Reverse Engineering 逆向工程

China rules EV's and battery tech, drive-train market electrifying, Ford needs help, BYD in Japan, Tik Tok secrets, Hedge Fund boom in Asia, Russia winning "logistics race"

UPDATE: You can’t make this stuff up. 25 years ago China needed technical assistance, technology transfers and large-scale funding to set up an internal combustion powered car manufacturing infrastructure. Today, China is entering a “Golden Age” of electric mobility where its technology, technical skills and funding capacity exceed those of Europe, Japan and the United States. Tesla, you say, but Tesla is fully integrated with China tech and skills and Shanghai Tesla exports more cars than any other Tesla facility. Japan has lagged in EV tech after 30 years of decreasing R&D and the same is true for Europe and the US. The Biden administrations efforts to reindustrialise are hurting Europeans, Japanese and Koreans, even as they target China. At the end of the day, the US is not the world’s largest market and reindustrialisation means exports to Asia, but Asia tech is already better, cheaper and greener.

One more thing - even the much sanctioned Russia has better logistics and manufacturing than the US and Europe, which is evidenced in its winning momentum in Ukraine. Munich Security Conference may be the turning point towards negotiations.

New Golden Age for China’s auto industry

Fast-growing companies such as BYD, XPeng, Li Auto and Nio are increasingly favoured by consumers. China’s booming electric vehicle industry is forecast to further cement its global dominance this year, shrugging off US and European efforts to catch up and posing a threat to foreign groups reliant on the world’s biggest car market.

Chinese consumers will buy about 8mn to 10mn EVs in 2023, up from record sales of 6.5mn vehicles last year and 3.5mn in 2021, according to company and analyst forecasts. This compares with nearly 3mn in Europe and 2mn in the US.

“China is expected to have the largest overall sales with 35 per cent year-on-year growth in 2023, after two years of extremely rapid growth [ . . . ] To put this in perspective seven out of every 10 electric vehicles are now sold in China,” (Neil Beveridge, Bernstein, 2023)

The biggest winners are a clutch of fast-growing local companies that are outperforming foreign carmakers. BYD, the Warren Buffett-backed Tesla rival and widely considered China’s brightest EV star, expects sales of plug-in vehicles to reach 3mn units this year after selling more than 1.85mn last year, Citi bank analysts said the estimate was “conservative”.

China remains one of the largest profit contributors for many international carmakers, leaving them particularly exposed if they cannot regain ground lost to domestic brands as the market rapidly shifts towards electric vehicles.

But groups such as BYD, XPeng, Li Auto and Nio, are now increasingly favoured by Chinese consumers. The market share of Chinese brands in the domestic EV segment edged higher from a staggering 78 per cent to 81 per cent last year. That compares with foreign groups enjoying 70 per cent market share about 10 years ago, before the massive surge in EVs and just after car sales in China overtook those in the US.

The pace of growth means China is on the cusp of hitting 50 per cent of car sales to be EVs by the end of 2025, becoming the first major economy to do so, according to Bernstein forecasts. BYD told Citi that the milestone, which compares with Beijing’s target of 40 per cent by 2030, could be hit this year.

Read more here.

