Restructuralisation

Understanding the BRI as a solution to global challenges, China excess supply to dominate semiconductors, US working on freely available chip technology widely used in China

UPDATE: This is not a travelogue. Rather, as I've moved through a Europe that is still struggling to come to terms with Brexit, the Ukraine crisis, energy security, climate change and sustainable economic growth. 140 countries participate in the Belt and Road Initiative, of the remaining 53 UN members only a minority remain hostile, and fewer still abstain. The following is a reflection on mounting and intersecting global development challenges and how to understand the BRI as a solution.

If the objective was to hamstring China’s economy, it has failed. The chip ban undoubtedly imposed severe costs on China, which is attempting to reinvent large parts of the semiconductor supply chain at high cost. But China can recompense itself for those costs by turning excess supply into a vehicle to dominate semiconductor markets globally in the not-too-distant future.

In a new front in the US-China tech war, US President Joe Biden's administration is facing pressure from some lawmakers to restrict American companies from working on a freely available chip technology widely used in China - a move that could upend how the global technology industry collaborates across borders.

The Belt and Road Initiative (BRI) responds to new era of global challenges.

By JOSEF GREGORY MAHONEY | China Daily Global

BRI has demonstrated its incredible capacity to jumpstart growth and development

This is not a travelogue. Rather, as I've moved through a Europe that is still struggling to come to terms with Brexit, the Ukraine crisis, energy security, climate change and sustainable economic growth, with some countries being friendly to the Belt and Road Initiative, some hostile, and some in between, this is a reflection on current challenges and how we should understand the initiative as a solution and not another headwind in this period of mounting and intersecting problems.

When the Belt and Road Initiative (BRI) was first proposed and its initial maps were published, it seemed fantastic and yet not unbelievable. As a global vision of real, mutual development largely devoted to building better connections within the Global South, it rang true in terms of Chinese discourses but presented the sort of bold plan of action that Beijing historically would have hesitated to mount on the world stage. Nevertheless, in terms of capacity to actually execute the plan, anyone familiar with Chinese development achievements over the course of reform and opening-up understood that China indeed had the ability to advance the initiative realistically.

In fact, while a great number of non-Chinese, many Western people greeted the initial plans with incredulity and, in some cases, fear-mongering, some Chinese themselves found the Belt and Road Initiative unsettling — they did not understand why China was taking a greater leadership role in the world, thinking it made more sense to avoid increased risks and responsibilities, and that it was better to concentrate national resources at home.

What some critics and naysayers did not understand then, and what the Chinese leadership would better explain is that China and the rest of the world were already entering a new era. On the one hand, this included China's rise as a major power, its timely achievements of eliminating extreme poverty, suppressing corruption, controlling the COVID-19 outbreak, and establishing a moderately prosperous society with more than 400 million middle-income earners, and doing these things while simultaneously emerging as the global leader in green innovation, environmental cleanups and ecological protection.

On the other hand, it likewise included a recalcitrant Global North, including several Western or West-oriented countries but most especially the United States, clinging desperately to old paradigms that had made it difficult for developing countries to break out of debt traps and take real steps forward, while also ensuring that most emerging countries become stuck in middle income, energy and security traps. But this new era would also include, as some leading scholars, think tanks and government agencies predicted, a global failure to reverse climate change, an increase in novel disease outbreaks, growing political instability and polarization in a growing number of countries, and war.

When I was in Ukraine, I saw a country that needs China's help to mediate peace and, thereafter, help in rebuilding. The West has offered tepid assurances that it can help Ukraine rebuild, but even more tepid have been promises to join the European Union and NATO. In fact, the West cannot save Ukraine and perhaps cannot even save itself. Indeed, the West bears considerable responsibility for the circumstances that led to the crisis, and likewise responsibility for sustaining it now, with dozens killed daily, despite an effective stalemate since late last year. In fact, almost all of the Ukrainians I interviewed, across the country and across the political and economic spectrums, knew these things to be true.

And yet, many Ukrainians remain vulnerable to disinformation, believing China's neutrality has allowed it to benefit from the conflict, for example, through increased trade with Russia. In fact, those increases are modest compared to the damage China has suffered given intense US pressures in European capitals to return to a Cold War paradigm.

