Flight or Fright?

Vietnam has take-off problems, ASEAN faces energy shakeout, RCEP monsoon replenishes, China ready for take-off, Japan snowed under, Korea lags and no home runs for Australia

UPDATE: The Long Mekong Daily takes a brief economic snapshot of the RCEP area and provides real-time flight details. Vietnam is having some technical issues with infrastructure and ASEAN has energy transition issues. The RCEP is monsoonal but flights are on schedule. China is ready for take-off with new fleet of aircraft. Japan is debt fuelled, high on inflation and looking for military clearance. Korea has been delayed and no take-off announced yet. Australia has yet to get its house in order and inflation and debt are keeping the economy grounded. Brought to you by the Long Mekong Daily in-flight edition.

Runaway Costs at Long Thanh Airport

This week, the outlook for Long Thanh International Airport in Dong Nai took a massive blow. The timeline was already in rough shape since a chunk of land needed for the megaproject still hasn’t been handed over, even as officials push a remarkably (absurdly?) ambitious schedule: the Ministry of Transport has demanded that the facility’s first flight must take off no later than September 2, 2025.

On Sunday, the Airports Corporation of Vietnam (ACV) announced that it had canceled a US$1.5 billion bidding package to design and build the passenger terminal of Long Thanh’s first phase.

This package is expected to take 33 months to execute. Only one contractor submitted bidding documents and its dossier “failed to meet the requirements as per Item 1, Article 17 of the Bidding Law.”

A new bidding process must now take place, which will take a minimum of 45 days. Construction needed to start this month if there was even an inkling of hope of making that September 2025 deadline.

That timeline hasn’t officially changed, but the writing is on the wall: there’s no chance Long Thanh will open in three years.

Meanwhile, Tan Son Nhat, which Long Thanh is supposed to relieve pressure on, will have to handle 10% more passengers this Tet than it did in 2019. This comes out to about 130,000 people daily, including an estimated 144,000 passengers on January 29 (mostly domestic).

Planes will operate throughout the night, with 44 flights per hour scheduled - the most TSN has ever handled.

Recently, there’s been a lot of coverage of the miserable experience at the airport’s domestic terminal, with every arrival and departure step marred by huge crowds, creaking infrastructure, and strained service. TSN’s leaders have pre-emptively asked for understanding from passengers and more or less admitted that Tet will be terrible there. So good luck if you’re flying.

Read the full article here.

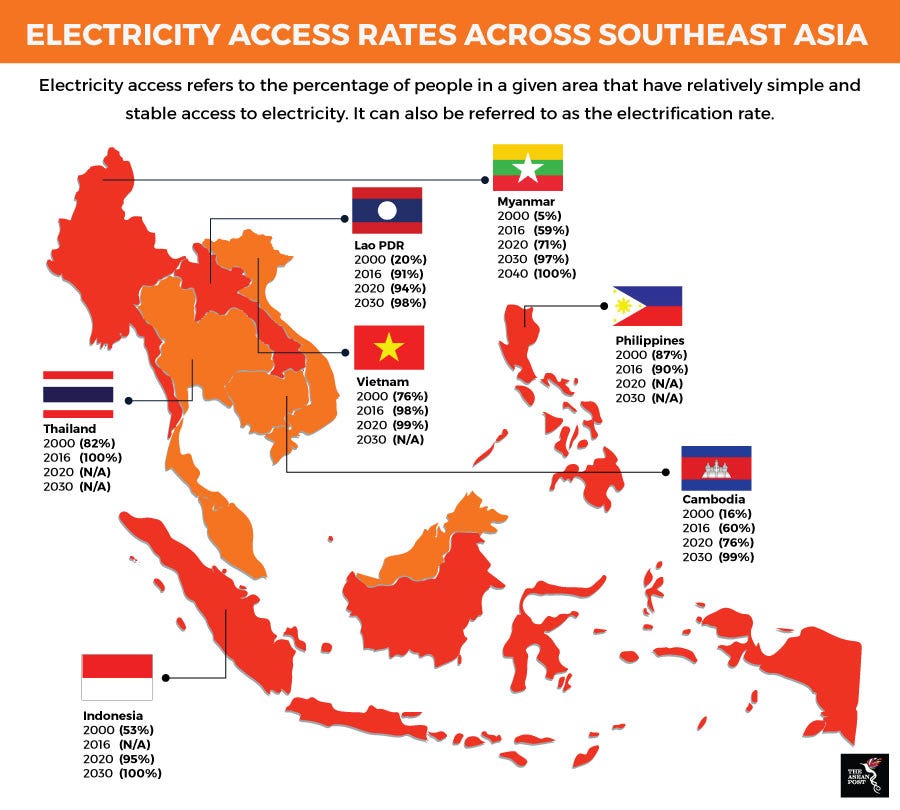

Balancing technology will be key to achieving net-zero targets in Southeast Asia

Achieving emission reduction targets in Southeast Asia has been a prime concern of its nations for many years now. With the effects of climate change being felt across the globe, finding ways to mitigate it continues to be a primary concern, not just for leaders, but for businesses and industries as well.