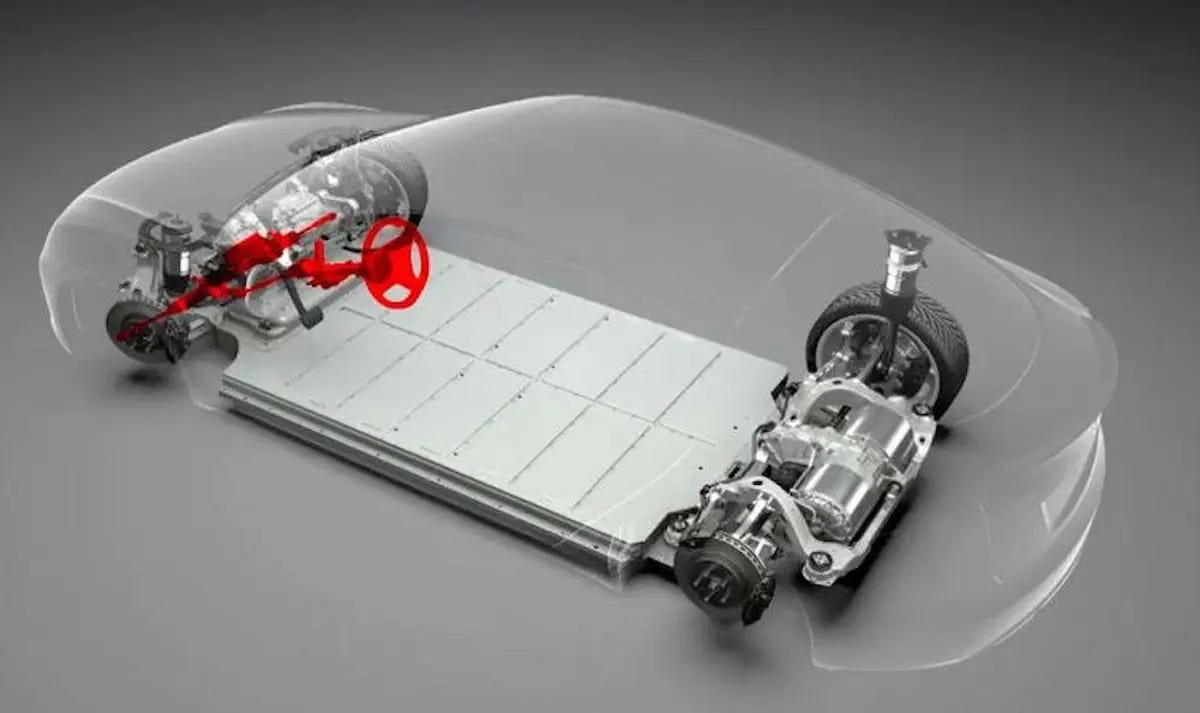

Electric Vehicle (EV) Powertrain Market is Set to Cross US$ 112 billion by 2033

Chinese EV Powertrain Market it is still poised to grow at a rate of 21.3% through 2033. The overall demand for EV powertrains in particular may experience a higher growth rate of 19.6% during the projected period. The size of the worldwide EV powertrain market, which is estimated at US$ 10,470.6 million in 2022, is anticipated to register a CAGR of 24% from 2023 to 2033. By following this impressive growth rate the total valuation is anticipated to reach US$ 112,036 million by the end of 2033.

China leads in production as well as the supply of EV powertrains around the world. This country is further projected to hold the dominant position in the coming days by registering a growth rate of 21.3% through 2033.

Germany led the European region in the production of EV powertrains by generating revenue of around US$ 1,005 million in the year 2022. This value was nearly 9.6% of the revenue generated globally, making it the second leading region followed by the United States.

The United States leads the global market in sales, but not production, of EV powertrains. As it generated a revenue of around US$ 1,057.5 million, it was figured out to have captured 10.1% of the global market.

Contrarily, India remains the most notable region for witnessing rapid expansion in the adoption of EV powertrains these years. With an annual growth rate of 25.4%, the sales of EV powertrains in India are poised to grow faster than in other countries.

Access the report here.

Ford Will Build a U.S. Battery Factory With Technology From China

Ford’s $3.5 billion plant in Michigan will draw on technology from CATL, a Chinese company that is the world’s No. 1 maker of electric-car batteries. Ford Motor said on Monday that it planned to build a $3.5 billion electric-vehicle battery factory in Michigan using technology licensed from a Chinese company that has become one of the most important players in the auto industry.

The plant, to be built in Marshall, a rural town about 100 miles west of Detroit, will be the latest in a growing list of new battery and electric-car factories that companies have announced in recent months. Ford expects to employ about 2,500 people at the plant and begin production in 2026.

The automaker said it would own 100 percent of the plant and make battery cells using technology and services from Contemporary Amperex Technology Limited, known as CATL. The company, the world’s largest producer of batteries for electric vehicles, has 13 factories of its own in Europe and Asia but none in the United States.

Just a quarter-century ago, Chinese officials were eagerly asking U.S. automakers to bring their investments and expertise to China. Today, the roles are reversed, with one of America’s most storied industrial giants asking China for the technology needed to survive in a rapidly changing global automotive landscape.

“This will help us build more E.V.s faster,” William Clay Ford Jr., the company’s executive chairman, said on Monday. He added that CATL would “help us get up to speed so we can build the batteries ourselves.”

Read more here.

Ford to axe 3,800 European jobs in electric-car overhaul

The car giant said the bulk of the job losses are set to affect its technical centre in Dunton in Essex, and a smaller site in Stratford, east London. Around 1,300 UK jobs are being axed by Ford as part of a wider cull of roles across its European business as the car giant looks to reinvent the brand and focus on a smaller range of electric vehicles.

The job cuts will see Ford lose around a fifth of its 6,500-strong UK workforce and come amid wider plans to scrap around 3,800 jobs in the next three years across Europe. It said the bulk of the UK job losses will affect the company’s technical centre in Dunton in Essex, where it has about 3,400 workers.

A smaller operation in Stratford in east London, where about 200 staff work, will also be hit. Manufacturing and logistics plants at Halewood in Merseyside, Dagenham in Essex, Southampton in Hampshire, and Daventry in Northamptonshire will be unaffected by the shake-up, Ford said.

