UPDATE: Stimson Center finds Mekong Dam activity is near normal, but still only refers to China as “upstream”. The IMF has published a series of articles on the “Future of Money”, which is required reading if you want to know more about crypto and digital currencies – BTW China leads the pack. Three billion people cannot afford a healthy diet and the failure of diplomacy to bring an end to the conflict in Ukraine is certainly not helping. A new “Diplomatic Brief” from Konrad Adenauer Stiftung looks at Southeast Asian relations and the Stockholm International Peace Research Institute (SIPRI) releases a report on arms sales and military supplies from third-parties dominate South East Asian procurement. Tech in Asia is seeing some problems with labour supply and lower investment and a research article from the US investigates Hydro Power politics in the Greater Mekong Subregion. Enjoy your Wednesday read on The Long Mekong Daily!

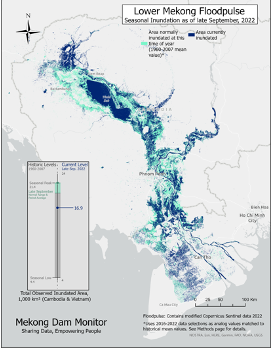

FLOODPULSE

If you’ve been to the Tonle Sap Lake recently, the lake is brimming with water, and locals will tell you it feels like old times – except for the fact that they cannot fish like

they used to due to a fishing ban that expires next month. Indeed, the lake has significantly expanded this wet season, but below-normal wet season flooding around Phnom Penh is keeping this wet season’s flood pulse well below normal range. The floodpulse expanded by 14% compared to early September, and last week’s typhoon could bring further expansion into October. Mekong Water, 4 October 2022

THE FUTURE OF MONEY

The future of money is undoubtedly digital. The question is, What is it going to look like? Of course, digital money has been developing for some time already. New technologies hope to democratize finance and broaden access to financial products and services. A key goal is to achieve much cheaper, instantaneous domestic and

cross-border payments. Eswar Prasad takes us on a tour of existing and emerging forms of digital money and looks at the implications for finance, monetary policy, international capital flows—even the organization of societies. Not every form of digital money will prove viable. Cryptocurrencies like Bitcoin fail as money, says Singapore’s Ravi Menon, among others. Recently these tokens have lost two-thirds of their value. While they are actively traded and heavily speculated on, prices are divorced from any underlying economicvalue. Stablecoins are designed to rein in the volatility, but many have proved to be anything but stable, Menon adds, and depend on the quality of the reserve assets backing them. Still, journalist Michael Casey argues, decentralized finance (DeFi) and crypto are not only here to stay but can address real-world problems such as the energy crisis. Regulation is key. The IMF’s Aditya Narain and Marina Moretti call for global regulation to bring order to markets and provide a safe space for innovation. Meanwhile, central banks are considering their own digital currencies. Bank for International Settlements Chief Agustín Carstens and his coauthors suggest that central banks should harness the technological innovations offered by crypto while also providing a crucial foundation of trust. Privacy and cybersecurity risks can be managed with responsibly designed central bank digital currencies, adds the Atlantic Council’s Josh Lipsky. It’s too early to tell how the digital landscape will evolve. But with the right policy and regulatory choices, we can imagine a future with a mix of government and privately backed currencies held safely in the digital wallets of billions of people. Download IMF F&D

