Media Monday

ASEAN & Google MSMEs, Cambodia silences Soros, Vietnam's cable woes, Shein, Tuma & Tik Tok shopping, ASEAN Digital Masterplan, new Huawei hand in Thailand, 10 threats to telecoms

UPDATE: Today, the Long Mekong Daily has dived into online and digital to provide a brief overview of the media and communications sectors across ASEAN.

Micro-Small & Medium sized enterprises (MSMEs) get Google assistance.

George Soros, Nancy Pelosi and Scandinavian Christian groups are the faces behind Cambodia’s discredited Voice of Democracy radio.

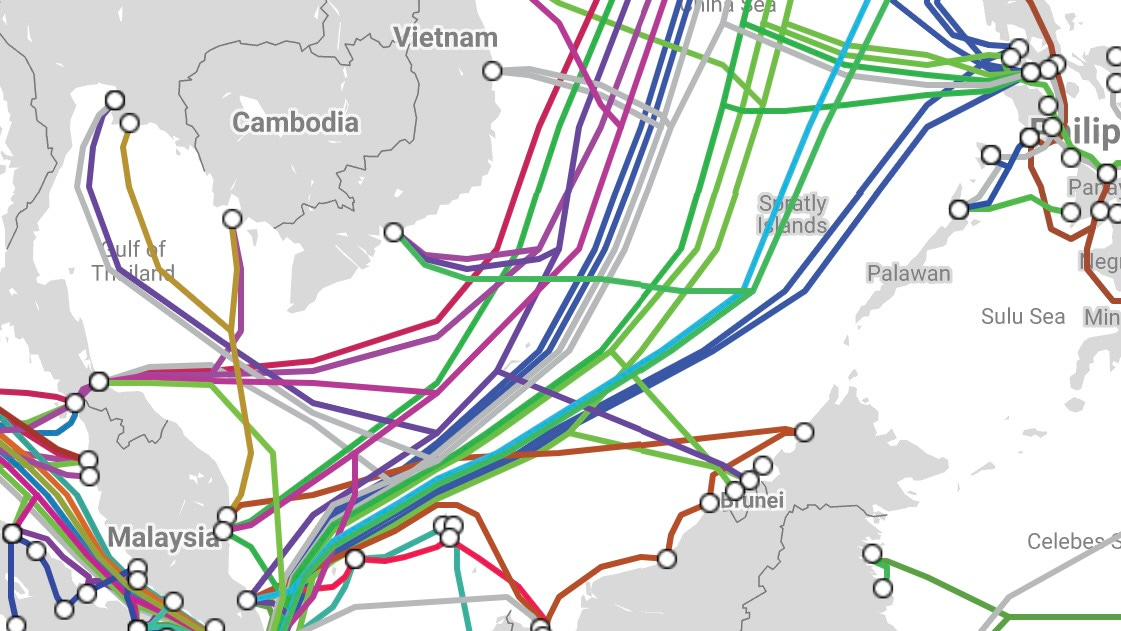

Vietnam has real and ongoing problems with its undersea fibre-optic cable networks - something fishy?

China’s online shopping platforms are cheap fast and good.

ASEAN has a masterplan and a commitment to strengthen cooperation the telecommunications sector and digital technology.

Thailand gets a new Huawei hand as David Li takes the helm.

Ernst & Young release a report on the top ten threats to telecommunications - consumer management is number 1 - what did you expect from a management consultancy ?

Joint ICC, Google and ITC programme to support small businesses in the ASEAN region

The Digital Export Enablement Programme (DEEP) for ASEAN Small Businesses aims to support 1,000 micro-, small- and medium-sized enterprises (MSMEs) in the ASEAN region by equipping them with digital export-relevant skills.

According to a recent study conducted by ICC and Google, MSMEs in ASEAN have a relatively low participation in regional trade relative to their economic importance, and 60% of these firms have a strong interest in expanding their activities to new markets in the region. Yet, to be able to take advantage of new opportunities in the region, over 75% of MSMEs surveyed voiced their needs for tailored support to increase their skills and capabilities in digital marketing and in leveraging digital tools and technologies to access market information.

