Rise and Fall

Liu He in Davos and in Zurich with Janet Yellen. China tech zooms. Arden curtain call. US on the brink. Currency collapse in Amsterdam. NATO seeks peace in weapons. And, Malacca trade eruption

UPDATE: The Long Mekong Daily pays a virtual visit to Davos only to discover that China is setting the terms of trade, while NATO sets the terms for war. China technology is energised while New Zealand’s PM has not enough in the tank.

Is the US dollar melting in the heat of war, rising on a tide of inflation, sinking in a sea of debt or just running out of energy? The collapse of the Amsterdam Bank 300 hundred years ago may illuminate the question.

Finally, it seems the Malacca Dilemma is not an Indo-Pacific security chokepoint for China, but a volcanic catastrophe waiting to explode. Anyway, clip on your skis and take a giant slalom descent into the valley of Davos to find out more.

Liu He, Vice-Premier of the People's Republic of China

Davos 2023 - Speech Excerpts

In 2022, China completed its major political agenda. We held the 20th National Congress of the Communist Party of China (CPC), and elected the new central leadership with President Xi Jinping at its core. We drew up an ambitious blueprint for advancing Chinese modernization in the coming five years and beyond.

Last month, we held the annual Central Economic Work Conference to make plans for 2023 in line with the deployment of the 20th CPC National Congress. In 2022, China’s growth was 3%. And we managed to keep jobs and prices stable. Urban surveyed unemployment rate was 5.6 percent, CPI was two percent, and current account surplus was slightly above two percent of GDP.

In 2023, we will continue to try to make progress while maintaining stability, and follow a proactive fiscal policy and a prudent monetary policy. We will strive to maintain reasonable economic growth, and keep prices and jobs stable. More focus will be placed on expanding domestic demand, keeping supply chains stable, supporting the private sector, reforming the state-owned enterprises (SOEs), attracting foreign investment, and preventing economic and financial risks.

If we work hard enough, we are confident that growth will most likely return to its normal trend, and the Chinese economy will see a significant improvement in 2023. A noticeable increase of import, more investment by companies, and consumption returning back to normal can be expected.

Over the past ten years, China’s GDP grew from 54 trillion to 121 trillion yuan; average life expectancy rose from 74.8 to 78.2 years; and contribution to global growth reached around 36 percent. There are five things that we always bear in mind in making such achievements.

First, we must always take economic development as the primary and central task.

Second, we must always make establishing a socialist market economy the direction of our reform.

Third, we must always promote all-round opening-up.

Fourth, we must always uphold the rule of law.

Fifth, we must pursue innovation-driven development.

The above five points are the important experience we have learned and gained since China started its reform and opening-up. We must stick to them and never waver in our commitment.

Real estate sector is still a pillar for China’s economy. It accounts for nearly 40 percent of bank lending, 50 percent of overall local government fiscal resources, and 60 percent of urban household assets. From the second half of 2021, China experienced a rapid decline in property prices and home sales. Many property developers suffered from liquidity shortage and deteriorating balance sheet. The risks of a handful of leading property developers are particularly noticeable.

If not handled properly, risks in the housing sector are likely to trigger systemic risks. That is why prompt steps must be taken to address them. That said, however, we should also prevent possible moral hazards while doing so. Here is what we have done.

First, we have stabilized expectations by honoring contracts and protecting property rights.

Second, we have conducted massive “blood transfusion” to the real estate sector.

Third, we have helped the real estate sector with “blood formation”.

Thanks to these efforts, the supply and demand in the market has seen noticeable improvement. Looking ahead, China’s urbanization is still on a fast track, and the enormous potential demand generated in this process will provide a strong underpinning for the development of the real estate sector.

Right now, China is stepping up efforts to foster a new development paradigm with domestic circulation as the mainstay and domestic and international circulations reinforcing each other. The focus of domestic circulation is on expanding internal demand, promoting industrial upgrade, developing a consumption-led growth model, and re-balancing the economy. (This is a logic reflecting international consensus since 2008.)

China’s national reality dictates that opening up to the world is a must, not an expediency. We must open up wider and make it work better. We oppose unilateralism and protectionism, and look forward to strengthening international cooperation with all countries for world economic stability and development, and the promotion of economic re-globalization.

As for how to advance international cooperation, I would like to share with you the following three observations.

First, we need to uphold the right principles and maintain the effective international economic order.

Second, we need to strengthen international macro policy coordination and strike a good balance between inflation and growth.

Third, we need a global response to climate change.

China will honor its commitments to the international community, push for global cooperation on climate change, and work with other countries to tackle the serious challenges posed by climate change, and build a community with a shared future for mankind.