When I was in Greece, I heard much about one of the Belt and Road Initiative's early successes, the Greek Port of Piraeus, but thereafter in Italy, under intense pressure from Washington, the government in Rome decided to abandon the Belt and Road Initiative. The Italian prime minister was in a pickle, forced as others increasingly are into a zero-sum game versus building a shared future for humanity. Although she counterbalanced her decision by assuring that bilateral ties with China remain strong, and perhaps they do, only those espousing US interests or xenophobia see such steps as promising.

In Poland, I saw a country and political elite mobilized by a pro-Ukraine, anti-Russian narrative, but likewise longstanding anti-German narratives that understandably remain part of Poland's national identity. Nevertheless, many people assured me, these "anti-narratives "have more to do with the politics of distraction, advanced by politicians who lack a real vision of the future and seem to believe that advancing a pro-US line is the only way to advance Poland. In fact, Polish people are not politically naive, and while not succumbing to the negative spirit of such negative rhetoric, most of those I spoke with were unable to envision the possibility of an alternative politics.

In Hungary, people told me of the country's increased economic dependence on China, particularly as its other major economic partner, Germany, has suffered significant setbacks after losing access to Russian energy; and yet, I also heard accounts of the attacks, including dog whistle racism, advanced by Hungarian liberals against Fudan University's efforts to build a campus in Budapest. Hungary remains positive toward China, but US soft power remains potent there.

In Prague, I saw Chinese by the dozens, still a major tourist draw, especially among couples seeking a romantic holiday. And yet, the Czech academics I met there spoke of the increasingly difficult political climate they faced in their universities, of an emerging cancel culture directed against those engaged in candid discussions about global affairs, and a growing lack of confidence in the future. What about China, many asked me: Is there a future for us in China?

To hear such questions in Europe while the EU and the United Kingdom find themselves increasingly drawn down Washington's dark path, and while NATO expands and Washington dreams of advancing it against China, I am reminded effectively of the answers to such questions that we've heard from the Global South, especially Southeast Asia, the Middle East, Central Asia, Africa and Latin America: as the past 10 years have demonstrated, and as the Belt and Road Initiative has helped illustrate, there is no future without countries moving hand-in-hand with China. Washington's counter-proposals, such as the Build Back Better World Initiative, are known shams. Without China, there's little to no shared development, no major trading partner, no bulwark against climate change or future pandemics, no respite from US hegemony, no security from military and political interventions and the constant threat of eroding sovereignty.

Over the past decade, the Belt and Road Initiative has demonstrated its incredible capacity to jumpstart growth and development. Over the past 10 years, we've also seen the initiative and anything associated with China being demonized by the US and those who have decided to keep their declining fortunes and futures in lockstep with Washington. To be sure, the Belt and Road Initiative has had its ups-and-downs: not every project has been realized, and certainly challenges such as the pandemic were impossible to weather perfectly. Nevertheless, the initiative has proven itself to be one of the few and perhaps only major plan to make significant achievements in advancing human progress across a great number of diverse countries. It remains the only credible effort capable of still achieving much more in a world that desperately needs much more. It's with this perspective that we should greet the Belt and Road Initiative's 10th anniversary, and encourage others to do the same before they're left further behind.

Read more here.

Tech Controls Bite Back

By David P. Goldman

Free trade has always been the favoured policy of established economic powers, and protection has been the weapon of choice of the challengers. Exporting cheap goods to undercut nascent rivals has long been a mainstay in the imperial playbook. America’s controls on technology exports to China are a historical anomaly and may produce the opposite of the intended effect.

As Michael Lind observes in his economic history of the United States, Britain responded to the surge in American manufactures during the War of 1812 by dumping goods below cost in the American market. Lind cites Henry Brougham, then a member of Parliament and later Lord Chancellor, explaining why it paid Britain to sell to Americans at a loss: “It was well worthwhile to incur a glut upon the first exportation, in order, by the glut, to stifle, in the cradle, those rising manufactures in the United States, which the war had forced into existence, contrary to the natural course of things.”