At the recently concluded Enlit Asia 2022 held at the Bangkok International Trade & Exhibition Centre (BITEC), Asian Power had the opportunity to interview Wärtsilä Energy’s President and Executive Vice President, Sushil Purohit, and discuss the energy transition in Southeast Asia.

When asked about how feasible it will be for countries within the Southeast Asian region to commit to their net-zero targets, Purohit said that it is not a distant dream, hinting at its plausibility.

“We recently published a “Rethinking Energy in Southeast Asia” report that looks at cost-optimal paths to net-zero power systems in three Southeast Asian countries: Vietnam, the Philippines, and Indonesia. The key finding of the report is that achieving net-zero is not a distant dream and it is not going to be more expensive than the power system cost that we currently have. The steps that we need to take across the region are going to be similar,” he said.

Purohit said that it is necessary to rapidly increase the number of renewables to become the main source of energy. Then, alongside that, adding flexible balancing capacity will be crucial.

“When we talk about balancing technology, we are talking about two things: energy storage, which provides minute-to-hour balancing of the power systems, sometimes also load shifting; and grid balancing engine power plants, which provide balancing on an hourly, daily, weekly, and seasonal basis. Both these technologies, together with renewables, can actually provide an optimal pathway to net-zero.”

Read full article here.

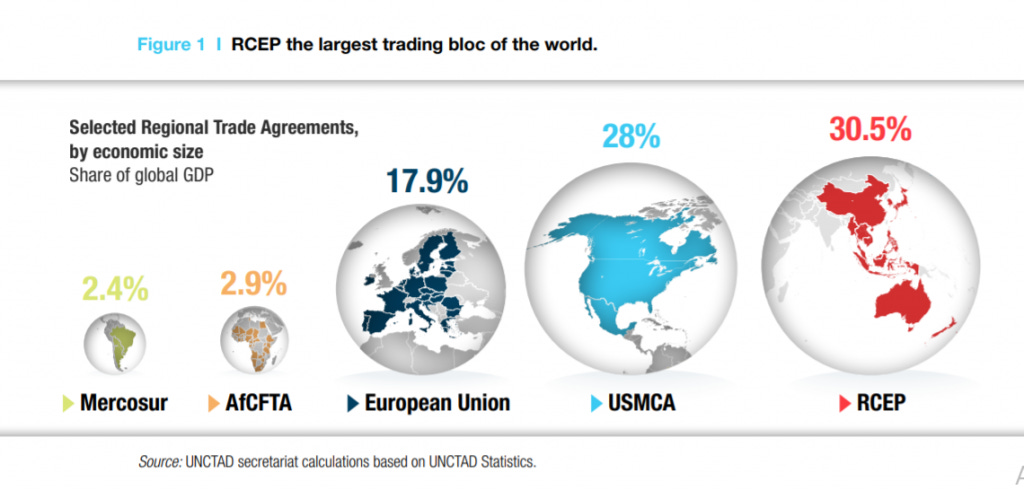

[ASEAN] The "Monsoon Path": The RCEP Recovery Model in Southeast Asia

Southeast Asia's impressive economic performance in the face of many challenges, including the escalating crisis in Ukraine and climate anomalies, could not have been achieved without the Regional Comprehensive Economic Partnership Agreement (RCEP), a regional economic cooperation framework pioneered and led by ASEAN.

It has not only awakened a "spring breeze" in Southeast Asia in the short term, but will also blow the "monsoon" of economic recovery from Southeast Asia to other regional economies such as China, Japan and South Korea, showing a unique path of the traditional concept of the periphery driving the recovery of the central countries in reverse.

Wind at the periphery: waking up the recovery

According to the International Monetary Fund (IMF), the global economic recovery continues to face many challenges in 2022, with economic growth in developing countries set to fall by 1.3% year-on-year and international trade volume fall by 3%. However, Southeast Asia, often seen as the 'periphery' of the regional economy, has shown a clear recovery since the second quarter of 2022, with domestic production stabilising and some countries allowing social and economic activity to shift from anti-epidemic mode to normal.