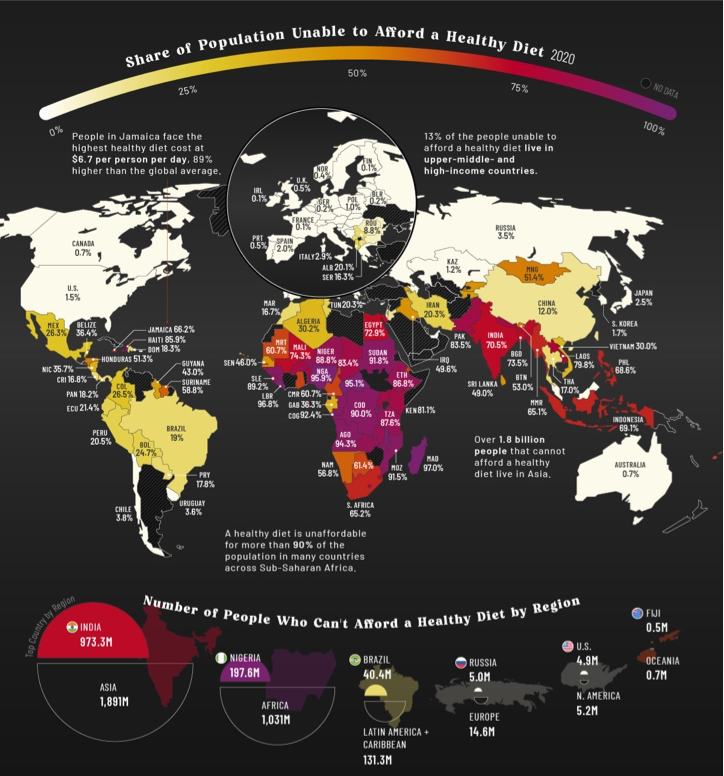

A HEALTHY DIET, OR NOT?

While they aren’t often the focus of news media, hunger and undernourishment are problems plaguing millions of people every day. According to the UN Food and Agriculture Organization (FAO), more than 3 billion people could not afford a healthy diet in 2020, an additional 112 million more people than in 2019. The increase was partly because of rising food prices, with the average cost of a healthy diet rising by 3.3% from 2019 levels. As of August 2022, the FAO food price index was up 40.6% from average 2020 levels. Unless income levels increased by a similar magnitude, the healthy diet crisis is likely to have worsened, especially in low-income countries experiencing rampant food inflation. Using data from the FAO, the above infographic maps the share of people unable to afford a healthy diet in 138 different countries as of 2020 (latest available data). Visual Capitalist, 5 October 2022

NEW TRENDS IN INTERNATIONAL RELATIONS

Konrad Adenauer Stiftung Cambodia releases new issue of "Diplomatic Briefing", volume 05/2022, in cooperation with the Cambodia Institute for Cooperation (CICP). The volume looks at a diverse range of issues in the realm of the region’s growing security dilemma and its implications. Many pressing and timely subjects were brought into focus through the comprehensive insights and perspectives of key experts across the region and beyond. Download PDF here

REGIONAL ARMS CAPABILITIES - SIPRI

Today, SIPRI releases a report that investigates self-reliance in domestic arms production in the Indo-Pacific region. Arms-production Capabilities in the Indo-Pacific Region: Measuring Self-reliance. Armed forces in the Indo-Pacific region remain

dependent on weapon systems imported from foreign suppliers. This is despite the efforts of many governments in the Indo-Pacific to implement policies that support the development of local arms industrial capabilities with the aim of increasing self-

reliance. This report develops three indicators to give a score and regional ranking of self-reliance in arms production to 12 jurisdictions in the Indo- Pacific region: Australia, China, India, Indonesia, Japan, South Korea, Malaysia, Pakistan, Singapore, Taiwan, Thailand and Viet Nam. Overall, this report contributes to knowledge and debates on armament trends and military modernization in the so-called Indo- Pacific. In a region where tensions among neighbours are rising, it further contributes to transparency with regard to levels of self-reliance in domestic arms production, allowing for an independent assessment of the region’s respective arms industries. Download the SIPRI Report here.