America responded in 1816 with a 25% tariff on textiles, with the support of Southern states who thought it “essential that America protect what limited industry had been established” in case of a new war. By contrast, the South, an importer of British goods rather than a competitive producer, bitterly opposed the 1828 “tariff of abominations,” designed to protect the manufacturing industry from British dumping, because the war threat had long passed.

For similar reasons, China discouraged Google services starting in 2010, protecting fledging competitors like Baudi, China’s leading search engine. Whether Google initiated its departure from the Chinese market in frustration over government censorships and hacking attacks, or whether China effectively pushed Google out, remains in dispute. Then Google CEO Eric Schmidt fulminated, “You cannot build a modern knowledge society with that kind of censorship.” Matt Sheehan reported in MIT Technology Review:

But instead of languishing under censorship, the Chinese internet sector boomed. Between 2010 and 2015, there was an explosion of new products and companies. Xiaomi, a hardware maker now worth over $40 billion, was founded in April 2010. A month earlier, Meituan, a Groupon clone that turned into a juggernaut of online-to-offline services, was born; it went public in September 2018 and is now worth about $35 billion. Didi, the ride-hailing company that drove Uber out of China and is now challenging it in international markets, was founded in 2012. Chinese engineers and entrepreneurs returning from Silicon Valley, including many former Googlers, were crucial to this dynamism, bringing world-class technical and entrepreneurial chops to markets insulated from their former employers in the US. Older companies like Baidu and Alibaba also grew quickly during these years.

Protectionism worked for China’s Internet companies, which leapfrogged their American counterparts. Online sales comprised 27% of total retail sales in China in 2022, compared to 15% in the United States. Mobile payments in China reached $US 70 trillion with a total of 158 billion transactions, compared to $8 trillion in the United States.

Consider this contrafactual scenario: In 2020, China imported $378 billion in semiconductors, or 84% of its total consumption of the critical building blocks of the digital economy. The Chinese government tried to foster its domestic industry with subsidies, but the United States—taking a leaf from Britain’s nineteenth-century playbook—united with Japan, Taiwan, and South Korea to flood China with cheap chips, semiconductor equipment, and design tools. China’s inefficient state-owned foundry, Semiconductor Manufacturing International Corp (SMIC), couldn’t compete, much less the local startups in chip manufacturing equipment. China responded, in our fictional scenario, by imposing tariffs and some outright prohibitions on imports, in emulation of its earlier protection of the Internet sector. Washington lodged complaints with the World Trade Organization and other international bodies, denouncing China’s contempt for the rules-based international order. Within two years, though, China began to market smartphones and server processors with home-produced chips.

Of course, it didn’t happen that way. Instead, Washington, DC, in October 2022, banned the export of high-end computer chips (with a transistor gate width of 7 nanometers or less) as well as the tools and software needed to make them. Because advanced chips are made with a substantial proportion of US intellectual property, the US claimed extraterritorial rights to ban exports of these chips from Taiwan and South Korea, the only countries that can make them. It persuaded the Netherlands not to sell the Extreme Ultraviolet lithography machines required to etch impossibly small transistors on a silicon wafer, and cajoled Japan to stop selling other sophisticated equipment. US nationals were forbidden to work for Chinese chip companies and equipment firms were banned from servicing existing contracts.

