Extraordinary Measures

Global monetary policy is set in the USA for the benefit of the USA, but Washington holds views on the global economy far removed from the material well-being of the Global South.

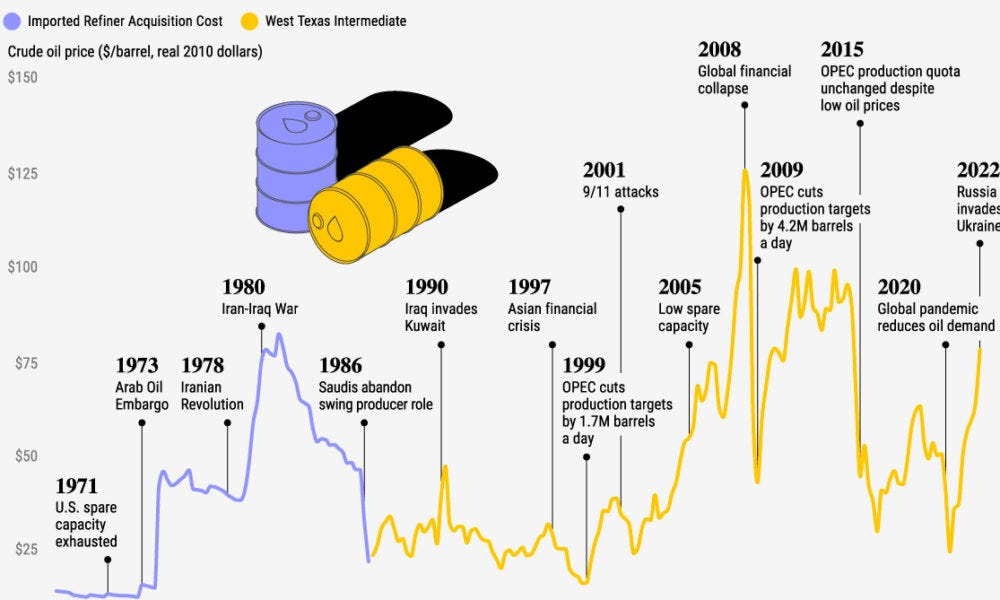

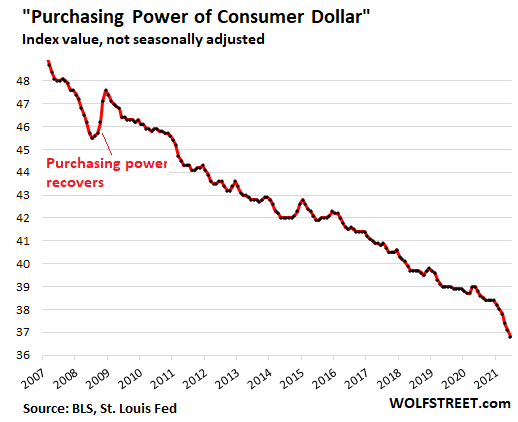

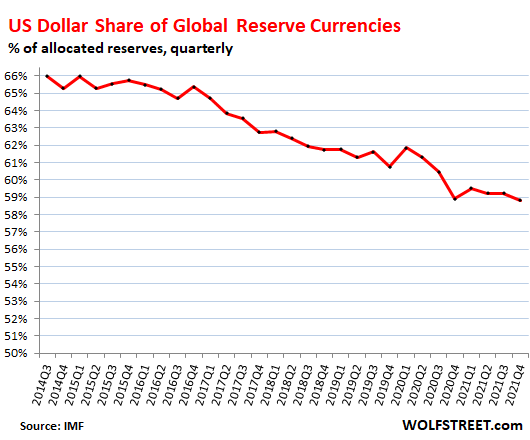

UPDATE: The US has hit the debt ceiling yet again, but what does it mean for global markets and dollar dominance? The Long Mekong Daily explores the literature to discover that since 1970 when Richard Nixon unpegged the dollar from gold, the USA has been in constant decline. Bretton II still governs global monetary policy, but Zoltan Pozsar from Credit Suisse, which had its biggest loss ever in 2022, thinks Bretton Woods III is inevitable and it is being manifested in War and Inflation, Algorithms and Technology, Debt and De-dollarisation.