TECH IN ASIA

When things look dour, the interconnected nature of modern economies and industries are often put under the microscope. Layoffs across Southeast Asia and the rest of the world are no coincidence, but rather the expected result of interest rate hikes by central banks. Strong labor markets aren’t exactly conducive to reining in inflation. The global economy is overheating, and federal bankers are looking to put a lid on the spending power of both companies and consumers by raising the cost of borrowing. The government of Indonesia, Southeast Asia’s largest economy, raised not only interest rates but also the prices of subsidized petrol and diesel. Singapore has tightened lending limits for housing loans, while Thailand, Malaysia, Vietnam, Philippines, and Taiwan have been steadily hiking interest rates. Even the bravest economists are unlikely to place bets on how high inflation can go from here. In times of such uncertainty, investors are naturally less inclined to park their money in risky assets such as stocks, let alone in loss-making tech companies. Amid this economic quagmire, Grab (GRAB, NDAQ) has sought to provide clarity on its path toward profitability at its first-ever investor day last week. The headline was that the Singapore-based tech titan is expecting to break even by the second half of 2024. However, that was not enough to appease jittery investors.Grab shares have fallen more than 8% since its investor day last Tuesday. The stock is currently flirting with a new record low at US$2.63 a piece, giving the firm a market value of about US$10.1 billion – well below the nearly US$40 billion valuation at which it went public last year. Nonetheless, as highlighted in today’s featured piece, Grab's bold move is a chance for the company to build credibility with investors, but comes with risks. We’ve already witnessed how poorly the market reacts when guidance targets are not met. Sea Group (SE, NYSE) shares tanked after it suspended full-year revenue guidance for Shopee, its ecommerce unit, in August. The premium story also sheds light on how Grab, largely known for its ride-hailing and food delivery services, is placing a greater emphasis on GrabFin and how its financial arm keeps the cogs of the firm’s wider ecosystem running smoothly. Further, my colleague, Simon, touches upon Grab’s shift to an asset-light model in the groceries business and how the company is looking to draw inspiration from China's Meituan (3690, HKG) to integrate higher-margin businesses into its ecosystem through advertising. Tech in Asia, 5 October 2022

HYDROPOWER POLITICS

Since the 1990s, many large hydropower dams have been built in the Mekong River Basin. There has been considerable concern about resettlement and compensation linked to reservoir flooding, as well as the impacts of dams on wild-capture fisheries, riparian livelihoods, and aquatic biodiversity and ecosystems. Anti-dam activists in the Mekong Basin have contested these impacts by claiming that dam impact assessments limit the spatial scale of recognized impact areas in order to reduce both the political backlash against projects and the costs of dam development. In this article, we consider the contentious politics of hydropower dam impact assessments in order to understand how the spatial strategies of anti-dam activists influence the recognized scale of dam im- pacts. We analyze three of the most contested hydropower projects in the Mekong River Basin: the operational Pak Mun dam in northeastern Thailand, the recently completed Lower Sesan 2 dam in northeastern Cambodia, and the planned Sambor dam on the mainstream Mekong River in Cambodia. We argue that the recognized scale of impacts is in part an outcome of anti-dam activists’ different spatial imaginaries and associated scale fra- mes—along with those of state actors, business interests, and project consultants— that inform activist strategies for mobilizing geographically dispersed people to make claims about dam impacts. Although activists have sometimes challenged the spatial extent of project impact assessments, they have also sometimes inadvertently adopted strategies to contest dams that have reproduced project scale frames favorable to dam proponents. Download PDF here

REMEMBERING GANDHI

We are celebrating yet another Gandhi Jayanti. Given the significance that Mahatma Gandhi holds not only for Indians but globally, some introspection about the current state of affairs in India and Gandhi’s philosophy as a possible antidote to rapidly increasing hatred and violence is urgently required. Let me begin by using Dharma as an example. The contemporary fallacy of collapsing dharma into mere religion is part of the problem. Hindutva misuses the concept of ‘Dharma’ and ‘Ram Rajya.’ Ram Rajya, technically and in Gandhian terms, would mean a state/regime where justice reigns supreme, where the most marginalised are taken care of without discrimination. The image of Lord Rama enjoying half-eaten fruit from Sabri displays not only his magnanimity but outreach. He did not seek vengeance for being banished to the forests but instead took the suffering as his duty. Politicians in India often resort to insincere caricaturing of Rama as their political project but overlook the qualitative difference between his politics of suffering and their politics of making others suffer. Countercurrents, 5 October 2022