In response, the International Chamber of Commerce (ICC), in collaboration with Google and the International Trade Centre (ITC), has launched the Digital Export Enablement Programme (DEEP) for ASEAN Small Business to help MSMEs from across ASEAN member states grow their business internationally, by equipping them with digital export-relevant skills.

Download full report here.

Who is behind Voice of Democracy (VOD) in Cambodia

Cambodian Prime Minister Samdech Akka Moha Sena Padei Techo Hun Sen has ordered the Ministry of Information to revoke the licence of The Voice of Democracy (VOD) after the latter failed to make a public apology.

“Can the words 'regret and tolerance' replace 'apology'?

To protect the Royal Government’s honour, I decided to end the issue by ordering the Ministry of Information to revoke the VOD’s licence from now on, and all VOD’s broadcasts must completely end by 10:00 a.m., Feb. 13, 2023,” he said.

Samdech Techo Prime Minister also asked Phnom Penh Capital Hall and relevant institutions to protect the order and property of this radio. “We only stop all its broadcasts, we don’t touch its property,” he underlined. “Foreign friends who provide money to this radio, please withdraw the money or help another country. For the staff, please look for other job.”

Today, VOD receives its funding from the Open Society Foundations, a US grant fund founded by George Soros, DanChurchAid, a Danish Christian aid organisation, and Diakonia, a Swedish Christian human rights organisation. DanChurch operations in Cambodia are funded by USAID and a number of European state-run agencies. Diakonia

George Soros is a controversial figure and his Open Society Foundation has been at the centre of many political scandals, which ended with Open Society being closed or restricted from operations in a number of countries. He is close friends with Nancy Pelosi, the former US house speaker, and infamous for her Taiwan trip and the sticky corruption allegations about insider trading to amass her wealth. Scandinavia’s Lutheran Christian sects have deep networks in Europe and America and receive considerable state funding for their religiously inspired programs for developing countries.

In 2007, Nicolas Guilhot (a senior research associate at the French National Centre for Scientific Research) wrote in Critical Sociology that the Open Society Foundations serve to perpetuate institutions that reinforce the existing [capitalist] social order. Guilhot argues that control over the social sciences by moneyed interests has depoliticized this field and reinforced a capitalist view of modernisation.

George Soros has made his mark as an enormously successful speculator, wise enough to largely withdraw when still way ahead of the game. The bulk of his enormous winnings is now devoted to encouraging transitional and emerging nations to become "open societies", open not only in the sense of freedom of commerce but—more important—tolerant of new ideas and different modes of thinking and behaviour. (Paul Volcker, 2003)

In November 2015, Russia banned the activities of the Open Society Foundations because it represents a threat to the foundations of the constitutional system of the Russian Federation and the security of the state. In 2017, the government of Pakistan ordered the Open Society Foundations to cease operations within the country.

In November 2018, Open Society Foundations met strong opposition from governments in Turkey and Hungary and announced they were ceasing operations in Türkiye and closing their European office in Budapest and moving to Berlin.

Read more here.

Continuing problems with Vietnam’s subsea cable connections

A subsea cable that’s about to be decommissioned is now the only fully functional pathway that connects Vietnam’s internet with the rest of the world. Out of the five subsea cables that connect Vietnam with the rest of the globe, the SMW-3 has been around the longest. Expecting to be decommissioned in 2024, the soon-to-retire cable is now the only fully operational pathway that holds Vietnam’s international internet connection together for 70 million users.

This is the second time in the last 24 years of operation that the SMW-3 has found itself in the same situation. The first time was in 2007, when one of Vietnam’s two cables at the time was surreptitiously sabotaged. And this time, four out of the five available cables encountered issues all at once.

Over the past three months, the four cables have encountered issues one after another, partially or fully disabling internet connections running through them. The first one to have trouble was the AAE-1, which lost the data flow en-route towards Hong Kong on November 24 last year. Seventeen days later, the AAG completely lost all signals.

The state-run Vietnam News Agency has reported that internet service providers are the problems – the reason for which is unknown – are seriously affecting performance and reliability. The Submarine Cable Systems group reported that Vu The Binh, secretary general of the Vietnam Internet Association (VIA) said that Vietnam needs at least two or three more subsea cable routes in the next five years to serve mounting demand.

