Economic Storm for South East Asia

US geo-strategic intransigence and geo-economic spillovers are accelerating the global economic slowdown

UPDATE: The Long Mekong Daily took a one day hiatus yesterday due to conference fatigue. The end of the rainy season seems to have sparked a large number of government, NGO, think tank and corporate conferences, seminars and workshops. Climate Change, post-Covid recovery and political socialisation programs are the leading money spenders. However, today’s Long Mekong Daily takes a birds-eye view of Southeast Asia’s currency, financial and digital landscape. The emerging picture is not rosy. US foreign policy and domestic fiscal and monetary policy is wreaking havoc in ASEAN and elsewhere across the Global South. Perhaps most alarmingly, both the UK and Japan are in very tight fiscal and monetary straits and signal a major crash in the US, most probably after the Democrats get hammered in the mid-term elections. Tighten your seat belts and buy gold says Nouriel Roubini (the man who predicted the 2007-8 GFC) in his new book ‘Mega Threats’.

"Read and pay attention" (Martin Wolf, the Financial Times): the bestselling author of Crisis Economics argues we are heading toward the worst economic catastrophe of our lifetimes, unless we can defend against ten terrifying threats.

Renowned economist Nouriel Roubini was nicknamed “Dr. Doom,” until his prediction of the 2008 housing crisis and Great Recession came true--when it was too late. Now he is back with a much scarier prediction, one that we ignore at our peril. There are no fewer than ten overlapping, interconnected threats that are so serious, he calls them Megathreats. From the worst debt crisis the world has ever seen, to governments pumping out too much money, to borders that are blocked to workers and to many shipments of goods, to the rise of a new superpower competition between China and the U.S., to climate change that strikes directly at our most populated cities, we are facing not one, not two, but ten causes of disaster. There is a slight chance we can avoid them, if we come to our senses—but we must act now.

In the 1970s, the U.S. faced stagflation: high rates of inflation combined with stagnant employment and growth. Today, we are heading toward a Great Stagflation that will make the 1970s look like a walk in the park. Amazon

Global Recession to Hit SEA

The World Bank has warned that the world is edging towards a global recession next year, possibly leading to a string of financial crises in emerging markets and developing economies, according to a study it published last month. Fitch Solutions, a financial research company, expects the US to suffer a "mild recession” in late 2023. The International Monetary Fund, or IMF, reckons the eurozone area will see growth of 3.1% in 2022 and just 0.5% 2023, according to its latest outlook published this month.

More precise trade figures from Southeast Asia will likely be released later this year, but across mainland Southeast Asia, preliminary numbers show exports have been declining since July. In 2022, the export of Cambodia's textile goods, which account for more than half of the country's overall exports, grew year-on-year by 37% between January and June but slowed to 19.9% in July and just 2.7% in August. Exports in total decreased by 7.5% in September, compared to the same month last year, according to data from the Cambodian General Department of Customs and Excise. Ken Loo, secretary-general of the Garment Manufacturers Association in Cambodia, an industry body, told DW he thinks Cambodia's exports to European markets will continue to decline in the fourth quarter of this year and into 2023.

Vietnam, whose trade with EU markets soared by 14.8% last year to $63.6 billion (€64.4 billion), saw its exports decline by 14% between August and September, with many factories already suspending operations, according to Vietnam government data that was reported by local media. DW

