Update: The weekend read is all about the economy and investment. The Long Mekong has provided links to a few reports on regional trends and global shocks. Phnom Penh is losing its lakes and floods may be more frequent. More than enough to read for a Long Mekong Weekend.

Phnom Penh’s Shrinking Lake

The news of Boeng Tamok being chopped up and given to various entities and individuals is not new if you’ve been following Campuccino or other Cambodia-related news. I guess the reason it keeps appearing as a news headline is because there is no sign to indicate that the reclamation of the lake would slow down any time soon. It makes me question, are we looking at the same future of another Boeng Kak? In the event of a major flood, what would hold the water to protect the city now if these lakes are no more?

According to a news report by VOD in May, Boeng Tamok which used to span over 3,190 hectares, is now reduced to a mere 157 hectares. The article explores the different stakeholders involved in claiming the lake and looks into the now precarious lives of residents living around the lake. The interactive map in the article shows the rapid disappearance of Phnom Penh’s last major lake and wetland.

Another VOD article published earlier this week saw authorities clearing fish farms of the lake’s residents despite their protest. I’m going to end this section with an excerpt from the article:

[…] Residents living around the lake have requested all levels of officials to find a solution where they can continue to live by the lake and use it for their livelihood. Instead, district officials have filed a court complaint against residents for obstruction and incitement.[…] Campuccino

Endless Summer Droughts

The summer droughts that affected parts of the U.S., Europe, and China were made 20 times more likely by climate change, finds a new study by World Weather Attribution (WWA). China had its driest summer in 60 years, while drought conditions in Europe sparked brush fires and dried up rivers.

The scientists with the WWA, an international organization comprised of scientists who study the connection between climate change and extreme weather, analyzed weather data, computer simulations, and soil moisture across those areas, and discovered “climate change made dry soil conditions much more likely over the last several months.”

The scientists said: If not for human-caused climate change, this type of drought would happen across the Northern Hemisphere just once every 400 years. Because the climate has warmed by 2.2 degrees Fahrenheit, they anticipate these conditions will now repeat every two decades.

Many catastrophic weather events took place in the summer, including months of rain in Pakistan that flooded entire communities. These disasters are “the fingerprints of climate change,” said climate scientist Maarten van Aalst, a study co-author, and Director of the Red Cross Red Crescent Climate Center. “The impacts are very clear to people and are hitting hard, not just in poor countries, like the flooding in Pakistan, but also in some of the richest parts of the world, like western central Europe.” Van Aalst added that one way to reduce the “compounding and cascading” effects of climate change around the world is to reduce emissions. Counter Currents

Economic Indicators

The ASEAN+3 Macroeconomic Research Office (AMRO) yesterday revised upwards Cambodia’s GDP growth rate to 5 percent in its October quarterly update, from 4.9 percent in its July quarterly update. However, the regional macroeconomic surveillance organisation revised downwards the Kingdom’s economic growth expectations for next year to 5.4 percent, from its July growth estimates of 5.8 percent.

While talking about the inflation projections for the country, it said the Consumer Price Index (CPI) in the country is set to decrease to 5.3 percent this year, down from its July estimates of 6.4 percent. The CPI for next year is estimated to be 3 percent, down from its earlier prediction of 4.4 percent.

While talking about the growth expectations of Cambodia, AMRO chief economist Dr Hoe Ee Khor told Khmer Times: “Cambodia’s economy is expected to grow at a faster pace of 5.0 percent in 2022 on the back of robust external demand and a resumption in tourism and domestic activity.” Khmer Times

ASEAN +3 Indicators

The ASEAN+3 Macroeconomic Research Office (AMRO) today revised downwards its short-term growth forecast for the ASEAN+3 region. The continuing strict dynamic zero-COVID policy and real estate sector weakness in China and potential recessions in the United States and the euro area are weighing on the region’s outlook.

In its October Update, AMRO staff forecasts the ASEAN+3 region to grow by 3.7 percent this year—down from the 4.3 percent growth projected in July reflecting mainly weaker growth in Plus-3 economies. The ASEAN region is expected to grow strongly by 5.3 percent. The region’s inflation rate for 2022 is now projected to be 6.2 percent—a full percentage point higher than previously forecast. Growth is expected to increase to 4.6 percent in 2023 as China’s economy picks up, with inflation moderating to about 3.4 percent.

The prolonged war in Ukraine is deepening Europe’s energy crisis, pushing it closer to recession. In the United States, aggressive monetary tightening to fight persistently high inflation is intensifying fears of a hard landing.

“A simultaneous economic slowdown in the United States and euro area, in conjunction with tightening global financial conditions, would have negative spillover effects for the region through trade and financial channels,” said AMRO Chief Economist, Hoe Ee Khor.

In ASEAN+3, inflation is accelerating. Food and fuel prices remain elevated despite recent easing in key global commodity benchmarks. Subsidy cuts in some economies and depreciating currencies have also pushed prices higher.

“Central banks in the region are raising policy interest rates to safeguard price stability and support their currencies. However, the pace of monetary tightening has generally been more measured and gradual than in the United States and the euro area,” said Dr. Khor.

AMRO’s assessment are found in the latest quarterly update of its flagship report, the ASEAN+3 Regional Economic Outlook (AREO). The next update will be published in January 2023.