See the full speech here.

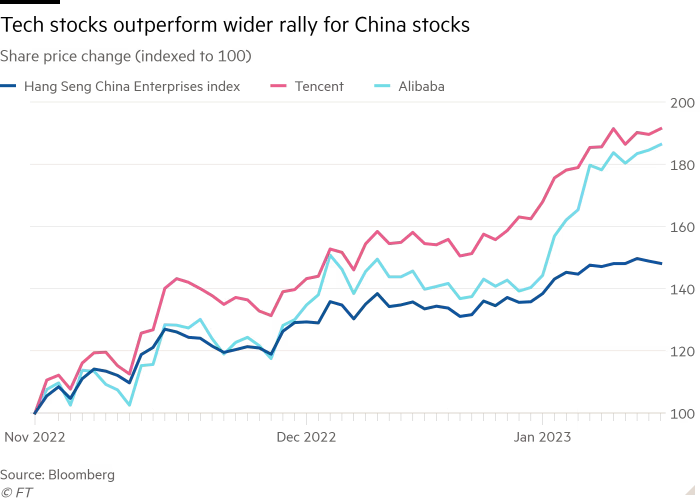

As China Tech Stocks Roar Back, a New Normal Will Test Upside

Chinese tech stocks are suddenly back in Wall Street’s favour, but that doesn’t mean investors and analysts expect the sector to regain its former glory any time soon — if ever. From Goldman Sachs Group Inc. to Morgan Stanley, a growing number of strategists have made bullish calls following President Xi Jinping’s Covid Zero exit and vows to end a crackdown on the sector. The shifts have spurred a 60% rally in the Hang Seng Tech Index since an October trough, a world-beating feat even though the gauge’s market value is still half of its February 2021 peak.

While few doubt the worst is over, a bigger question looms on the sector’s fair valuation under a regulatory regime where free-wheeling growth is no longer tolerated, and as the industry matures.

“Chinese tech shares were once the easiest bet, and for most of the past decade you were able to win and see outperformance without doing much,” said Chen Da, managing director at Fortune Hill Asset Management Ltd. “It’s possible we’ll never see those times again.”

Outlook on the sector has gone through a sea change from early last year, when some of the biggest banks questioned whether the industry was even “investable.”

Having endured two straight years of losses, markets are brimming with hopes over the sector’s returns as signs grow that authorities are taking a more lenient stance. Guo Shuqing, party secretary of the People’s Bank of China, said this month that a regulatory overhaul is drawing to a close.

That, coupled with the reopening and thawing tensions with the US, has led to a flurry of price target upgrades across the sector including for Alibaba Group Holding Ltd. and Tencent Holdings Ltd., though targets fall far short of their highs.

Read full article here.

Jacinda Ardern resigns as New Zealand’s prime minister

Prime Minister has today announced she will stand down on February 7 and will not be seeking re-election. The Labour leader said she would be stepping down as she “no longer had enough in the tank” to do the job. “I know when I have enough left in the tank to do it justice,” she told New Zealanders during a press conference from the Caucus retreat in Napier.

“I would be doing a disservice to New Zealanders to continue.”

She made the announcement choking back tears. “This has been the most fulfilling five and a half years of my life,” Ardern said. The news shocked New Zealanders and people overseas, who immediately took to social media to post their messages to and about Ardern.

Australian Prime Minister Anthony Albanese wrote on Twitter that “Jacinda Ardern has shown the world how to lead with intellect and strength.” “She has demonstrated that empathy and insight are powerful leadership qualities. Jacinda has been a fierce advocate for New Zealand, an inspiration to so many and a great friend to me,” he added.

“Jacinda Ardern showed the world that a small country could be a leader internationally; a leader in decency and in building bridges between people, cultures and religions at home and abroad,” wrote Mike Rann, chair of the Climate Group and former South Australia Premier. “She also deserves enormous credit for her government’s management of the Covid 19 crisis.”

Read more here.

Liu He, Janet Yellen meet in Zurich, a bilateral respite that would boost confidence for world economic recovery

With the meeting between Chinese Vice Premier Liu He and US Treasury Secretary Janet Yellen on Wednesday in Zurich, the ice between the world's two largest economies showed another sign of breaking, as the world's two largest economies attempt to soothe their relationship that has grown tense in recent months over technology access and other issues.

The meeting between the two senior officials of the world's top two economies is seen by experts as a respite that would offer huge confidence boost for a global economic recovery, particularly at a time of heightened international tensions, while they also called for the US to act responsibly and back the gestures with actions.