The Vietnam Posts and Telecommunications Group (VNPT) said this was an unfortunate “force majeure”, according to a representative quoted by the Submarine Cable Systems group. The Submarine Cable Systems group is run by the Vietnamese military, has re-routing plans to regulate traffic on the remaining sea cable and terrestrial cables. The news agency said two cables were completely offline, the Asia-America Gateway (AAG) and the Asia Pacific Gateway (APG). Two others, Asia Africa Europe 1 (AAE-1) and the Intra Asia (IA) cable are seeing problems, said the state news agency.

VNPT, quoted by the Submarine Cable Systems group, said platforms such as Facebook, TikTok and YouTube can still be accessed normally, while financial, banking, and insurance transactions can still be conducted.

Read more here.

Chinese shopping platforms gain ASEAN market share

Finding new revenue streams outside China became urgent for major Chinese online retailers as Covid control measures and a turbulent domestic regulatory environment hurt economic growth and consumer confidence in the country. Shein, which started as a small cross-border wedding dress supplier, turned into a unicorn worth $100 billion by April 2022, demonstrating a successful path for other shopping platforms trying to sell outside of China. Chinese overseas-focused online shopping apps were a bright spot in a year otherwise characterized by high inflation and weak demand in the world’s major economies.

Fast fashion giant Shein maintained strong growth despite sustainability, imitation, and labor rights controversies, while the more established Alibaba saw its turnover decline in Europe despite narrowed losses in Southeast Asia. Pinduoduo-backed Temu, seemingly out of nowhere in September, shot to the top of the US app downloading chart by the end of 2022. ByteDance-owned TikTok tried to navigate the same successful path as its sister app Douyin in e-commerce, but with less impressive results in the UK.

Here’s what you need to know about the overseas adventures of Shein, Temu, TikTok Shop, and Alibaba in 2022.

Shein

Shein was the most popular fast-fashion brand worldwide in 2022, according to research conducted by price comparison site money.co.uk, which shows that Shein experienced tremendous global growth over the year. The company reportedly surpassed its full-year 2021 sales of $15.7 billion just midway through 2022 and was expected to have made sales of $24 billion by the end of the year.

In April, Shein received a $100 billion valuation from General Atlantic, Tiger Global Management, and Sequoia Capital China, but as one person who declined to invest in Shein at a roughly 30% discount told Financial Times, the firm may well have been overvalued.

The buzz around Shein shows no signs of abating in 2023, and the company seems to be expanding its business model, reportedly exploring a marketplace platform that would enable other merchants to sell directly to customers, in a move to compete more directly with e-commerce giants like Amazon and Alibaba-owned AliExpress.

Temu

Less than four months after its launch, Temu, the cross-border e-commerce platform owned by Pinduoduo, has already shown strong appeal with its big discounts and generous coupons, and for most of the past two months, it has been the most downloaded app in the US.

Temu’s sales growth rate cannot be underestimated. In October, its average daily sales generated more than $1.5 million, reportedly slightly below internal expectations. Temu reached a peak weekly GMV of over $40 million around Black Friday, with sales topping $10 million in the first week of November, according to data provider Sandalwood.

TikTok Shop

In 2022, the sales growth achieved by TikTok was mainly driven by its Southeast Asian markets, especially Indonesia — the largest e-commerce market and economy in the region. TikTok Shop already had tens of thousands of sellers in the country, most of whom were micro, small, and medium-sized enterprises, by November 2022.

TikTok’s e-commerce business hit $200 million in monthly GMV in the Indonesian market, while only $24 million in the UK. Consumers were more receptive to live commerce in Southeast Asia, which helped TikTok find success in the region, with a survey conducted by market research firm Ipsos revealing that 71% of Indonesian consumers had accessed live commerce events, and 56% had made purchases during such events.

However, Shopee and Alibaba-owned Lazada still dominate most e-commerce markets across Southeast Asia. In Malaysia, Shopee holds 71% of the region’s overall e-commerce web traffic, followed by Lazada at 18% and PGMall at 9%, tech news site Tech Wire Asia said.