The BRICS is now arguably more significant than the G7 and the Global South, including the members of the SCO, are exerting diplomatic and economic pressure on the recessionary prone Global North to arrest NATO’s proxy war with Russia and rapid militarisation of the so-called Indo-Pacific. EU resistance to US policies is also paving the path to reset trade-relations with China and allow global economic growth to flow to the Global North.

The Long Mekong Daily doubts that US president Biden, and his foreign policy and military advisors, are capable of changing course or that the US Congress can unify on anything other than “foreign demons’. Thus, the Global South’s de-dollarisation pressure and the weakened economies of US-allies, UK, Japan, Germany and France, are beginning to look like lemmings running of a fiscal and monetary cliff with increased military budgets pulling them toward a hard-landing ever faster.

America Hit Its Debt Limit, Setting Up Bitter Fiscal Fight

By Jim Tankersley and Alan Rappeport for the New York Times

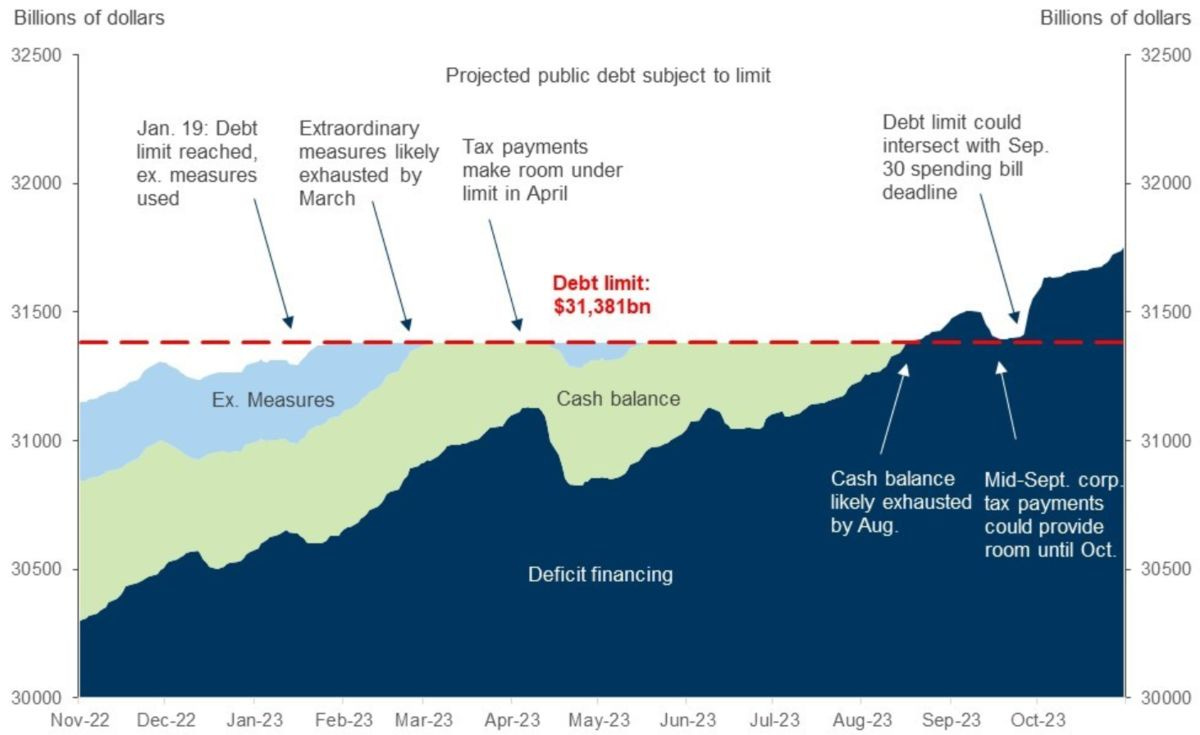

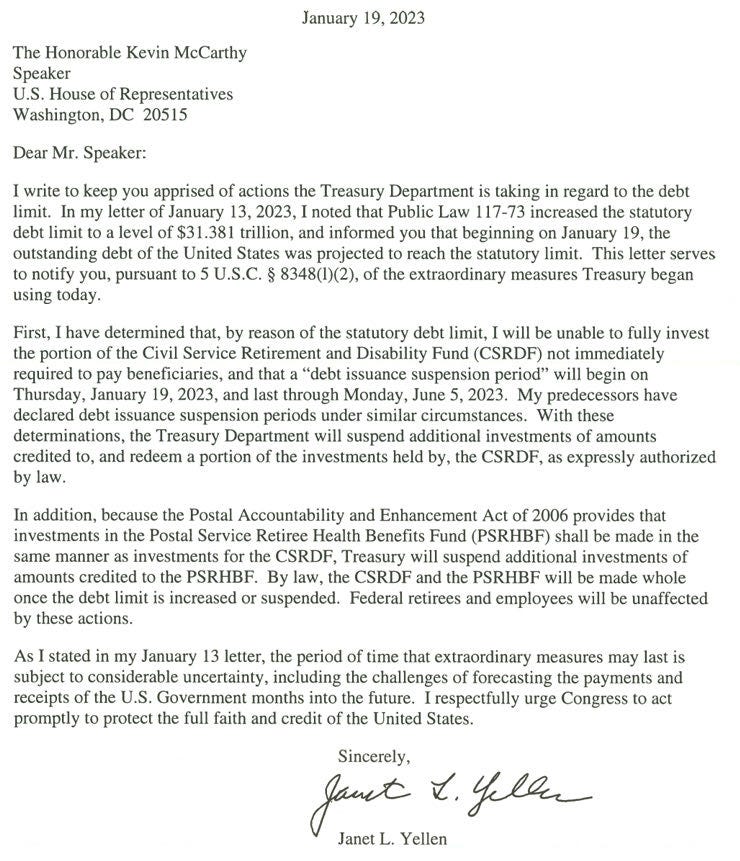

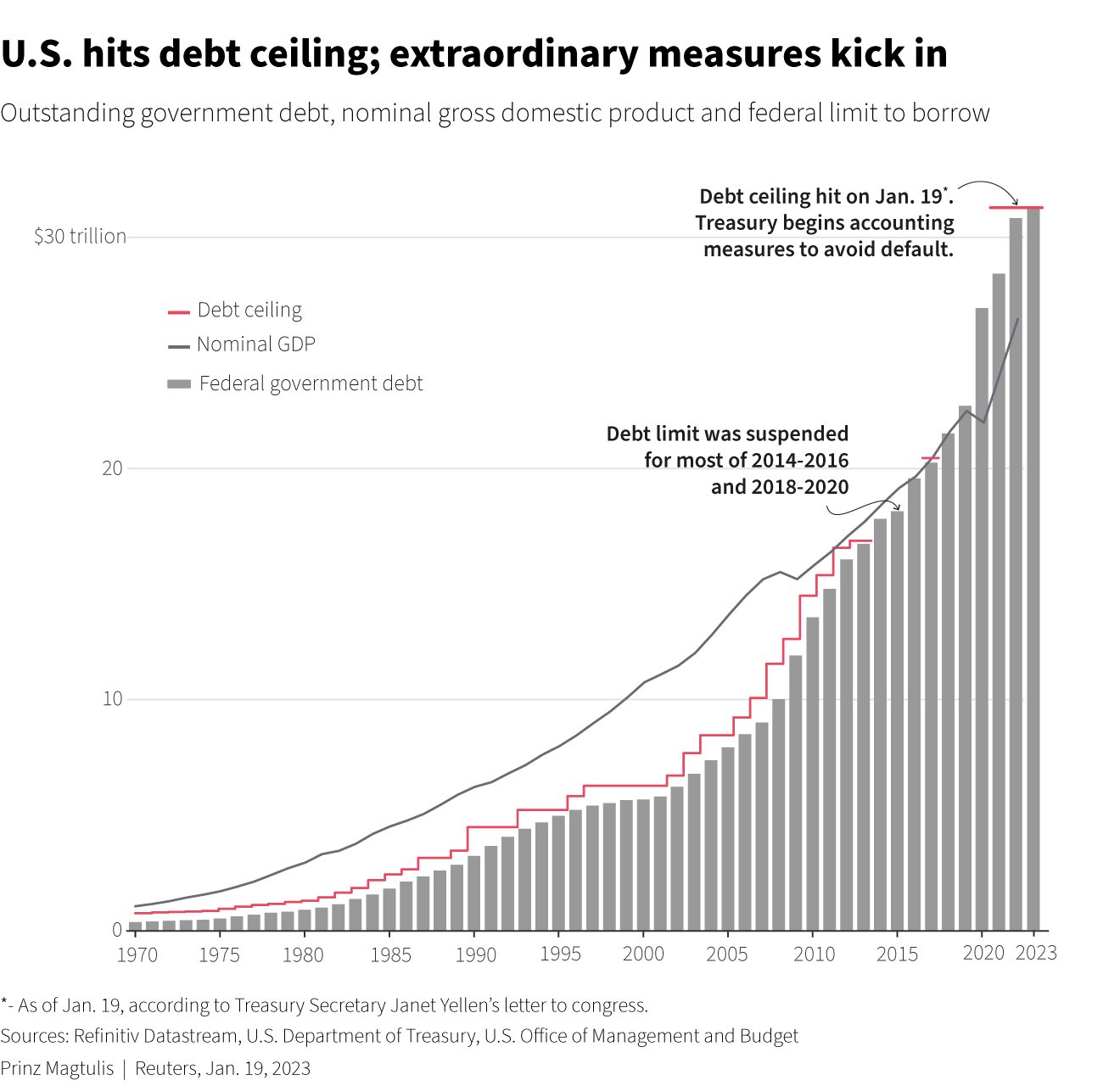

The Treasury Department said it would begin a series of accounting moves to keep the U.S. from breaching its borrowing cap and asked Congress to raise or suspend the limit. The United States hit its debt limit on Thursday, prompting the Treasury Department to begin using a series of accounting manoeuvres to ensure the federal government can keep paying its bills ahead of what’s expected to be a protracted fight over whether to increase the borrowing cap.