The two sides agreed that the world's economic recovery is at a critical stage and it is in the interest of both countries as well as the whole world for China and the US to strengthen macro-policy communication and coordination and jointly address challenges in the economic and financial fields, Xinhua reported.

During talks with Yellen, Liu also expressed concern over the US economic, trade and technological policies toward China and hoped that the US will pay attention to the impact of these policies on both sides, the Xinhua News Agency reported.

Tian Yun, a macroeconomic observer, said the US is more urgently pushing a thaw in China-US relations because the US, which is in the middle of a disinflation cycle, needs support from China whose economy is spiraling up following COVID-19 response optimisation.

Without China's industrial output, the US is very likely to get stuck in moderate or even severe stagnation that will deal a heavy blow to the country's economy whether in terms of trade, the dollar's position or other issues, Tian said.

"On the debt issue, the US needs China, the second-largest non-US holder of Treasuries, to help it stabilize its debt market," Gao said.

Yellen warned last week that the department will have to start taking "extraordinary measures" after the US reaches its existing borrowing cap of $31.4 trillion on Thursday, according to a CNN report.

Li also said that when Western media outlets and politicians look at China-US relations, they should not use strategic differences to dominate the entire relationship. Instead, they should seek pragmatic solutions to practical problems and achieve an effect of controllable and gradual easing of China-US strategic competition through cooperation.

Read the full article here.

At war, the US dollar is on the brink of collapse

The US is at war, and the dollar is at risk of imminent collapse. Australia’s lobbying of the United States as a good ally should focus on these issues above all else. I am aware that many readers will say oh dear, you must not talk like that. But it’s sensible to discuss the distance to the ground before we jump off the cliff. And a lot has already gone over the cliff. In the narrow spectrum of security, focused on war and peace, the largest problems we cannot afford to ignore right now are as follows:

War elements are increasingly out of control, In Europe and elsewhere. Clausewitz was right, war drives out policy and pursues its own ends.

We are effectively in a world war and the barrier to nuclear exchange is perilously thin. I’ve written about this before, thus in 2022. Way back in 2003 in a letter to the Foreign Minister I set out the slippery slope comparable to the beginning of World War I on which we had embarked… a slow slow process but of comparable stupidity and consequence. It’s speeding up.

Here’s another more significant, French, voice this week warning that the third world war has already begun.

There is at present no trust basis for negotiations to avoid widening the war between the US and Russia.

There is a lemming-like rush to war with China on the part of American political leaders and a weird entanglement of Australia in that rush through our rhetoric and deployments, as addressed by Mike Gilligan, drawing on his background in systems analysis in the Australian Department of Defence.

The prime minister of Japan as chair of the G7 is going round the membership of the G7 beating war drums, when he is head of a government which only has a modest drum, no more, and he antagonises major powers as he builds his “wolf-whistle-diplomacy” as we might call it.

These things happen while the main theatre of conflict, Ukraine, is a mire of deception. [ All warfare is based on deception ]

And there is no element, in the body of nation states pitched into war now, that is desirous of peace.

These things happen while, apart from use of nuclear weapons, western powers are talking-talking far beyond their real military capabilities. As great weapons are brought out for show and boom, their owners appear more and more paper tigers.

Read the full article here.

The Bank of Amsterdam and the limits of fiat money

Central banks can operate with negative equity, and many have done so in history without undermining trust in fiat money. However, there are limits. How nega- tive can central bank equity be before fiat money loses credibility? We address this question using a global games approach motivated by the fall of the Bank of Amsterdam (1609–1820). We solve for the unique break point where negative equity and asset illiquidity renders fiat money worthless. We draw lessons on the role of fiscal support and central bank capital in sustaining trust in fiat money.

Download the full article here.

NATO Secretary-General Jens Stoltenberg

Davos 2023 - Speech Excerpts

For many years, NATO and NATO Allies have supported Ukraine, in particular the United States, Canada, the United Kingdom, and also Turkey. Providing equipment and training for tens of thousands of Ukrainian soldiers.

NATO’s main responsibility is to protect all Allies and prevent this war from escalating, causing even greater death and destruction. We may have been shocked by Russia’s brutal invasion, but we should not be surprised. This invasion was one of the best-predicted acts of military aggression ever.

Since the first invasion of Ukraine in 2014, NATO has been adapting and preparing, with increased defence spending and invested in modern capabilities. We deployed combat-ready battlegroups in the eastern part of our Alliance for the first time in our history. We have increased the readiness of our forces and established new defense domains, including space and cyberspace.

When Russia invaded Ukraine again this year, NATO was ready. We deployed additional forces to the east of our Alliance. Today, we have over 40,000 troops under direct NATO command, backed by significant air and naval assets. We doubled the number of multinational battlegroups from the Baltic to the Black Sea and we have 100,000 troops on high alert, ready to respond to any aggression and to defend every inch of NATO territory.