The major ASEAN countries all recorded positive real gross domestic product (GDP) growth in the second quarter. Among them, Malaysia's economy grew by 5% in the first quarter and 8.9% in the second quarter compared to the same period last year, the second highest single quarterly growth rate since the epidemic, beating market expectations. Meanwhile, the country's exports grew by 23.3% year-on-year in the second quarter, with a number of figures, including total trade, reaching record highs.

The lifting of restrictions on normal economic activity has been accompanied by an increase in personal consumption and a continued rebound in production in the Southeast Asian country. According to data released by HIS Markit, a leading international information services company, the average manufacturing PMI (Purchasing Managers' Index, which indicates expansion or contraction in the manufacturing sector by being above or below 50) for ASEAN countries rose to 49 in August from 46.5 in July, the fourth consecutive monthly increase. In particular, the Myanmar manufacturing PMI rose to 53.2 in August from 51.7 in July, the highest in 15 months. Indonesia's manufacturing PMI rose to 50.8 in August from 46.9 in July, indicating that the manufacturing sector ended five consecutive months of contraction and turned to expansion. Thailand's manufacturing PMI continued to rise in August, improving to 49.7 from 45.9 in July, the highest level since January 2022.

Southeast Asia's economic recovery could not have been achieved without the help of the RCEP, a stable, comprehensive and effective FTA that has contributed to Southeast Asia's economic recovery in the short term.

Read the full article here.

China on track for rapid post-Covid economic recovery in H1 2023, official forecasts

After some reopening jitters, the country can expect economic activity to come back to life, particularly in the second quarter, Han Wenxiu says. Authorities must also support smaller businesses that have taken a huge hit in the three years of zero Covid, former statistics chief says.

Despite short-term interruptions from reopening, China’s economy will recover quickly in the first half of next year, a senior economic official has forecast.

Han Wenxiu, deputy director of the General Office of the Central Financial and Economic Affairs Commission, offered the assessment after Beijing renewed its commitment to get the economy back on track during the annual tone-setting Central Economic Work Conference on Friday.

“The impact of optimising the pandemic prevention and control measures on economic operation will be a J curve,” state news agency Xinhua quoted Han as saying at a conference hosted by the China Centre for International Economic Exchanges on Saturday.

“It will disturb the economy in the short term, but will be a major boon for the whole year.“It is expected that in the first half of next year, particularly in the second quarter, the resumption of work and normal life will be accelerated, and economic vitality will occur at an accelerated pace.”

He said China’s economic fundamentals – resilience, great potential, vitality and sustainable long-term growth – remained unchanged, and the compounding effects from reopening, and more supportive fiscal and monetary policies would support the economy in 2023.

“We have the confidence, conditions and ability to promote the overall improvement of China’s economic operation,” he added.

Read full article here.

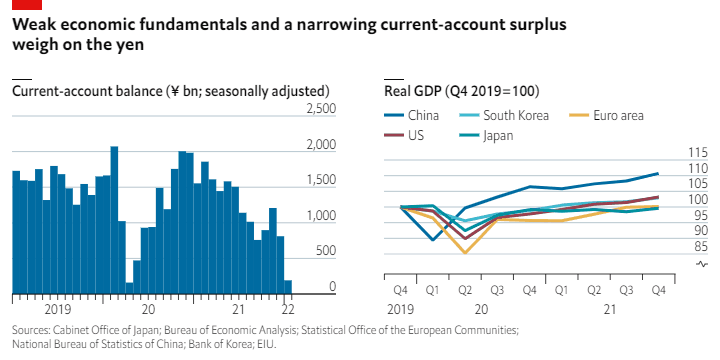

Tokyo declines on US, EU recession fears, but national budget balloons

Tokyo stocks fell sharply Friday morning, pressured by fears over a potential recession in the United States and Europe amid a series of interest rate hikes by their central banks to tame inflation. The 225-issue Nikkei Stock Average shed 431.04 points, or 1.54 percent, from Thursday to 27,620.66. The broader Topix index was down 14.51 points, or 0.74 percent, at 1,959.39. Stocks fell almost across the board on the top-tier Prime Market, with electric appliance, precision instrument, and information and communication issues leading the decline.

The Japanese government is considering raising its general-account spending above 114 trillion yen in fiscal 2023, which starts next April, a record high for the 11th straight year, sources familiar with the matter said Monday.