The milestone of reaching the $31.4 trillion debt cap is a product of decades of tax cuts and increased government spending by both Republicans and Democrats. But at a moment of heightened partisanship and divided government, it is also a warning of the entrenched battles that are set to dominate Washington, and that could end in economic shock.

Read full article here.

Extraordinary Measures

Shocker From Fed Repo Oracle Zoltan Pozsar: Powell Must Crash The Market

By Tyler Burden for Zero Hedge

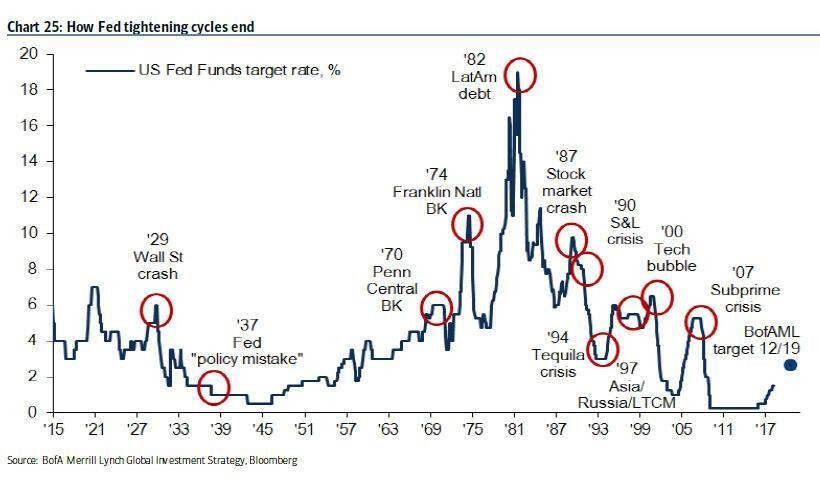

Back on November 7, just one day before the Russell, cryptos and most risk assets peaked for the year and perhaps this cycle, we asked a simple question yet one which the "expert punditry" immediately dismissed as it was - what else - just more conspiratorial thoughts, to wit: "Did The Fed Just Set The Stock Market Up For A Crash?"