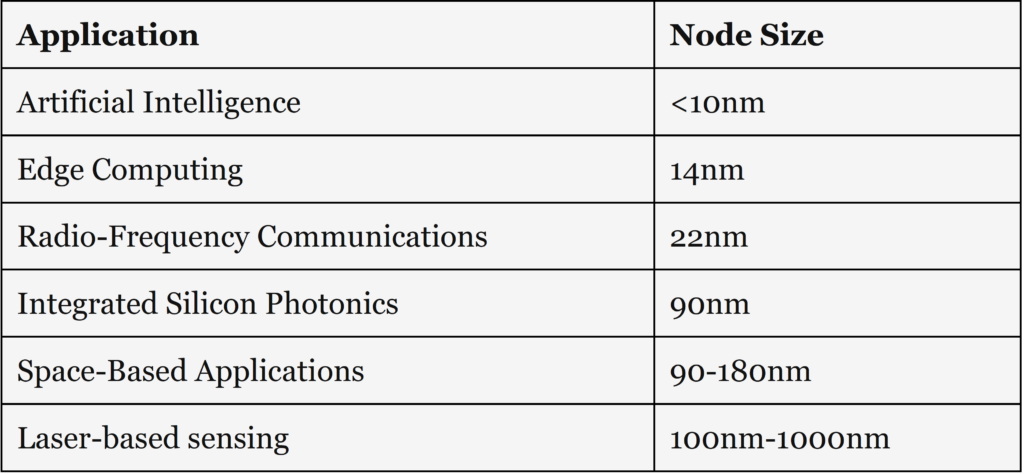

It isn’t clear what the Biden Administration was thinking. The official rationale for the chip control was to stop the Chinese military from gaining an advantage. According to a 2022 RAND Corporation study, virtually all military applications employ older chips (see chart below). The older processes are easier to harden, and most military software has been tested for years on existing hardware rather than rewritten for newer chips. Artificial Intelligence applications use faster chips, but it isn’t clear what these are. The 2,000 surface-to-ship missiles that China has pointed at our Pacific Fleet and the satellite sensors that guide them run on mature nodes.

If the objective was to hamstring China’s economy, it has failed. The chip ban undoubtedly imposed severe costs on China, which is attempting to reinvent large parts of the semiconductor supply chain at high cost. But China can recompense itself for those costs by turning excess supply into a vehicle to dominate semiconductor markets globally in the not-too-distant future.

In March 2020, the Trump Administration banned sales of high-end chips to Huawei, crushing its handset business. Without the newer, faster chips, Huawei could not make 5G smartphones, eliminating what had been the world’s biggest handset maker from the high end of the market.

Western media announced—prematurely—the death of China’s semiconductor industry. “This is what annihilation looks like: China’s semiconductor manufacturing industry was reduced to zero overnight,” wrote the Independent, in an article headlined, “US sanctions on Chinese semiconductors ‘decapitate’ industry, experts say.”

Yet in September 2023, China’s leading telecom equipment maker Huawei announced its Mate60 smartphone with 5G capability. The Canadian research firm TechInsights disassembled a copy and found a 7-nanometer chip inside manufactured by China’s SMIC. It was common knowledge that older chipmaking equipment could make a 7-nanometer chip through a laborious, iterative process, but American experts assumed that the engineering difficulties and high cost of such an exercise ruled out a commercial application. But the engineering difficulties of this exercise were formidable; in 2020, America’s largest chip fabricator, Intel, abandoned plans to manufacture a 7-nanometer chip.

We have no idea of the cost of Huawei’s 7-nanometer chip, nor how many it plans to produce, nor whether a Chinese government subsidy is involved. Chinese analysts are talking about a sales volume for the Mate60 of 6 million units, so it appears that the chip can be made in large numbers. More important is that the same chip powers Huawei’s Ascend chipset, used for its high-end Artificial Intelligence processor. The Ascend processor 910 AI processor, launched on August 29, reportedly offers performance comparable to Nvidia’s A100 chip, the instrument of choice for generative Artificial Intelligence applications. Under the American restrictions, Nvidia offers a somewhat slower version of the A100 to Chinese purchasers, namely the A800. Chinese tech companies Alibaba, Baidu, ByteDance, and Tencent have ordered $5 billion worth of Nvidia chips for delivery in 2023 and 2024, including 100,000 units of the A800.

China’s application of Artificial Intelligence focuses on industrial rather than consumer applications. Huawei claims to have built fully automated factorieswhere robots communicate via 5G networks and AI algorithms direct production, as well as “intelligent mines,” warehouses, and ports. In August, I toured one of Huawei’s factories near its sprawling Shenzhen headquarters, where fewer than a hundred workers produce 1,800 5G base stations per day. That’s a fifth of the world’s total installed 5G capacity at a single installation. I also visited the Tianjin Port, one of the world’s ten largest, where autonomous cranes communicate via 5G empty large container ships in less than an hour using an AI optimization algorithm. At our Long Beach, California port, the same work takes a day or two. Except for a couple of repairmen working on one of the autonomous trucks that move containers away from the autonomous cranes, there were no workers on the longshore and no operators in any of the equipment at the Tianjin Port. A handful of port employees monitor the machines from a distant tower.