Online Shopping Takes a Hit

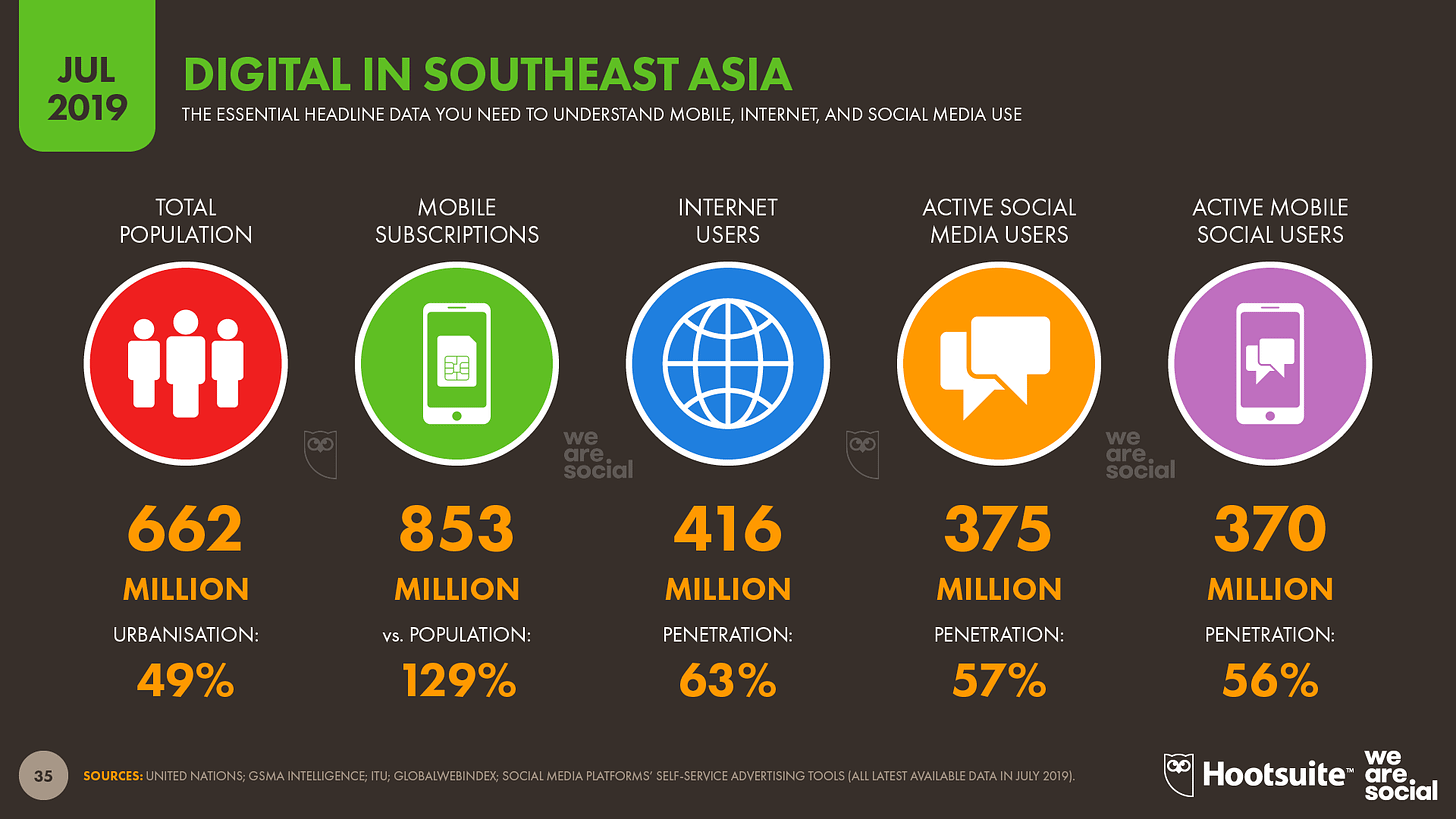

Southeast Asia Digital Economy Slows as People Curb Spending. Online shoppers limit purchases as prices, interest rates rise Region’s digital economy to hit $200 billion this year. Growth in Southeast Asia’s internet economy is slowing after years of expansion, showing that even emerging digital markets aren’t immune to economic headwinds. Online spending in the region will rise about 20% this year to $200 billion, research from Google, Temasek Holdings Pte and Bain & Co. showed, slowing from 38% a year earlier. The region’s internet economy is set to reach $330 billion by 2025, according to the report, down from a previous forecast of $363 billion. Bloomberg

Not So Bad after all?