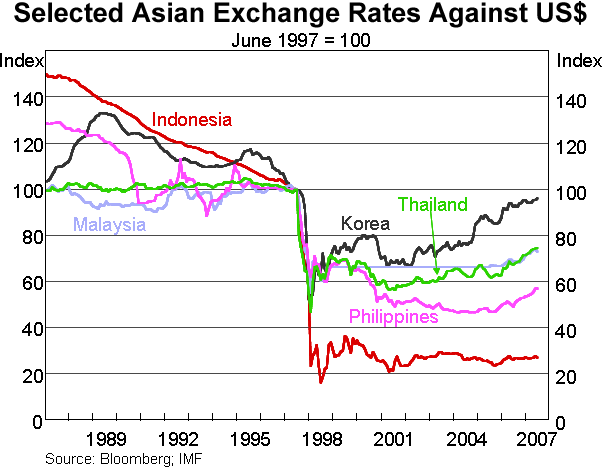

1997 Deja Vu?

Things were very different (worse) in 1997 Asia

Being old enough to have been covering the Asia-Pacific region during the financial crisis in 1997/98, I can speak with some authority in saying that it was nothing like what we are experiencing today. Indeed, the Asia region as a whole was in far worse shape then than it is now.

Perhaps the most important difference between now and then is in the exchange rate regimes being run by Asian economies. For the most part, these were fixed exchange rates pegged to the USD. There is a concise description of the causes and effects of the Asian financial crisis from the IMF in 1998 here. In a nutshell, Asian economies back then combined high interest rates to attract capital inflows to finance investment and currencies pegged to the US dollar at favourable rates to achieve rapid export-led growth. Hot money was often channelled into unproductive property investments rather than raising the productive capital of these economies, which worsened the side effects when the bubble finally popped.

About the only similarity between then and now is what ultimately broke the currency pegs: hot money outflows attracted back to the US as the Federal Reserve raised rates to curb inflation upon emerging from recession in the mid-1990s. This caused the USD to appreciate along with Asian currencies as they were pegged, losing competitiveness. The Thai baht collapsed first, and contagion then pulled down the Philippine peso, Indonesian rupiah, and eventually the Korean won. The foreign debt that had helped finance the earlier rapid growth then became a massive debt-service headache, requiring IMF assistance and bailouts to prevent default. Think ING

World Economic Outlook, October 2022

Description: The IMF’s forthcoming October 2022 World Economic Outlook examines two economic forces that could impact inflation going forward. One chapter looks at wage dynamics post-COVID-19, wage-price spiral risks, and how policymakers can respond. Another chapter investigates the potential near-term effects of critical climate policies on inflation and economic activity and how they can be best designed. Download Report

IMF Vietnam

Vietnam: 2022 Article IV Consultation-Press Release; Staff Report, and Statement by the Executive Director for Vietnam. Spurred by an impressive vaccination drive, the economy is rebounding from a severe pandemic wave. The government successfully maintained fiscal, external, and financial stability. Nonetheless, the labor market recovery is lagging, with sizeable underemployment, small and medium sized enterprises remain vulnerable, problem loans are rising, real estate and corporate bond market risks are elevated, and the pandemic exacerbated longstanding structural challenges. Download Report

Regional Investment Framework 2022

The Regional Investment Framework 2022 (RIF 2022) is the medium term pipeline of priority projects in the Greater Mekong Subregion (GMS). It is a consolidation and expansion of the earlier Regional Investment Framework (2013–2022) and continues to operationalize the strategic priorities of the GMS Program under the GMS Strategic Framework (2012–2022) and the Hanoi Action Plan 2018–2022 (HAP).

The RIF 2022 covers a wide range of sectors including transport, energy, environment, agriculture, health and human resource development, information and communication technology, tourism, transport and trade facilitation, and urban development. This pipeline is intended to be used as an instrument to have greater alignment between regional and national planning for GMS projects and as a tool to galvanize new financing for projects. Download Report

ASEAN Investment Report 2022

ASEAN recorded a robust rebound in Foreign Direct Investment (FDI) inflows, surging by 42 percent to reach US$ 174 billion in 2021. This increase to near pre-pandemic levels reverses the decline in 2020 caused by the COVID-19 outbreak and reflects the attractiveness of the region’s economy for global investors. With a large market and strong regional integration, ASEAN remains a major FDI destination in the developing world – second only to China – and will play an important role in driving global economic recovery.

Intra-ASEAN FDI, which continue to be an important source of FDI as well as the establishment of production networks in the region, have been increasingly driven by emerging opportunities in sectors such as electric vehicles, electronics, digital economy and green technologies. Start- ups – in particular the unicorns – have been critical in driving these new trends and contributing to the Industry 4.0 transformation in ASEAN. At the same time, private equity and venture capital firms have been playing an increasingly active role to support the growth of start-ups, with total assets under management rising rapidly from US$36 billion in 2017 to US$66 billion in 2021. Download Report

Cambodia Mekong Cooperation Framework

Mekong Cooperation is renowned as a sub-regional cooperation that consists of the countries along the Mekong River, namely, Cambodia, Lao PDR, Myanmar, Thailand, and Viet Nam. The participating countries and partners of this cooperation includes China, India, Japan, Republic of Korea, the United States, the European Union, ADB etc. with the aim of ensuring sustainable development and utilization of water resources, contributing to the economic and social development, enhancing well-being of the people, narrowing the development gap among regional countries, supporting ASEAN Community building and addressing challenges in the Mekong region. Ministry of Foreign Affairs