Alibaba

The Chinese e-commerce giant’s overall performance in international commerce retail in 2022 was muted, with revenues in the first three quarters essentially flat compared to the same period a year earlier, up just 1.6% to RMB 31.15 billion.

In the quarter ending September 2022, Southeast Asia-focused Lazada’s order growth posted its first year-over-year decline in orders in two years, which Alibaba said was largely affected by a lifting of Covid-19 restrictions that lured consumers back to offline channels.

Alibaba-owned AliExpress recently gained notable success in South Korea, with the app ranked first in terms of downloads in the shopping section in the country’s app store, according to Chinese media outlet The Economic Observer, citing mobile data analytics provider App Annie.

A person in charge of the platform’s Korean market told the media that AliExpress currently has nearly 3 million monthly active users, which covers around 10% of the country’s e-commerce users.

Read more here.

Malaysia committed to developing telecommunications and digital technology sector in Asean

Malaysia is actively contributing to the development agenda of the digital and communications technology sector in the Asean region, aligned with the Asean Digital Master Plan 2025 (ADM2025). Communications and Digital Minister Fahmi Fadzil said Malaysia's commitment can be seen through the implementation of projects outlined in ADM2025 and its participation in the Malaysian Delegation to the 3rd Asean Digital Ministers Meeting (ADGMIN3).

"Malaysia's participation in ADGMIN3 was to express its continued commitment in strengthening the role of ICT as the main driver of Asean's economic and social transformation post-Covid-19.

"The meeting also ratified the Boracay Declaration which outlines the commitment of Asean member countries in 2023 to strengthen cooperation towards the development of the telecommunications sector and digital technology through the implementation of projects in parallel with ADM2025," he said in a statement.

Download the ASEAN Masterplan here.

New Huawei chief reaffirms Thai vision

The newly appointed chief executive of Huawei Technologies (Thailand) is committed to developing the nation as the digital hub of Asean, supporting businesses and startups to adopt secure and reliable cloud solutions and playing a part in improving the country's Global Cybersecurity Index (GCI) ranking. David Li was promoted to the top position, replacing Abel Deng who became president of Huawei Asia-Pacific's carrier business department.

Speaking during a news briefing yesterday, Mr Li said demand for green energy is growing rapidly in line with the carbon neutral trend and Huawei will provide solutions and global practices that will push Thailand towards the Asean carbon neutral leader and electric vehicle (EV) production hub in the region.

These commitments are part of its six strategic businesses to pursue in 2023.

The six comprise 5G infrastructure for vertical industry adoption; cloud for enterprise business; digital transformation; green energy with new energy solutions for sustainability; cybersecurity; and local ecosystem promotion, including the incubation of digital talent.

"All operations are in line with our mission of 'Grow in Thailand, Contribute to Thailand'," said Mr Li.

Thailand is one of 5G technology leaders in Asean as the country is one of the early adopters of 5G technology and the country has attained advancement in 5G technology with strong implementation progress.

Read more here.

Ernst and Young: Top 10 risks for telecommunications in 2023

As the telecoms industry strives to stay resilient through challenging times, we examine the top 10 risks facing operators.

In brief

It’s vital that telcos respond appropriately and effectively to the pressures their customers are facing from the cost-of-living crisis.

Telcos must focus strongly on security and trust: 39% of telco CISOs believe security is insufficiently factored into strategic investments.

Actions to improve workforce culture and better manage the sustainability agenda rank among the industry’s most urgent imperatives.

Going into 2023, telecoms operators worldwide can be heartened by the collective resilience they’ve shown amid the recent geopolitical and economic turbulence. In the past two years, a combination of price increases, M&A deals and government intervention has helped share prices across the global telecoms sector broadly recover from the lows they touched during the pandemic — although the rebound remains gradual and uneven.

But are telcos sufficiently attuned to the current and emerging risks confronting them to achieve these goals? Amid a high inflationary environment — pushing up operating costs — telcos must also deal with a range of challenges from customers’ cost-of-living pressures, to evolving expectations around security, to changing perceptions of workforce culture — the threats being faced are both urgent and diverse.

Access the full report here.