In the meantime, NATO is vigilant in the Baltic Sea region, and Allies have increased their presence. We have stepped up our exercises and deployments and for the first time ever, a US Amphibious Ready Group has been placed under NATO command.

These massive sanctions remind us of one of the important lessons from this conflict, that we should not trade long-term security needs for short-term economic interests.

The war in Ukraine demonstrates how economic relations with authoritarian regimes can create vulnerabilities - over-reliance on the import of key commodities, like energy, risks created by exporting advanced technologies, like Artificial Intelligence, and weakened resilience caused by foreign control over critical infrastructure, like 5G.

This is about Russia. But also about China. Another authoritarian regime that does not share our values. And that undermines the rules-based international order.

International trade has undoubtedly brought great prosperity. I, and many of us here today, have worked hard to promote a more globalized economy, but we must recognize that our economic choices have consequences for our security. Freedom is more important than free trade. The protection of our values is more important than profit.

At the NATO Summit in Madrid next month, NATO leaders will make bold decisions to continue to strengthen and adapt our Alliance for this more dangerous and competitive world.

This conflict in Ukraine has underlined the importance of Europe and North America standing together in NATO, and of working with our like-minded partners around the world, to defend our values, and promote peace and prosperity.

Full text of speech here.

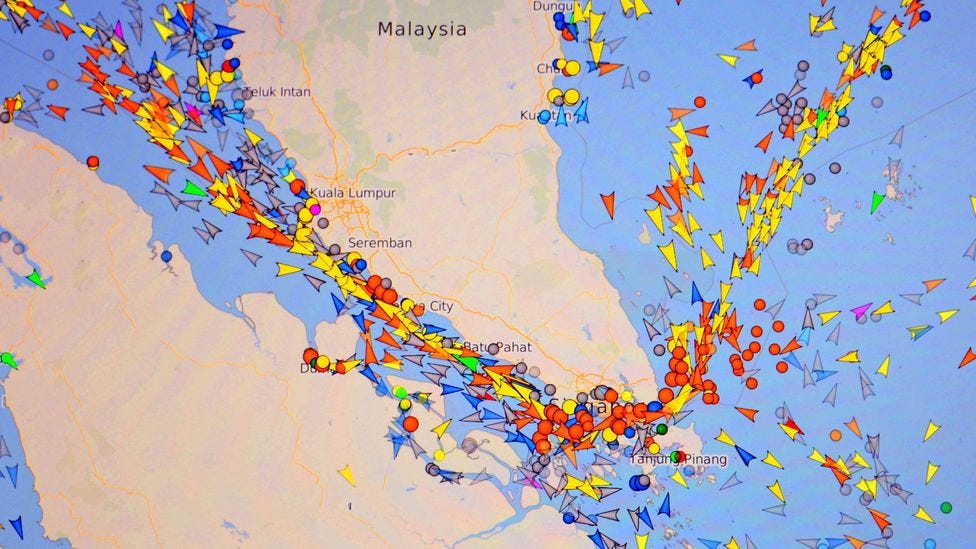

Malacca Strait: The sea lane that could trigger world chaos

Disruption of major trade routes due to crime or human error is a well-established problem. Piracy has long plagued the region, but the strait, which is cooperatively controlled by Indonesia, Malaysia, Singapore and Thailand, is generally under control. Still, ship collisions here are not uncommon: in 2017, 10 American sailors were killed when the USS John McCain collided with a Liberian-flagged tanker. Thin enough to be blocked by an errant container ship the way the Suez Canal was in 2021 by the 400 m (1,312 ft) Ever Given.

The biggest threat to the Strait of Malacca, which separates the Malay Peninsula from the Indonesian island of Sumatra, lies in the natural world. Of the many intriguing maps of activity in the region, the most fascinating is one that collates the world’s active volcanoes and recent earthquakes. Along the coast of Sumatra and the more southern part of Java, following the path of the Sunda Trench, there is a band of earthquake activity, and several volcanoes.

Two volcanoes in Java, Semeru and Merapi, have recently erupted. In the Sunda Strait, which separates Java from Sumatra, is Krakatoa, and further west is Tambora, whose eruption in 1815 caused crop failures in Europe and the eastern United States.

The Tambora eruption had a magnitude VEI7 in the Volcanic Explosivity Index (VEI), going up to VEI8 on a logarithmic scale. An event like 1815 may happen once or twice per millennium. But an explosion doesn’t have to be big enough to cause serious problems at the global choke point.

Read full article here.