The toxic combination of COVID, inflation and the war in Ukraine has triggered a bout of global volatility that has hit Asia and other emerging markets hard, but many are weathering the challenges better than anticipated and a growing number of investors and businesses are recognising value in their long-term growth prospects. The International Monetary Fund forecasts that emerging and developing economies will grow 28% faster than the global average this year and more than twice as fast as the average next year. The relatively robust performance of such a wide and disparate group of emerging markets is down to two factors. The first is much better macro-prudential management over the past few years. In general, these economies have managed their debt exposures carefully to avoid the sort of currency mismatch that tripped up Asian markets in 1997. They have floated their currencies and built up foreign exchange reserves, and they have created a mutual support system by reducing barriers to trade, largely via regional pacts. The second factor is the vast shift in the shape of the global economy. Even 10 years ago, the economic role of emerging markets was largely limited to providing cheap labor and cheap commodities for developed economies. Nikkei

Mixed Messages

Economies in Asia-Pacific will dominate global growth in the upcoming year, according to S&P Global Market Intelligence. S&P predicts the region will achieve real growth of roughly 3.5% in 2023, while Europe and the U.S. will likely face recession. “Asia Pacific, which produces 35% of world GDP, will dominate global growth in 2023, supported by regional free-trade agreements, efficient supply chains, and competitive costs,” S&P said in a note. The firm trimmed its growth forecast for global real GDP by 0.6 percentage point from last month’s forecast of 2% — and now expects to see 1.4% growth in 2023. That’s a steep decline from 5.9% global growth in 2021 and even slower than the 2.8% growth S&P expects for 2022. CNBC

Currency Plunge

Currency Depreciations Risk Intensifying Food, Energy Crisis in Developing Economies. The shrinking value of the currencies of most developing economies is driving up food and fuel prices in ways that could deepen the food and energy crises that many of them already face, according to the World Bank’s latest Commodity Markets Outlook report. In U.S. dollar terms, the prices of most commodities have declined from their recent peaks amid concerns of an impending global recession, the report documents. From the Russian invasion of Ukraine in February 2022 through the end of last month, the price of Brent crude oil in U.S. dollars fell nearly 6 percent. Yet, because of currency depreciations, almost 60 percent of oil-importing emerging-market and developing economies saw an increase in domestic-currency oil prices during this period. Nearly 90 percent of these economies also saw a larger increase in wheat prices in local-currency terms compared to the rise in U.S. dollars.

Elevated prices of energy commodities that serve as inputs to agricultural production have been driving up food prices. During the first three quarters of 2022, food-price inflation in South Asia averaged more than 20 percent. Food price inflation in other regions, including Latin America and the Caribbean, the Middle East and North Africa, Sub-Saharan Africa, and Eastern Europe and Central Asia, averaged between 12 and 15 percent. East Asia and the Pacific has been the only region with low food-price inflation, partly because of broadly stable prices of rice, the region’s key staple. World Bank

Golden Decade is Over

From Grab to Sea, ASEAN tech confronts end of golden decade. Investors taste first market downturn as unicorn high wears off. A 10-minute drive from the central financial district in Singapore, Grab's new nine-story headquarters that houses 3,000 employees shows how far the company has risen since its early days working from a small rental car office storeroom. "We would just grind it through," said CEO Anthony Tan at the opening of the building in August. In line with its 10th anniversary, the event was joined by dozens of drivers -- now five million strong in eight Southeast Asian markets -- honking and circling the entrance in their ride-hailing cars. Also present as confetti flew was Singapore's prime minister-in-waiting Lawrence Wong, waving a large green flag bearing the company's logo. Nikkei