The company revealed that the majority of the Europe-wide job losses will occur in Germany, where about 2,300 roles are set to go, followed by 1,300 in Britain and 200 in the rest of Europe.

Read more here.

BYD to launch EV sales in Japan

Chinese EV giant BYD rolled out its electric crossover, the Atto 3, in Japan on Jan. 31, and will introduce two more models by the end of 2023. BYD Co.'s Japanese division said on Monday it would start selling its first battery electric vehicles in the country early next year, as the world's largest EV maker further steps up plans to either sell or make vehicles available across major markets.

China's BYD, partly owned by Berkshire Hathaway, has rolled out an electric crossover, the Atto 3, in Japan on Jan. 31. The car has a cruising distance of 485 kilometres and will cost 4.4 million yen (US$32,735.66).

BYD's Japan arm is planning to introduce two more models by the end of 2023 and more than 100 dealerships in Japan by the end of 2025, the company said.

Gasoline-electric hybrid models remain more popular than BEVs in Japan. However, the share of battery-driven vehicles is expected to grow, partly due to non-Japanese automakers such as BYD and Volkswagen Group making their way into the market.

Japanese automakers have been increasingly criticized by activists and green investors, who slam them for not embracing battery electric vehicles fast enough.

Read more here.

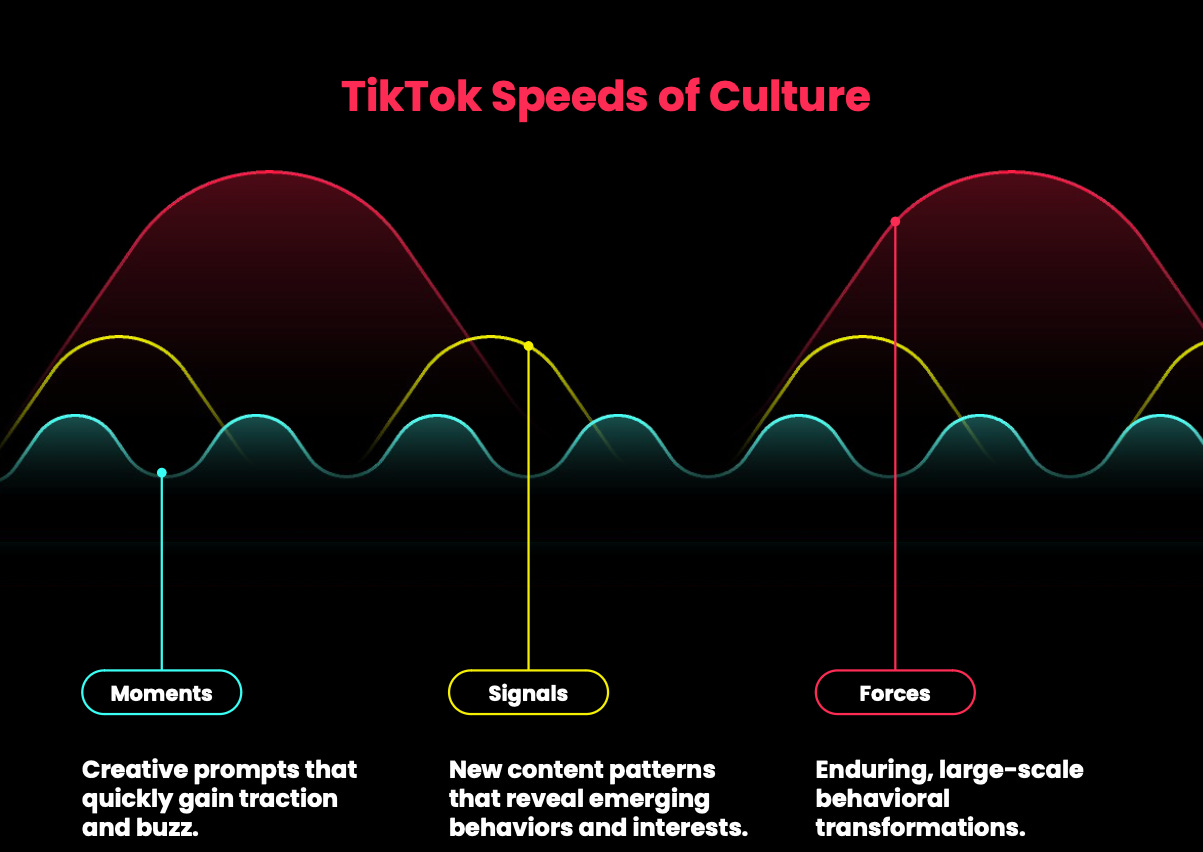

TikTok targeted but Booms

TikTok’s influence is expanding well beyond the social sphere. The app is increasingly being used for the types of internet searches one would normally rely on a web search engine for. The video-based social app might not seem like the best place to get answers to your burning questions, but many users have made it their tool of choice for finding bars and restaurants to visit, movies to watch, or clothes to wear. It’s a trend that has companies like Google more than a little concerned.