Of course, on its face this would seem preposterous: after all, the Fed's entire legacy over the past 13 years has been merely creating hyperinflation among financial assets (and creating the largest wealth and social divide the US has ever seen), while doing everything it could to keep real-world economic inflation subdued to avoid the risk of an inflationary meltup (like the one we have now).

Furthermore, crashing the market in a hyperfinancialized world such as this one, where the value of financial assets is now more than 6x US GDP would immediately lead to a major recession, if not outright depression.

Read full article here.

War and Peace

by Zoltan Pozsar of Credit Suisse

In 2019, James Sweeney, then chief economist at Credit Suisse, popped into my office and said “you know this pandemic and lockdowns... this is where your world [funding] and my world [global industrial production] intersect, because supply chains are payment chains in reverse”. I thrive on memes, and after James’ blitz visit, we quickly wrote Covid-19 and Global Dollar Funding, a piece that explained why the pandemic would lead to a major funding crisis...

In 2022, Pippa Malmgren became my source of macro stimulus. Her meme that “World War III has already started, but it’s different from “traditional” world wars: it is a hot war in cold places [like Svalbard, underwater, cyberspace, and space], and a cold war in hot places [like islands in the Pacific, the DRC, and the Sahel]” inspired me to write four “war” dispatches last year: War and Interest Rates, War and Industrial Policy, War and Commodity Encumbrance, and finally, War and Currency Statecraft. In these, I identified six fronts (meaning “hot wars”) in “macro-land” (a “cold place”) where Great Powers were going “at it” in 2022:

the G7’s financial blockade of Russia, Russia’s energy blockade of the EU, the U.S.’s technology blockade of China, China’s naval blockade of Taiwan, the U.S.’s “blockade” of the EU’s EV sector with the Inflation Reduction Act, and China’s “pincer movement” around all of OPEC+ with the growing trend of invoicing oil and gas sales in renminbi.

Those were six geopolitical events in one single year, that is, a geopolitical curveball to deal with every two months.

I don’t think 2023 will be different: in a number of regions in Europe and Asia, the threat of a hot war is real; the BRICS are set to expand with new members (“BRICSpansion”), which means more de-dollarization of EM trade flows; CBDCs are spreading like kudzu, with Türkiye the latest country to launch one; and with the launch of every new CBDC, the potential of Project mBridge to diminish the role of the dollar in FX transactions and trade invoicing will rise as it interweaves BRICS (and soon BRICS+) central banks into a global network to rival the global network of correspondent banks on which the dollar system runs.

Download the full article here.

Bretton Woods III

by Zoltan Pozsar of Credit Suisse

We are witnessing the birth of Bretton Woods III – a new world (monetary) order centered around commodity-based currencies in the East that will likely weaken the Eurodollar system and also contribute to inflationary forces in the West.

A crisis is unfolding. A crisis of commodities. Commodities are collateral, and collateral is money, and this crisis is about the rising allure of outside money over inside money. Bretton Woods II was built on inside money, and its foundations crumbled a week ago when the G7 seized Russia’s FX reserves...

The beautiful paradox of linear rates (the stuff you trade and I write about) is that you need to think linear to find relative value most of the time, but you have to think non-linear to recognize and survive regime shifts. We are seeing a regime shift unfold in funding markets currently (which, as always, will pass), and a sea change in inflation dynamics and FX reserve management practices.

We have two convictions today. First, June FRA-OIS spreads can widen more, to at least 50 bps, both due to funding premiums driven by commodity prices and the market taking out Fed hikes, and second, it’s a good time to get long...

