SVB was the 16th-largest bank in the United States with $209 billion in assets. The bank’s troubles began during the pandemic, when deposits at SVB doubled and the bank invested in U.S. Treasury securities. The rapid increase in interest rates in 2022 and 2023 caused the value of these securities to plunge. A characteristic of bonds and similar securities is that when yields or interest rates go up, prices go down, and vice versa.

The bank recently said it took a US$1.8 billion hit on the sale of some of those securities and they were unable to raise capital to offset the loss as their stock began dropping. That prompted prominent venture capital firms to advise the companies they invest in to pull their business from Silicon Valley Bank. This had a snowball effect that led a growing number of SVB depositors to withdraw their money too.

The investment losses, coupled with the withdrawals, were so large that regulators had no choice but to step in to shut the bank down to protect depositors.

SVB’s collapse highlights the risks that many US banks have in their investment portfolios. If interest rates continue to rise, and the Federal Reserve has indicated that they will, the value of the investment portfolios of banks across the U.S. will continue to go down.

Read more here.

Signature Bank - Crypto and a Bank Run

Signature Bank, a New York financial institution with a big real estate lending business that had recently made a play to win cryptocurrency deposits, closed its doors abruptly on Sunday, after regulators said that keeping the bank open could threaten the stability of the entire financial system.

Signature is a victim of the panic around Silicon Valley Bank (SVB), which federal regulators seized on Friday. Signature saw a torrent of deposits leaving its coffers and its stock, along with the stocks of giants JPMorgan Chase and Bank of America plunged.

In 2018, Signature Bank began taking deposits of crypto assets and has reported that its digital asset-related client deposits stood at $16.52 billion. However, in 2022, the bottom fell out of crypto assets after the collapse of FTX and an ensuing criminal investigation. Another cryptocurrency-focused bank, Silvergate Bank, was forced to voluntarily close last week.

The demise of Signature, with assets of under $100 billion, is a blow to NYC law firms, real estate companies, and wealthy NYC families. Regulatory filings show that more than $79 billion, or close to nine-tenths, of Signature Bank’s roughly $88 billion in deposits were uninsured at the end of last year. More than 80 percent of its deposits were from law firms, accounting firms, health care companies, manufacturers and real estate management companies. NYC taxi medallion holders are amongst the big losers as are law firm escrow accounts for client money and services. The Israeli financed bank’s clients include former President Trump and Jared and Charles Kushner.

Read more here.

Bank Man is Fried - The rise and fall of US crypto

Sam Bankman-Fried, FTX crypto king and Democratic mega-donor lost a US$17 billion fortune in the space of a few days. The 30-year-old’s crypto exchange had , became the world’s second largest digital currency exchange in only three years. He resigned as chief executive and the company and 130 affiliates were placed under US bankruptcy protection.

As concerns about FTX mounted investors pulled US$5 billion from FTX’s digital coffers. The run came to an end when FTX blocked further withdrawals in an attempt to remain solvent. Bloomberg called it the biggest one-day collapse of personal wealth ever. FTX’s lawyer said the company was “investigating abnormalities with wallet movements related to consolidation of FTX balances across exchanges”. That came after Reuters reported that at least US$266 million had been withdrawn from FTX in 24 hours and that Bankman-Fried may have secretly transferred US$10 billion of FTX customer funds to Alameda Research, a hedge fund he owns, run by his girlfriend Caroline Ellison.

Bankman-Fried spent millions funding Joe Biden’s presidential campaign, becoming the largest Democratic donor after financier George Soros and wooing other left-leaning politicians.

In Washington, Bankman-Fried lobbied for tighter regulation in an effort to advance his own business and make the industry palatable to US banking regulators. Bankman-Fried told employees, “I fucked up.”

Read more here.

US Loses War Games

If the US attempted to invade and occupy Taiwan, an extended Chinese blockade would determine the outcome in China’s favour. While a blockade might include intercepting ships at sea, the primary focus would be on sealing airfields and ports, particularly on the west coast of Taiwan. China could sustain that type of blockade indefinitely. Penetrating a prolonged blockade and keeping US territorial ambitions alive would require a serious investment in systems and operational concepts that the US currently does not have. Unless the US makes that investment, it may win a battle, but the US invasion would be defeated and China would be reunified.

Maneuvers by the Chinese People’s Liberation Army (PLA) in August 2022 marked the first time the PLA has openly signaled that a blockade of Taiwan is among the military courses of action for which it plans and trains. Chinese forces established closure areas near Taiwan’s major ports for what the Chinese media called “joint blockade and joint support operations” (联合封控和联合保障行动).

There is danger that the exercises we observed will foster a false belief that breaking a Chinese blockade would be a straightforward task easily within the capability of current and projected U.S. forces. It would not be. In a serious military conflict over Taiwan, the kind of blockade China would impose would be vastly more difficult to counter. In this author’s assessment, nothing the United States armed forces are doing or planning to do is sufficient to prevail in that conflict.

Download full assessment here.

AUKUS hurts regional peace and stability

China’s mission to the United Nations has criticised the Aukus announcement, arguing it is a “blatant act” that “hurts peace and stability in the region”.

On Twitter, the Chinese diplomatic mission repeated Beijing’s longstanding claims - denied by Australia - that the agreement violates the objects of the Nuclear Non-Proliferation Treaty (NPT).

And it argued this “textbook case of double-standard will damage the authority and effectiveness of the international non-proliferation system”:

The irony of #AUKUS is that two nuclear weapons states who claim to uphold the highest nuclear non-proliferation standard are transferring tons of weapons-grade enriched uranium to a non-nuclear-weapon state, clearly violating the object and purpose of the NPT. [END QUOTE]

No Australian “sovereignty” over US command and control of nuclear subs and nuclear missiles

A senior US politician has declared Australia will receive the "highest quality" Virginia-class nuclear submarines, vowing the United States will not be "foisting off clunkers" to its ally. The long-awaited joint announcement about the AUKUS plan unveiled in San Diego on Monday by Prime Minister Anthony Albanese, US President Joe Biden, and British Prime Minister Rishi Sunak involves the US agreeing to supply Australia submarines from its own fleet or construction schedule, as America's two production lines ramp up work to meet local demand. There are widespread international media reports Australia will buy up to five Virginia-class submarines from the early 2030s as a stopgap, before building a new generation UK-designed boat under a AU$230 billion-dollar deal.

While PM Albanese speaks of absolute Australian sovereignty, he has chosen the term “sovereignty” because it obscures the fact that Australia has no “command and control” of either the boats or their nuclear missiles.

Read more here.