TikTok had temporarily dethroned Google as the most visited website on the internet, and competitors such as Instagram and YouTube were scrambling to mimic the short video clips that made TikTok a sensation. However, TikTok’s leaders were responding to a slowdown in the growth of its audience in the U.S., the world’s biggest market for online advertising, and increasing attempts by US lawmakers mouthing security concerns and even introducing legislation calling for a wholesale national TikTok ban.

In a meeting last March, top Tik Tok executives discussed how the pandemic had created a major surge in the app’s audience and how, as the world returned to normal, they needed a plan to reenergize growth over the next few years, according to a person involved in the discussions. Among the responses they discussed were ways to improve engagement with new features connecting users with their friends on TikTok. At the same time, they discussed an expansion into shopping, which could also boost revenue.

Download the full report here.

Asia Hedge Funds Post Strongest Month in January Since 2016 - Goldman

After seeing record outflows in 2022, Asia-focused hedge funds posted a 5.3% gain in a January rally to mark their best monthly performance in years, bolstered mainly by a rebound in Chinese share prices, Goldman Sachs said in a note. The funds' performance in January, the strongest in Goldman Sachs records going back to 2016, comes as China's economy reopens after years of COVID-19 curbs and U.S. interest rates appear to be close to a peak.

MSCI's Asia Pacific stocks index soared 7.8% last month, outperforming the rest of the world.

For hedge funds, the best gains in January had come from a strategy of taking long and short positions in Chinese shares based on company fundamentals, Goldman Sachs said. The strategy returned 7.7% in January. Taking the same approach to Japanese shares yielded 2.6%. A separate gauge by Eurekahedge also showed Asian hedge funds rallied for the third consecutive month in January, with a 4.8% rise.

Asia-focused hedge funds dropped an average 8% last year, with a net outflow of $7.7 billion from Asia ex-Japan funds, according to Eurekahedge data from With Intelligence. Including Japan, the outflow was $8.5 billion.

Investors' interest in Asia and China this year should increase due to a weakening of the U.S. dollar and more attractive valuations of regional stocks relative to the U.S. markets, he said.

The Asia macro strategy - betting on macroeconomic and political trends - returned 6%, while Asia equity long/short gained 5% and Asia credit long/short gained 4%. The Asia multi-strategy lost 1% in January, Feb. 14 Eurekahedge data shows.

Read more here.

Russia is Winning the “Race Of Logistics” and “War of Attrition”

Russia has gained the strategic momentum in Ukraine. The combined military-industrial capabilities of the NATO bloc can no longer provide the logistical support required and Ukraine is losing territory and men at an unsustainable pace. Russia’s military-industrial complex is sustaining the needed pace, scale, and scope for the special operation in Ukraine despite the unprecedented sanctions regime imposed by the NATO allies.

The official NATO narrative has turned from “inevitable” victory to “potential” loss as a series of remarks from the Polish Prime Minister, President, and Army Chief as well as the US’ Chairman of the Joint Chiefs of Staff and the New York Times have all admitted that the sanctions regime against Russia is a failure.

NATO’s military-industrial crisis, which the New York Times warned about last November and spoken about by Biden’s Naval Secretary, finally became undeniable when NATO Secretary-General Jens Stoltenberg declared a so-called “race of logistics” against Russia. The transcript of Jens Stoltenberg’s pre-ministerial press conference published on NATO’s official website explicitly mentions the crisis.

“It is clear that we are in a race of logistics. Key capabilities like ammunition, fuel, and spare parts must reach Ukraine before Russia can seize the initiative on the battlefield.

Ministers will also focus on ways to increase our defence industrial capacity and replenish stockpiles.

The war in Ukraine is consuming an enormous amount of munitions, and depleting Allied stockpiles. The current rate of Ukraine’s ammunition expenditure is many times higher than our current rate of production. This puts our defence industries under strain.

For example, the waiting time for large-calibre ammunition has increased from 12 to 28 months. Orders placed today would only be delivered two-and-a-half years later. So we need to ramp up production. And invest in our production capacity.

Another article in Politico reinforced the crisis when four unnamed US officials said the US can’t send Kiev its requested “Army Tactical Missile Systems” (ATACMS) because “it doesn’t have any [of them] to spare”. Stoltenberg’s “race of logistics”, and “war of attrition”, is evidence that NATO completely miscalculated in respect to Russian economic and industrial resilience to sanctions.

Read more here.