...shipping freight rates. Yes, freight rates, which, at the current juncture are linked to “geo-monetary” dynamics. Freight rates are the price of balance sheet for “commodity RV traders” (the commodity trading houses) and for sovereigns that can take the risk of moving and storing subprime, sanctioned commodities.

Download the full article here.

Bretton Woods II Still Defines The International Monetary System

By Michael P. Dooley, David Folkerts-Landau and Peter M. Garber

In this paper we argue that net capital inflows to the United States did not cause the financial crisis that now engulfs the world economy. A crisis caused by such flows has been widely predicted but that crisis has not occurred. Indeed, the international monetary system still operates in the way described by the Bretton Woods II framework and is likely to continue to do so. Failure to properly identify the causes of the current crisis risks a rise in protectionism that could intensify and prolong the decline in economic activity around the world.

Critics of the Bretton Woods II system turned out to be right in predicting a financial crisis for the United States. In this paper we argue that the crisis that we have was unexpected and not directly or indirectly caused by international imbalances that preceded it. Moreover, the incentives that drive the Bretton Woods II system will be reinforced by the crisis and, looking forward, participation in the system will expand and the life of the system will be extended.

Download the full article here.

The Big Float

By Barry Eichengreen for Project Syndicate

August 15 is not a red-letter day on most calendars. True, August 15, 1969, was the first day of the Woodstock music festival. And the Panama Canal opened to traffic on August 15, 1914. Mostly, though, mid-August finds officials and others on holiday.

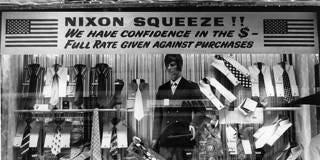

But not on Sunday, August 15, 1971. That evening 50 years ago, at the conclusion of three days of crisis meetings, President Richard M. Nixon announced that the United States was preemptively closing the “gold window,” the financial facility through which the country made gold available to foreign governments and central banks at $35 an ounce. To contemporaries and historians alike, Nixon’s announcement marked the end, or at least the beginning of the end, of the Bretton Woods international monetary and financial system. And that meant it marked the end, or at least the beginning of the end, of American economic and monetary hegemony. The postwar period when the US could all but unilaterally determine the monetary structure and financial fate of the Free World was drawing to a close.

By early 1973, however, reality had intruded, and the reconstructed system collapsed. Bretton Woods gave way to what economist John Williamson dubbedthe international monetary “nonsystem.” By abandoning fixed parities for their currencies, governments embarked on the unprecedented experiment with floating exchange rates that has preoccupied them ever since.

Read the full article here.

All Is Not Quiet on the Eastern Front

By Niall Ferguson for Bloomberg

2022 was the year in which war made a comeback. But Cold War II could become World War III in 2023 — with China as the arsenal of autocracy. War is hell on earth — and if you doubt it, visit Ukraine or watch Edward Berger’s All Quiet on the Western Front, Netflix’s gut-wrenching new adaptation of Erich Maria Remarque’s classic antiwar novel of 1929.

Even a small war is hellish for those caught up in it, of course. But a world war is the worst thing we humans have ever done to one another. In a memorable essay published last month, Henry Kissinger reflected on “How to Avoid Another World War.” In 1914, “The nations of Europe, insufficiently familiar with how technology had enhanced their respective military forces, proceeded to inflict unprecedented devastation on one another.” Then, after two years of industrialized slaughter, “the principal combatants in the West (Britain, France and Germany) began to explore prospects for ending the carnage.” Even with US intermediation, the effort failed.

As Kissinger rightly points out, two nuclear-armed powers are currently contesting the fate of Ukraine. One side, Russia, is directly engaged in conventional warfare. However, the US and its allies are fighting indirectly by providing Ukraine with what Alex Karp, chief executive of Palantir Technologies Inc., calls “the power of advanced algorithmic warfare systems.” These are now so potent, he recently told the Washington Post’s David Ignatius, that they “equate to having tactical nuclear weapons against an adversary with only conventional ones.” Take a moment to ponder the implications of that.

Read the full article here.

Read ‘Algorithmic warfare : applying artificial intelligence to warfighting’ here.

Read Alex Karp interview here.