AI applications are evident in the success of China’s Electric Vehicle industry, now the world’s largest as well as the world’s largest exporter. Robert Atkinson of the Information Technology and Innovation Foundation reports, “On a wage-adjusted basis, Southeast Asian nations lead the world in robot adoption. China leads the world with an astounding 8 times more robots adopted than expected, up from 1.6 times more in 2017. Korea has 4.8 times more robots than expected. Taiwan has 3.2 times more and Singapore 2.8 times more. The United States has just 70 percent of expected robots.”

It’s no longer accurate to think of China as a cheap labor manufacturer that takes jobs away from high-wage venues. Important parts of Chinese industry, notably autos, are more automated than their Western counterparts. Huawei claims that it has 10,000 contracts to install standalone 5G networks for business automation, including 6,000 factories. The Chinese government is using all of its power of persuasion as well as its checkbook to encourage businesses to get on board the so-called Fourth Industrial Revolution (the application of AI to manufacturing and logistics).

China can make the chips that train AI models on large datasets, a field dominated by America’s Nvidia. The company’s CFO last month warned, “Over the long-term, restrictions prohibiting the sale of our data center GPUs to China if implemented, will result in a permanent loss of an opportunity for the US industry to compete and lead in one of the world’s largest markets.” Qualcomm, which will sell over 40 million chipsets to Huawei in 2023, stands to lose over $10 billion in sales in 2024, according to some analysts.

For the time being, China’s production capacity for high-end chips will barely suffice to meet a portion of its domestic needs. SMIC’s engineering hat-trick with 7-nanometer chips still leaves it two generations behind Taiwan and South Korean fabricators. But that may not be the greatest risk to the Western chip industry. China may dominate the production of older (“legacy”) chips. American controls have forced China to duplicate capacity for semiconductors that it cannot buy (or fears it may not be able to buy) from the West. Global overcapacity could lead to a devastating price war that China is better situated to win.

“Legacy chips are at least as critical as advanced chips both in terms of economic importance and national security. Some 95% of the chips used in the automotive industry are legacy chips. Several other critical industries—medical devices, consumer electronics, infrastructure, industrial automation, and defense—also rely heavily on legacy chips. Russian military equipment found in Ukraine famously had legacy chips yanked from refrigerators and dishwashers,” wrote Rakesh Kumar in Fortune Magazine.

The Biden Administration’s CHIPS offers subsidies to Samsung and TSMC to build fabrication plants for advanced chips, with qualified success; TSMC’s Arizona plant is two years behind schedule, and the company has said that the chips it produces stateside will cost 30% more than the ones it produces at home.

A prominent Chinese commentator, the “Observer’s” Chen Feng, earlier this year compared China’s chip war with the United States to Mao Zedong’s revolutionary war in the 1940s. “Mid-to-low-end chips are still profitable,” Chen wrote in February,

but China will not be satisfied with producing low-end chips. Instead, it will use mid-to-low-end chips as a springboard to move up to high-end chips. This is a sustainable development. China’s steel industry, which dominates the world, developed in this way. Whether we are speaking of China’s Revolutionary War or the world economy, China’s most successful strategy was encircling the cities from the countryside.

“By the same token,” Chen wrote, “the United States is focusing on high-end chips, and adopting the strategy of Menglianggu,” referring to the decisive 1947 battle where Mao’s Red Army annihilated the Nationalist Army’s mountain redoubt in Shandong Province. “But that is all the United States can do. The investment would be too costly and the payback cycle too long to rebuild the chip industry in the United States, so its only option is to start with high-end chips. It can only go to Menglianggu.”

There is a great deal we do not yet know about China’s progress in working around Washington’s technology curbs. What is clear is that China has adapted much faster than the Biden Administration expected, and that the consequences of US policy may be much harder to manage than we imagined.

Read more here.

China-US RISC-V chip technology battle

Open-source chip architecture allegedly used to dodge sanctions.