The amount will be substantially higher than 107,596.4 billion yen in the fiscal 2022 initial budget and surpass 100 trillion yen for the fifth consecutive year. The increase reflects a plan to set aside a record high of some 6.8 trillion yen in defense spending as the government seeks to boost the country's defences. Social security costs are also expected to hit a record high due to the aging population, with an increase of hundreds of billions of yen from 36,273.5 billion yen in fiscal 2022.

The government is expected to adopt its fiscal 2023 budget plan as early as Friday.

Read more here.

South Korea warns of deepening economic slump

South Korea has warned of a deeper economic slowdown than expected next year, extending sales tax breaks on some fuel oil products and passenger cars by a few months.

“Our economy’s growth is expected to slow next year due to the effects from a global economic slump, and the difficulty will be focused on the first half,” Finance Minister Choo Kyung-ho said on Monday at a meeting with the ruling party leadership, adding the economy was slowing at a more rapid pace than expected.

The government is expected later this week to announce its economic policy strategies for next year, which will be the first full-year statement for President Yoon Suk-yeol’s administration since its launch in May.

South Korea’s economy, the fourth-largest in Asia, relies heavily on exports ranging from cars and ships to chips and smartphones. It is widely expected to see growth fall below 2 percent next year, down from close to 3 percent this year.

The central bank last month cut its projection for next year’s economic growth to 1.7 percent from the previous 2.1 percent in its scheduled revision, citing falling exports and the resultant reduction likely in corporate investment.

As the economy has now to rely more on domestic consumption to offset cooling export demand, the finance ministry has extended by as much as six months tax breaks on fuel oil products and passenger car sales beyond their original end-2022 expiry.

Read full article here.

The reasons why Australia’s economy is slowing

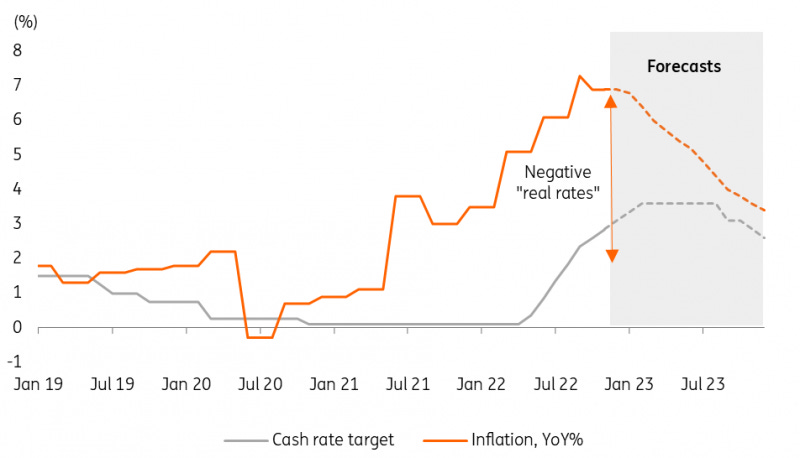

Australia's economy is showing clear signs of slowing and will drop further in 2023. House price growth appears to be on the cusp of turning negative and provides a rationale for a peak cash rate at the relatively low level of 3.6%. We believe the economic slowdown will be accompanied by a similarly rapid decline in inflation.

A lot has changed in the last year. In October 2021, the Reserve Bank of Australia (RBA) was still maintaining that the inflation target would not be sustainably met until 2024. A month later, it was abandoning its yield curve control in the face of market pressures. By May of this year, the RBA was hiking rates, throwing in the towel on its previous stance that concluded inflation would not sustainably be up to the RBA’s target until wage growth exceeded 3.5% (it still isn’t based on the 3Q22 wage price index).

Inflation hit 7.3% year-on-year in the third quarter of this year, with rises also in core measures, although the October monthly series has raised hopes that inflation may already have peaked, dropping to 6.9%YoY. We think it will now slow quite rapidly.

Macroeconomy: inflation outlook turning down

A lot has changed in the last year. In October 2021, the Reserve Bank of Australia (RBA) was still maintaining that the inflation target would not be sustainably met until 2024. A month later, it was abandoning its yield curve control in the face of market pressures. By May of this year, the RBA was hiking rates, throwing in the towel on its previous stance that concluded inflation would not sustainably be up to the RBA’s target until wage growth exceeded 3.5% (it still isn’t based on the 3Q22 wage price index).

Inflation hit 7.3% year-on-year in the third quarter of this year, with rises also in core measures, although the October monthly series has raised hopes that inflation may already have peaked, dropping to 6.9%YoY. We think it will now slow quite rapidly.

Read the full report here.