Dollar Loses face

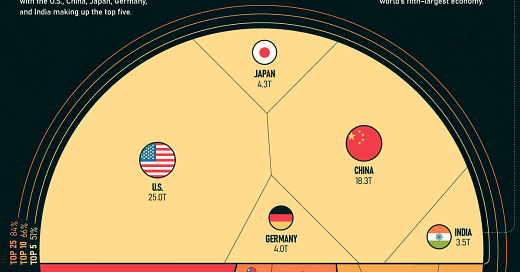

The world economy has fundamentally altered, Brazil has returned to Lula and de-dollarisation is a global trend, especially amongst the BRICS and the Global South

UPDATE: The Long Mekong Weekend edition investigates the global economy and the shift of wealth and power to Asia and the Global South. Brazil has returned to the safe hands of Lula (Luiz Inácio Lula da Silva) and will be seeking to strengthen the Global South, BRICS and de-dollarisation. The Long Mekong Weekend provides reading from China, ASEAN, West…