By Stephen Nellis and Max A. Cherney

In a new front in the US-China tech war, US President Joe Biden's administration is facing pressure from some lawmakers to restrict American companies from working on a freely available chip technology widely used in China - a move that could upend how the global technology industry collaborates across borders.

At issue is RISC-V, pronounced "risk five," an open-source technology that competes with costly proprietary technology from British semiconductor and software design company Arm Holdings.

RISC-V can be used as a key ingredient for anything from a smartphone chip to advanced processors for artificial intelligence.

Some lawmakers - including two Republican House of Representatives committee chairmen, Republican Senator Marco Rubio and Democratic Senator Mark Warner - are urging Biden's administration to take action regarding RISC-V, citing national security grounds.

The lawmakers expressed concerns that Beijing is exploiting a culture of open collaboration among American companies to advance its own semiconductor industry, which could erode the current US lead in the chip field and help China modernise its military.

Their comments represent the first major effort to put constraints on work by US companies on RISC-V.

Representative Mike Gallagher, chairman of the House select committee on China, said in a statement to Reuters that the US Commerce Department needs to "require any American person or company to receive an export license prior to engaging with PRC (People's Republic of China) entities on RISC-V technology."

Such calls to regulate RISC-V are the latest in the US-China battle over chip technology that escalated last year with sweeping export restrictions that the Biden administration has told China it will update this month.

"The CCP (Chinese Communist Party) is abusing RISC-V to get around US dominance of the intellectual property needed to design chips. US persons should not be supporting a PRC tech transfer strategy that serves to degrade US export control laws," Representative Michael McCaul, chairman of the House Foreign Affairs Committee, said in a statement to Reuters.

McCaul said he wants action from the US Bureau of Industry and Security, the part of the Commerce Department that oversees export-control regulations, and would pursue legislation if that does not materialise.

The bureau "is constantly reviewing the technology landscape and threat environment, and continually assessing how best to apply our export control policies to protect national security and safeguard core technologies," a Commerce Department spokesperson said in a statement.

"Communist China is developing open-source chip architecture to dodge our sanctions and grow its chip industry," Rubio said in a statement to Reuters. "If we don't broaden our export controls to include this threat, China will one day surpass us as the global leader in chip design."

"I fear that our export-control laws are not equipped to deal with the challenge of open-source software - whether in advanced semiconductor designs like RISC-V or in the area of AI - and a dramatic paradigm shift is needed," Warner said in a statement to Reuters.

RISC-V is overseen by a Swiss-based nonprofit foundation that coordinates efforts among for-profit companies to develop the technology.

The RISC-V technology came from labs at the University of California, Berkeley, and later benefited from funding by the Pentagon's Defense Advanced Research Projects Agency (DARPA). Its creators have compared it to Ethernet, USB and even the internet, which are freely available and draw on contributions from around the world to make innovation faster and cheaper.

Huawei Technologies

Executives from China's Huawei Technologies have embraced RISC-V as a pillar of that nation's progress in developing its own chips.

But the United States and its allies also have jumped on the technology, with chip giant Qualcomm working with a group of European automotive firms on RISC-V chips and Google saying it will make Android, the world's most popular mobile operating system, work on RISC-V chips.

Qualcomm declined to comment. Its executives said in August they believe RISC-V will speed up chip innovation and transform the tech industry.

Google did not respond to a request for comment.

If Biden's administration were to regulate US companies' participation in the Swiss-based foundation in the manner lawmakers are seeking, the move could complicate how American and Chinese companies work together on open technical standards.

It also could create hurdles for China's pursuit of chip self-sufficiency, as well as for US and European efforts to create cheaper and more versatile chips.

Jack Kang, vice president of business development at SiFive, a Santa Clara, California-based startup using RISC-V, said potential US government restrictions on American companies regarding RISC-V would be a "tremendous tragedy."

"It would be like banning us from working on the internet," Kang said. "It would be a huge mistake in terms of technology, leadership, innovation and companies and jobs that are being created."

Regulating the open discussion of technologies is rarer than regulating physical products, but not impossible, said Kevin Wolf, an export-control attorney at law firm Akin Gump who served in the Commerce Department under former President Barack Obama.

Existing rules on chip exports could help provide a legal framework for such a proposal, Wolf said.

Read more here.