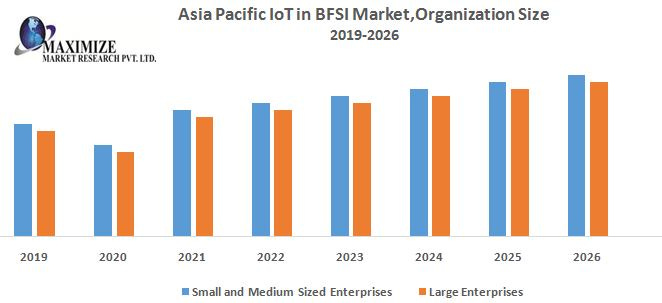

IoT Still Looks Good

IoT Market: Challenges and opportunities for Southeast Asia. IoT will witness tremendous growth in all 3 segments – Domestic, Industrial, and Smart City in the coming years. However, depending on the industry type, number of devices to be connected, data connectivity, power factor and the dependency factor there will be certain challenges and trade-offs. There will be cars that will converse with you about the alternate route options to avoid traffic congestion, take you to the right parking slot, and pre-pay before you arrive. Asia, especially the growing South-East Asian markets, is no exception when it comes to the new world of IoT. IoT is proving to be a promising technology and we are seeing growing traction toward its adoption. Both consumers and businesses are waiting to embrace the fascinating impact of the Internet of Things like bowls telling you if you are overeating or IP address for each organ of your body for doctors to connect and check. IoT devices are infiltrating every aspect of our life and some of us probably can’t imagine spending a day without them anymore. Economic Times

Cargo Slumps

"Sudden slump in demand' leaves Asia Pacific air cargo carriers in limbo. Asia Pacific airlines saw a double-digit drop in air cargo volumes last month, and forwarders expect only a modest uptick in Q4. According to the Association of Asia Pacific Airlines (AAPA), year-on-year international air cargo demand dropped 10.4% in September, measured in freight tonne km (FTK), while cargo capacity expanded 5.9%. As a result, the average load factor was down 11.4 percentage points, to 64%. AAPA said cargo markets remained under pressure due to depressed business and consumer confidence levels. Director general Subhas Menon added: “The outlook for the cargo market remains subdued in the near term. Overall, the region’s airlines continue to face a challenging operating environment, with costs under pressure as a result of high fuel prices and weak local currencies.” While airfreight rates in Asia have been dropping in recent months, there was a “short-lived price increase in the first half of October”, due to cancelled flights from China during Golden Week and high demand for e-commerce cargo, according to Taiwanese forwarder Dimerco. In its October freight update for Asia Pacific, it said: “With a reduction in shipment volume in the South-east Asia market, airlines are now willing to negotiate prices on high-quantity shipments and offer special ad-hoc rates for some outbound shipments from countries such as Indonesia and Thailand.” The LoadStar

US Rate Hikes Cause Currency Havoc

Chinese yuan remains pressured amid muted Asian FX. The Chinese yuan hovering near 15-year lows, the Vietnamese dong rises on rate hike and Asian stocks remain choppy. Most Asian currencies were muted and equities were mixed on Tuesday, as investors retreated from Chinese assets amid worries that President Xi Jinping's new leadership team could prioritise the state over the private sector. More positively for Asian currencies, analysts said the latest U.S. business activity report signalled that the U.S. Federal Reserve's rate rises have started to take effect, and that the Fed might hike rates by less than the 75 basis points previously expected at its Nov 1-2 policy meeting. Still, the Chinese yuan tumbled for the third straight session to trade close to its December 2007 lows, even as shares advanced about 1.1%. The yuan has now logged in almost a 13% decline on a year-to-date basis, and it is also one of the weaker performing units across Asia Pacific. The Chinese currency's weakness dampened the sentiment for its other Asian peers with Malaysian ringgit, Thai baht and the Indonesian rupiah trading 0.1%-0.3% lower, while the Singapore dollar was almost. Separately, the Vietnamese dong gained marginally about 0.1%, after its central bank raised its key policy rates by 100 basis, days after Southeast Asian nation voluntarily devalued its currency to reflect fluctuations in the global market. Analysts from Maybank said the depreciation bias on the dong is likely to continue due to the U.S. Federal Reserve's hawkish stance. "The FX intervention to maintain the VND within the trading band will likely to put further pressure on FX reserves," they added. The South Korean won also rose 0.3%. Meanwhile, multiple Asian equities were choppy, with markets in Thailand, Singapore and South Korea gaining between 0.3% and 0.6%, while stocks in Vietnam , Taiwan and Indonesia edged between 0.1% and 1.2% lower. Yahoo Finance